My clients routinely have trailing stops and contingent stops on stock and option positions, and Friday’s price actions certainly tripped several of those stops. I don’t think wholesale moves to cash are warranted yet, says Kerry Given, PhD, founder of Parkwood Capital.

One of the advantages of being a perennial bear is that eventually you get to say, “I told you so.”

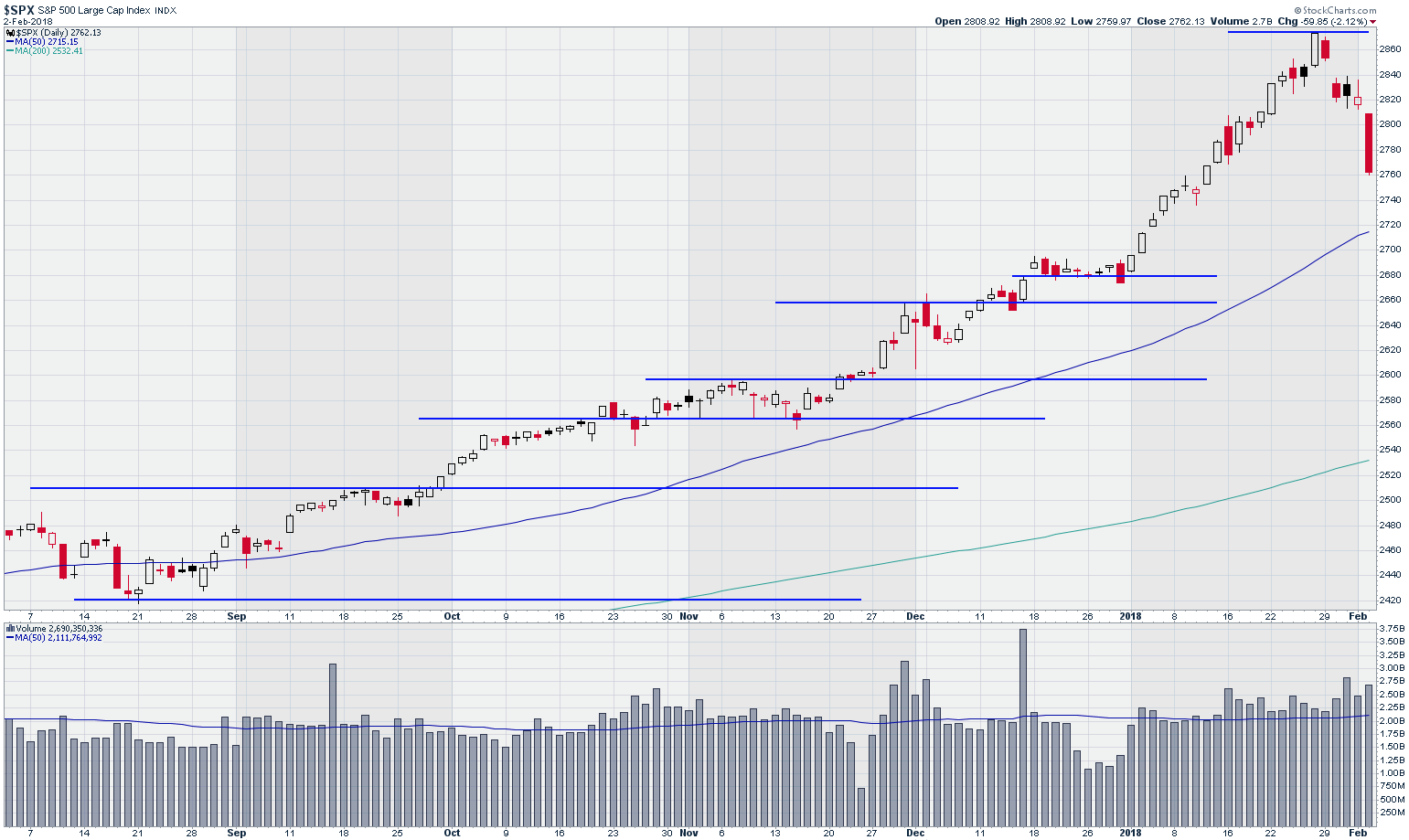

This incredibly strong bull market was overdue for a minor pause and I believe that is all we are seeing at this point. The S&P 500 Index (SPX) hit its recent all-time high on January 26 at 2873.

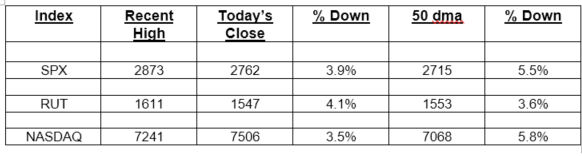

Friday’s close at 2762 represented a decline of 3.9%. The next obvious support level would be the 50-day moving average (dma) at 2715. That would be a 5.5% decline. Many technical analysts look for minor pullbacks in the 5 to 7% area and refer to corrections as declines in excess of 10%.

