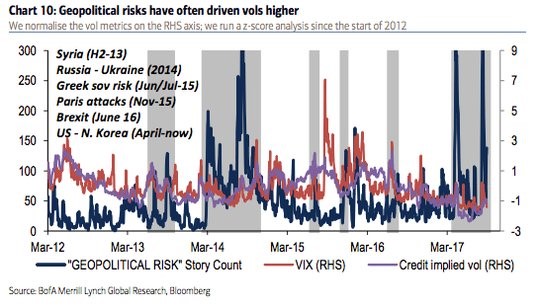

November has been a choppy month for news and dead calm for markets – with the usual geopolitical issues clouding the bigger picture of global coordinated growth with low rates and lower volatility across most markets, writes Bob Savage, CEO of Track Research Wednesday.

The last dinner for the year at Track Research brought an accomplished group of investors, analysts and portfolio managers together to discuss what we learned in 2017 and what those lessons mean for 2018.

The month was interesting for what didn’t happen more than what did.

November has been a choppy month for news and dead calm one for markets – with the usual list of geopolitical issues clouding the bigger picture of ongoing global coordinated growth coupled with low rates and lower volatility across most markets.

There was a bump in the middle of the month with high yield paper and forex markets bearing much of the doubt.

New York suffered a terror attack to start the month, the Saudi purge of princes began, Trump celebrated his election anniversary in Asia where he seems to have pushed bilateral trade deals in a region full of multilateralism, Zimbabwe dropped Mugabe for the Crocodile and Germany saw Merkel give up on a Jamaica coalition, while Catalan fears of independence reversed as Spain took over the region and called for Dec 21 elections.

Brexit doubts turned optimistic as UK May appears close to a E50bn divorce bill deal driving up BOE rate hike risks and hopes for a softer economic landing into 2019.

Inflation fears rose with oil prices but end the month a bit contained as yield curves drop with the U.S. back to decade lows driving up fears for a policy mistake.

Paradoxically, many worry that the U.S. could see a recession at the end of 2018 thanks to Fed rate hikes even as global growth expectations accelerate. Uncertainty in the U.S. over the Powell Fed, and the growing reality of some sort of tax reform, leave markets rotating into December.

Usually that begets volatility but that wasn’t the story at all, in fact it’s been the opposite.

November may best be remembered as the month when the world embraced risk, when complacency changed to fear of missing out and the buying of equities and other higher risk assets rose.

Bitcoin (BTC) being the leader of all such unbridled enthusiasm moving from $6600 lows Nov. 10 to over $11,000 Nov. 29.

On the month the biggest winner in big equity bourses is Hong Kong up 4.9% while the Nikkei is up 2.6% and China lags off 1.6% with corporate rate squeezes dominating discussions.

For Europe, a higher euro (EUR/USD), more doubt about ECB shifting policy and mixed politics left the Stoxx Euro 50 down 2.3% with Spain leading losses off 2.4%.

The US is up on the month with S&P500 Index (SPX) gaining another 1.9% and Nasdaq another 1.5% - even as millenials ditch tech shares for bitcoin.

Much was made about retail and Amazon (AMZN), but Singles Day in China might be even bigger story as Alibaba (BABA) saw $25bn in sales and JD (JD) $19bn. Black Friday was a paltry $5bn in comparison.

China’s shift from export driven manufacturing growth to domestic demand growth is well underway. What does this all mean for markets into the end of 2017 and how will it play out in 1Q 2018?

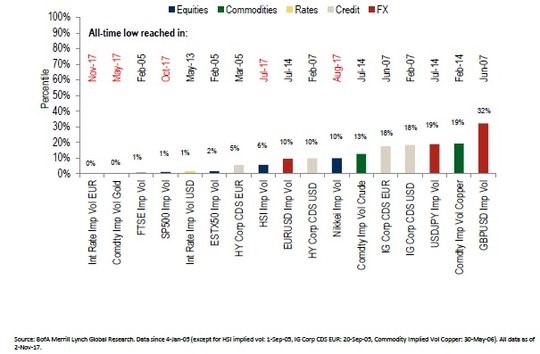

The shift in growth/value is just one example of how low rates and lower volatility has changed the markets. The response of markets to events seems to have also changed, with the “Brexit” and “Trump Election” one-day wonders leading to lower overall risk.

The fact that the S&P500 has gone over 277 days since it had a 3% drawdown – a record breaker of the previous streak back in 1996 – matters. Actual volatility adds to the shape of the volatility surface, leaving it part of the carry trade and the search for yield.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here