This week’s focus is on the IMF warnings to financial stability and debt growth both for countries and corporations. Rising rates in the U.S. may be leading to a rethinking of global credit risks too, writes Bob Savage, CEO of Track Research in his Sunday commentary.

Get Trading Insights, MoneyShow’s free trading newsletter »

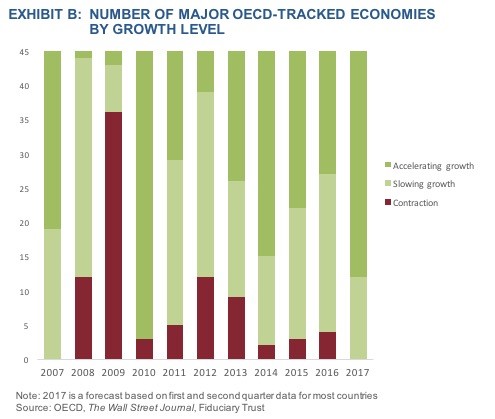

The surprise of October has been in the growing evidence of a coordinated, global growth across the major economies, sustained despite political uncertainty and higher rates.

The U.S. ISM, the Japan Tankan, the ongoing PMI reports from China and Europe – all point to a stronger global economy, with reflation going faster than some expected. This has lifted rates higher and brought the USD up from the lows.

This puts the pressure back on central bankers to explain the balance of risks for bubbles against targets for inflation.

The data in the week ahead from the U.S. may test this significantly as the doves from the FOMC will have to respond should inflation reach target even if it’s from hurricane-induced pain.

Advertisement

The IMF meetings in the week ahead will similarly play a role in this game of managing the markets as central bankers become content with easy policy eating up excess potential. The risks for an overshoot or a policy mistake grow with the economies going faster than many expected.

So focus remains on equities going up beyond valuation, bonds going down despite low inflation and government still pushing too much debt with populist undercurrents.

The forex markets remain on the front lines of the global growth and inflation watch with emerging markets up last week after being sold the into 3Q end. Whether that trade sustains and whether the USD bid holds into next week and the FOMC minutes, the U.S. debt sales and the U.S. CPI will be key to the new Trump reflation trade. Politics explain half the story, economies the rest.

What happened over the weekend? Another hurricane hits the US, the 4th in 6 weeks – this time Nate Category 1 hits Mississippi and Alabama – flooding Gulf Coast cities with an estimated $4 billion in damage. The storm is expected to drift to New York by Tuesday.

The threats of more testing of missiles from North Korea that spooked markets Friday didn’t happen while the hermit kingdom did see Kim Jong Un promote his sister to the center of power along with more praise for the nuclear program there.

The Trump talk of decertifying the Iran nuclear deal has led to Iran warning on new sanctions and retaliation with threats to U.S. bases in the region.

In a twist, Barcelona has protests against Catalan independence this weekend but both sides remain on collision course into next week.

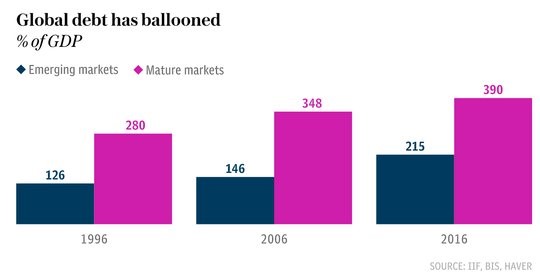

Question for the week ahead: Is Schauble right in warning of another financial crisis? The FT had an interview with the former German FinMin where he warned on rising levels of global debt and liquidity in the world economy.

The IMF October meetings are in Washington this week and maybe a lightning rod for the risks of easy money policy and the risks to financial markets with bubble watches in property, equities and technology all the rave for central bankers.

The IMF Lagarde comments last week are similar – she noted that the world was enjoying its best growth spurt since the start of the decade, but warned of “threats on the horizon” from “high levels of debt in many countries to rapid credit expansion in China, to excessive risk-taking in financial markets.”

Schauble also singled out the EU banks for risk noting the key task facing the single currency area was to “reduce the risks, which are still too high — think of the bank balance sheets in many EU member states.” “We have to ensure that we will be resilient enough if we ever face a new economic crisis,” he added. “We won’t always have such positive economic times as we have now.”

The focus for the week ahead may be on the IMF warnings to financial stability and the growth of debt in the world both for countries and corporations. The rising rate environment in the U.S. may be leading to a rethinking of global credit risks as well.

The investment grade risks by sector are worth watching into 3Q earnings.

View Track.com, the global marketplace for stock, commodity and macro ideas here