Standard and Poor’s 500 Index (SPX)

Chart courtesy of StockCharts.com

What triggered last week’s pull back?

The most common answer cited by analysts was the FOMC announcement that suggested more interest rate increases were coming this year. That should not have been a surprise and one or two modest interest rate hikes will still leave us at historically low levels of interest.

We are in the middle of the earnings announcements for the fourth quarter of 2017 and those announcements have been generally exceeding analysts’ estimates.

The effects of the recent tax law changes are only beginning to percolate through the economy. Just consider one of many examples: The Apple (AAPL) announcement of investing $350 billion into the U.S. economy has not yet resulted in any construction expenditures or new jobs. But it will.

My point is simple. The economic foundations are strong. A minor pullback in a strong bull market is perfectly normal. There is no reason to panic.

Trading volume in the S&P companies was above the 50 dma all last week as large institutions adjusted their portfolios in the face of the pullback. Many traders are locking in recent gains.

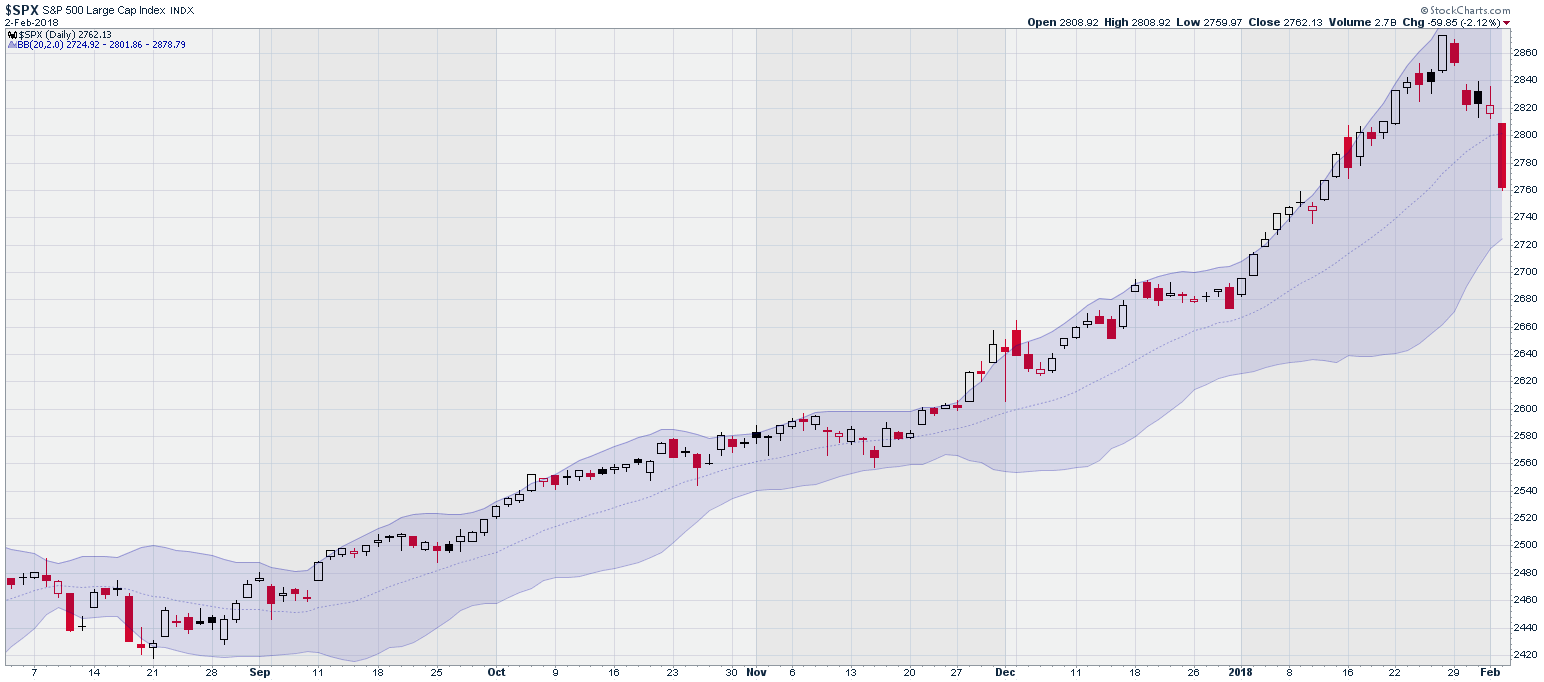

When we draw the Bollinger bands on the S&P 500 chart, we see another clue as to where this pullback ends. The lower edge of the Bollinger bands is at 2725, or down 5.2% from the high on January 26. That 5% number is coming up frequently.

