Markets have been bearish fixed income before and found no joy in the position. Perhaps that is the risk for 4Q, that the fear of the past can become the reality of the future, writes Bob Savage, CEO of Track Research in his Sunday commentary.

Get Trading Insights, MoneyShow’s free trading newsletter »

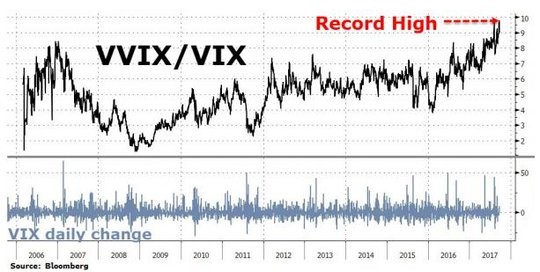

We all look through the same past set of data and news and yet we come up with a myriad of forecasts for the months ahead – uncertainty has never been higher but volatility remains near all-time lows.

September has always been a month of change, a passing through from Summer to Autumn, a shift from mid-year to end-year investment horizon, and usually a month of risk-off. This was still true but not with any notable volatility.

Advertisement

What was different in September matters for how we think about October and beyond. The markets didn’t sell-off equities, they sold bonds instead, they reversed course on the USD, bought oil, and they began to doubt the wisdom of central bankers.

There were 4 key actions that shifted the markets:

1) FOMC balance sheet adjustment – no matter how small or how well guided – this action changes the debt-monetization of the Federal Reserve and sparks comparisons to the ECB, BOJ and others.

2) The fiscal stimulus from the hurricanes. While not a significant amount it changed the Trump administration from being Republican to being something else – by working with Democrats he opened hope for fiscal spending writ large over the next 6-12 months. His tax plan release may add to the deficit and with the FOMC not covering that bills, the bond investors will charge a premium. The bipartisanship of September surprised many analysts.

3) Other central bankers shifted from accommodation to normalization – with the BOC Poloz being the front-runner but the ECB and BOE being the focus as their language shifts. Risks for 2018 reversing QE rise.

4) Geopolitics are less scary, North Korea lost its fear factor – even with a supposed hydrogen bomb test and multiple launches of ballistic missiles, the markets have learned to ignore the war of words and expect a path to peace as China tightens its trade and UN sanctions kick-in.

The weekend vote in Catalan looks to be a test for how much fear politics play in Europe again – with the German election leading to a tough coalition, the protests in Spain Sunday will test the mettle of EU calm and perhaps the global calm that it helped inspire post the French elections. As the chart of the VIX to VVIX suggests markets are less sure about the path forward – this reflects the S&P500 3M implied volatility which trades near the lows and the steep expectations for higher volatility ahead.

All of these points revolve around a more fundamental and less political story – inflation.

There are plenty of reasons that inflation was subdued over the last 7 years – from low rates dropping mortgage costs and spurring the oil boom in the US which in turn dropped energy prices, along with low growth hampered by low productivity, but many are now pointing to other factors for fear:

--the nationalist/populist push in many countries – particularly the U.S. and UK puts trade and trade links into question driving up prices via tariffs and uncertainty;

--the anti-migration mood leaves labor shortages in the U.S. and UK and elsewhere;

--the full-employment and easy money policies everywhere have left a floor to wages and started a shift to business investments to fill gaps;

--political pushes to fight inequality via minimum wages and other efforts have lifted wages in the U.S. and more states will see raises in wages in 2018;

--hurricane destruction of cars, homes, roads has left a demand shock for materials and workers that will lift prices;

--more political agreement to spend money on hurricanes and potentially tax cuts will drive up inflation as money velocity restarts;

--more global coordinated growth from China to Europe to the U.S. and across EM. The key will be how companies pass through price pressures to consumers both in the U.S. and abroad.

As we learned over the weekend, the Chinese are on the front lines of such a squeeze.

Markets have been bearish fixed income before and found no joy in the position. Perhaps that is the risk for 4Q, that the fear of the past can become the reality of the future.

View Track.com, the global marketplace for stock, commodity and macro ideas here