A Fed rate hike to prevent a speculative bubble could be in the cards. Jerome Powell is already expected to raise rates in March. That would also strengthen the dollar and push down oil prices, writes Don Kaufman, co-founder of TheoTrade.

Despite the speculation in the oil market for the past few weeks, the price continues to go up. It was down 10 cents on Thursday closing at $65.51 which is near its 3-year high.

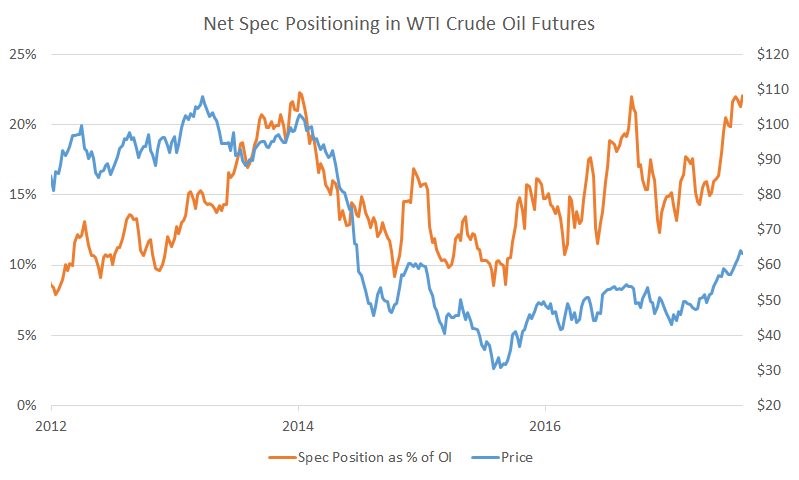

As you can see from the chart below, the net speculative position as a percentage of oil is near the peak in 2014 and in early 2017 when it fell from the mid $50s to the low $40s. The price of oil should have a correction, yet it hasn’t happened this year.

One news item which might pressure oil prices in the next few months is that Nigeria just added 200,000 barrels per day in production capacity which will fully be online by the end of the year. That is 10% of the national capacity. It is part of Total’s $16 billion project. The big part of this deal is that it is offshore production which means the militant groups won’t easily be able to attack.

ECB meeting: Guidance & jawboning

At the ECB’s meeting, Draghi criticized the Trump administration for pushing the dollar down.

As you can see from the chart below, this caused the dollar to actually go up. Ironically, Draghi's criticism of the U.S. manipulating the dollar price manipulated the dollar higher. This may have caused President Trump to say he wants a strong dollar. However, in my opinion the Trump administration will likely continue to support a weak dollar.

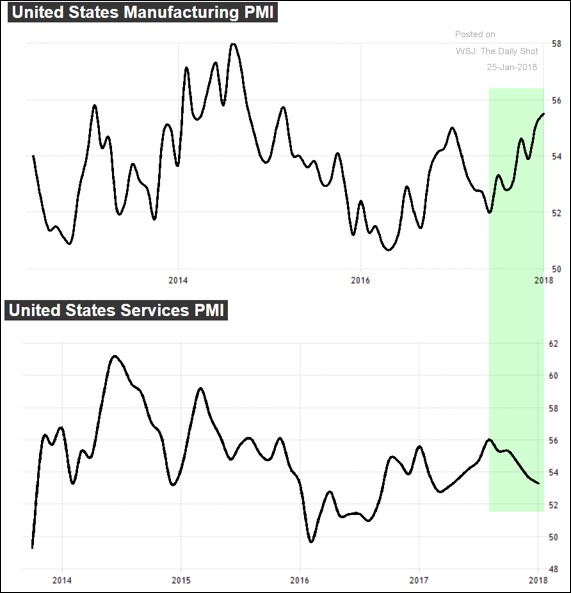

The chart below serves as a reminder of the effect of the weak dollar. As you can see, the manufacturing PMI has climbed while the services PMI has fallen.

This shows why some have criticized the president for supporting a weak dollar. The U.S. isn’t as reliant on manufacturing as much as it is on services, so this could be a bad trade-off.

Ray Dalio said the weak dollar would hurt Americans’ buying power globally, decrease the value of American debt held abroad, increase the paper value of stocks, increase inflation, and increase domestic activity.

Thus far, American stocks with international exposure have beaten the domestic ones. This shows the effect of the weak dollar; it hasn’t increased domestic activity enough to boost the domestically focused stocks.

The weak dollar is consistent with the likely large deficits that the U.S. is about to have in the next few years because of the tax cuts and the out of control government spending on medical care for an aging population also facing an obesity crisis.

I was expecting a potential surprise out of the ECB, but not in terms of the currency war. The policy guidance didn’t end up causing volatility in U.S. stocks as they continued on their run of near perfection in 2018.