Standard and Poors 500 Index (SPX) with Bollinger Bands

Chart courtesy of StockCharts.com

Russell 2000 Index (RUT)

Chart courtesy of StockCharts.com

The Russell 2000 Index (RUT) closed Friday at 1547, down 64 points or 4.1% from its recent high of 1611 on January 23. RUT has traded much more conservatively for the past month so one might expect less of a pullback in this index. RUT broke its 50 dma at 1553 then.

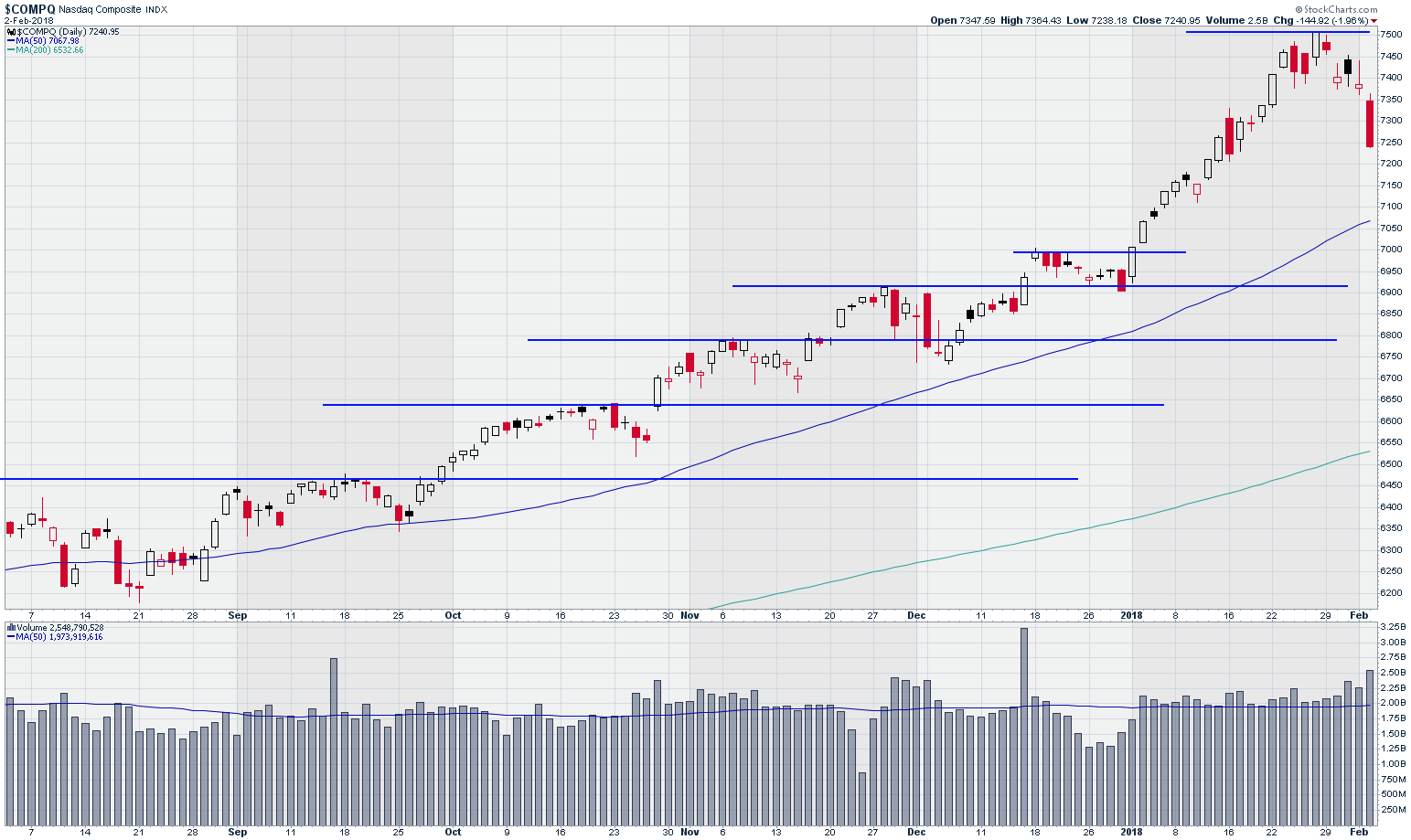

The NASDAQ Composite has traded strongly in January, matching the trajectory of the S&P 500 Index. Similar to SPX, trading volume in NASDAQ exceeded the 50-day moving average (dma) all week. NASDAQ closed Friday at 7241, down 3.5% from its closing high on January 26 of 7506. NASDAQ’s 50 dma stands at 7068, or down 5.8% from the 1/26 high – another number around 5%.

