The valuations of emerging markets relative to developed markets stocks is in line with the 21-year average spread. Emerging markets are less risky now than they used to be, so I consider this to be a favorable indicator, says Marvin Appel, MD, PhD, of Signalert Asset Management.

The pause in the stock market rally that I predicted Dec. 19 lasted barely two weeks—much shorter than I feared.

Broad-based equity index ETFs representing stocks around the world are making new highs. In the case of U.S. stocks, those highs are confirmed by the advance-decline line and by CBOE Volatility Index (VIX) hitting all-time lows.

All of these observations are consistent with our models, which tell us that conditions remain bullish.

That does not preclude the possibility that stocks will pause or pull back, but it does make it very unlikely that we will see a significant correction.

We continue to recommend holding full equity allocations.

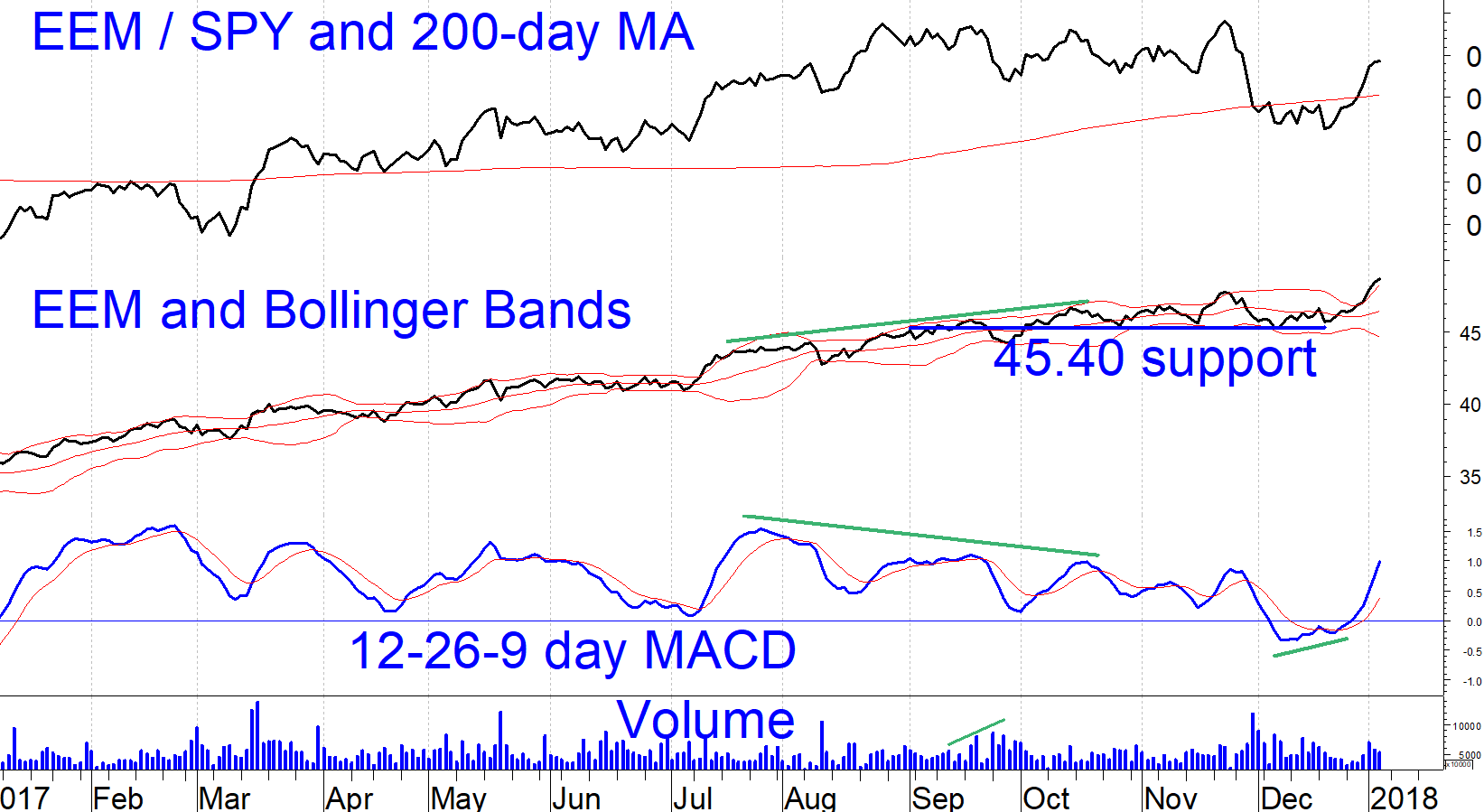

Although emerging markets stumbled in late November, I continue to recommend them for 2018. The ratio of EEM/SPY (total returns) is back above its 200-day moving average, which is a signal that historically has led to better relative performance in emerging markets.

And unlike SPDR S&P 500 Trust ETF (SPY), which remains somewhat overbought by MACD, and iShares MSCI Emerging Markets Index (EEM) generated a fresh MACD buy signal in December after MACD fell to negative territory. (See chart below.)

The valuations of emerging markets relative to developed markets stocks is in line with the 21-year average spread. However, emerging markets are less risky now than they used to be, so I consider this to be a favorable indicator for emerging markets as well.

Subscribe to investment newsletter Systems and Forecasts here…