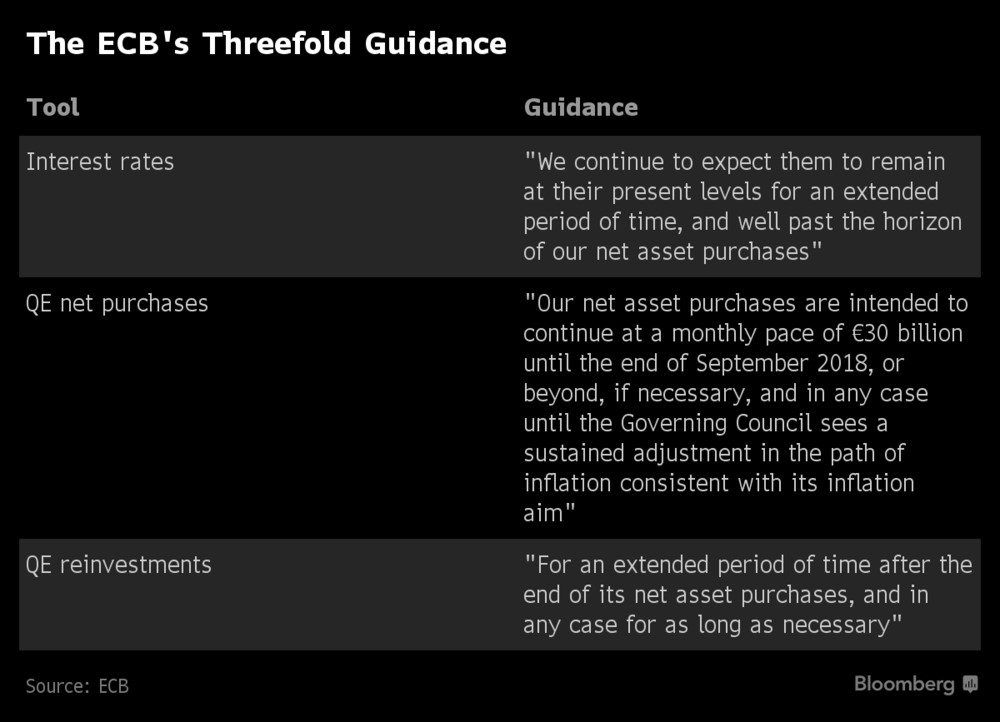

As you can see from the guidance table below, the guidance on interest rates was perfectly neutral. The market interprets the term “well past” to mean the first rate hike will be in March 2019. This is only a 10 basis point hike, which is less than half the size of the 25 basis point hikes the Fed has been doing.

As you can see, the QE net purchases will be €30 billion per month for the first 9 months of the year. They are expected to end in December.

The big debate at the ECB is whether to change the guidance language in March or June. The market expects a change in March. It makes sense to start acting more hawkish since the QE purchases will end this year.

On the other hand, inflation is still far below the 2% goal, so the ECB can decide to slow down the hawkishness to below a snail’s pace.

Finally, the QE reinvestments will continue for a while. The Fed started unwinding about 2 years after the first rate hike which would make the ECB’s unwind start in 2021.

I continue to be amazed by the central banks’ timing. They expect the next recession to be way out in the distance, allowing them to continue with this slow normalization process. The expansion needs to continue for a few more years for the Fed to be done with the unwind.

Starbucks Earnings

The next 2 weeks are key for this earnings season as next week includes most of the big tech names reporting.

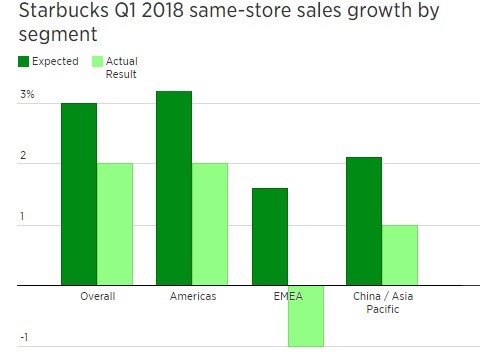

Thursday Starbucks (SBUX) reported non-GAAP EPS of 58 cents which beat estimates by one cent. Revenues missed expectations as they came in at $6.07 billion which was $110 million below projections. Same-store sales were only 2% which missed the estimate of 3%.

This miss was caused by global same-store sales which were up 2% instead of 3%. This is the 5th straight quarter the company missed global growth expectations by at least 70 basis points.

As you can see from the chart below, the Europe, Middle East and Africa segment missed by 2.6%. This weakness caused the stock to fall 4.31% after hours. The stock has been range bound for the past 2 years.

The company blamed the weakness in America on holiday limited time offerings not resonating with the customer. Holiday LTOs and lobby items hurt comps by 1%. If this execution error was responsible for the weakness, it might not be a signal that the consumer is weak.

The one bright side of the quarter was that same-store sales in China were up 6% and revenues were up 30%.

Conclusion

I don’t expect to see much policy changes out of central bankers this year until a bout of volatility in the markets or real weakness in the economy occurs.

It’s a self-fulling cycle in that the central bankers don’t change their minds because stocks are docile, which then makes them more docile.

Some past Fed chairs would be worried about this tranquility in the markets. A rate hike to prevent a speculative bubble could be in the cards. Jerome Powell is already expected to raise rates in March, so he’d either need to raise rates at the following meeting or raise them 50 basis points in March. That would also strengthen the dollar and push down oil prices.