NASDAQ Composite Index

Chart courtesy of StockCharts.com

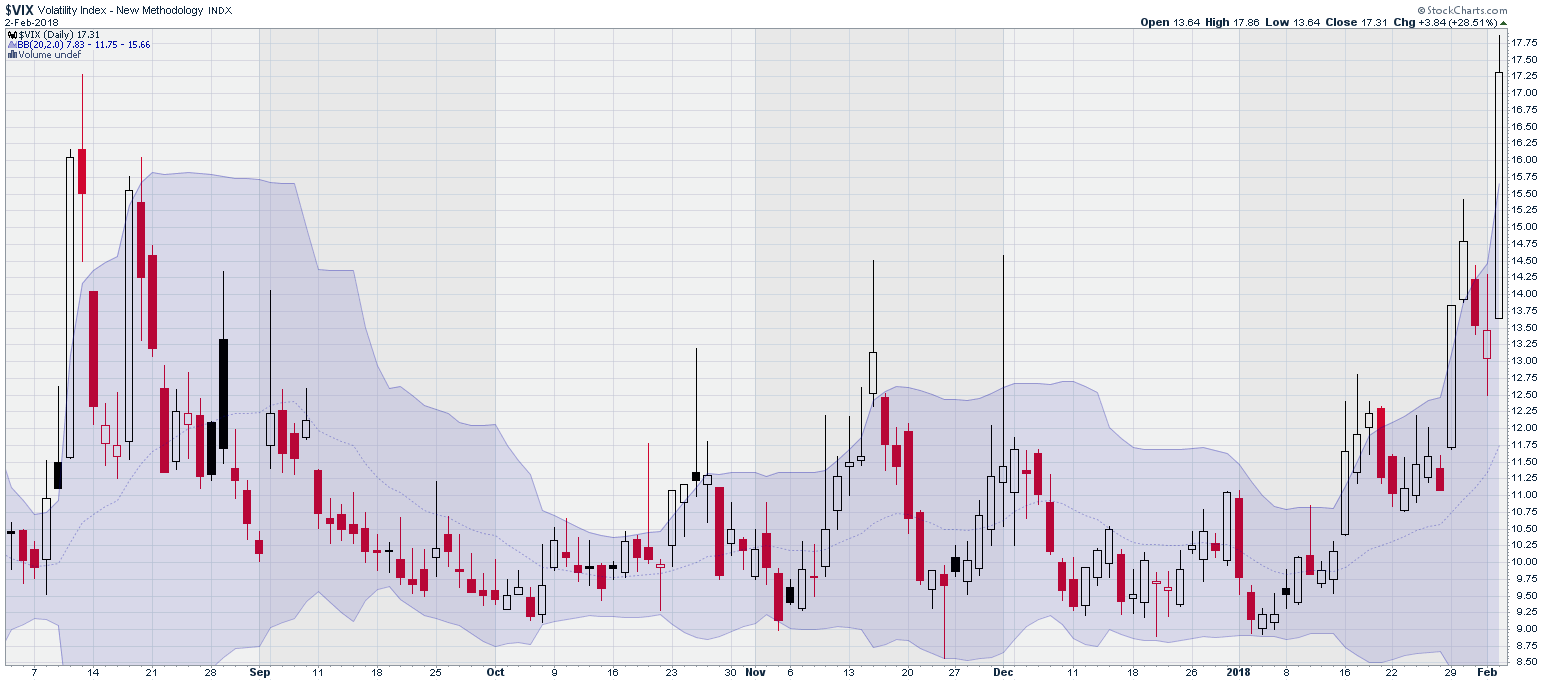

The CBOE Volatility Index of the S&P 500 (VIX) closed Friday at 17.3% after opening the week at 11.7%. This remains a relatively low level of volatility. We hit 17.3% intraday on August 11 last year. I am certainly not suggesting you ignore this increase in volatility, but pullbacks and corrections normally display levels of 25% or higher.

The Feb. 2 VIX, at 17.3%, was higher than any VIX number from 2017, but that was a record year for low volatility. In 2016, we hit highs of 23% in November, 26% in July, and hit 29% twice, once in January and once in February.

VIX is a very good warning signal, and we should pay attention, but the current levels are far from correction territory.

CBOE SPX Volatility Index (VIX)

Chart courtesy of StockCharts.com

My clients routinely have trailing stops and contingent stops on all stock and option positions, and Friday’s price actions certainly tripped several of those stops. But I don’t think wholesale moves to cash are warranted as yet.

I have summarized some key pullback levels for the S&P 500, Russell 2000 and NASDAQ Composite indices in the table below.

If we are looking at a pullback of the order of 5%, we may be close, and the 50 dma lines may be expected support levels, at least for SPX and NASDAQ.

If we break the 50 dma on SPX this week, I will be making some serious moves to cash my portfolio. But I don’t expect that to be the case. The bulls just need a breather.