The market is holding together at high retracement levels for the S&P. Yields reflect a stable dollar at the slightly lower levels, writes Gene Inger in The Inger Letter over the weekend. His presentation at Traders Expo is Tuesday, Feb. 27.

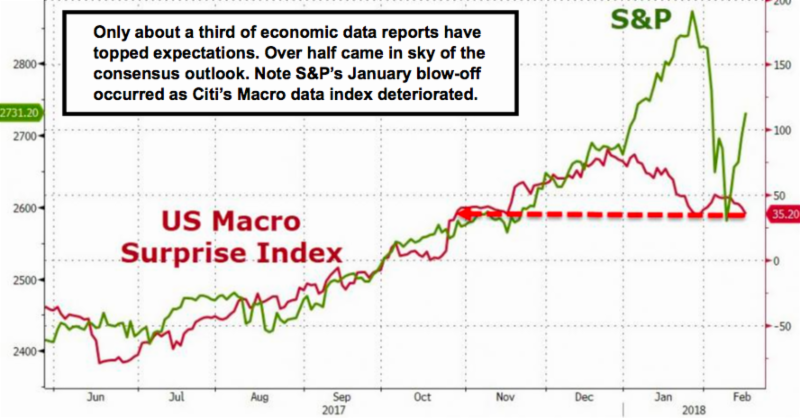

Phenomenal persistencewas anticipated into the mid-2700s. However, the way it held together in the face of protectionist omens from Commerce Secretary Ross, was altogether reflective of how this fearless market remains on a mission.

What’s the mission as unjustified as it is: we have speculated it’s really a drive to recover everything (and then more) lost in the projected rocky late February action leading in the flash crash drop we called for ideally occurring in early February. This market doesn’t even express concern about protectionism and retaliation but ultimately that’s a real issue.

A recovery from the high-level double bottom at the March S&P clearly developed 200-day moving average? Yes, we thought so, although with it being too textbook, and at a high level we were (and are) unwilling just to throw caution to the wind and suggest high-level investing beyond the trader only short-term rebound view expressed when calling for what I termed an automatic rally off the double-bottom washout.

Chasing it up here is now ludicrous, even if it manages to advance further. A serious question might be whether any further strength should be lightened-up.

This past week we called for Oil to rebound (it did a bit from high 50s to the low 60s), but by no means moving back toward 70 barring a crisis of course.

And we thought that the S&P (and NASDAQ especially) needed oil stocks to assist their effort as traders rotated from techs into others in the well-oiled drill of using rotational shifts to prop-up the market pattern.

Free-trade debates aren’t terribly impactive, though they could be over a period of time. The levies proposed on steel and aluminum are not new from a broad sector area, as there have been some. For several years, in addition, there have been political pressures to dissuade using cheap Chinese steel. I pointed to the San Francisco/Oakland Bay bridge as a case in-point, however additional levies might pressure private industry, which is being discouraged from global outsourcing in many ways now.

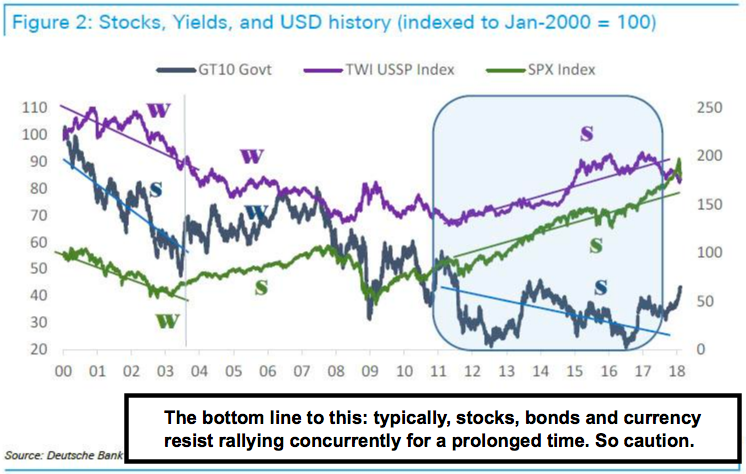

With respect to yield movements there are debates. Generally, if a bond is denominated in a major currency expected to rise against the dollar, well then, it’s perfectly reasonable for its yield to be lower than equivalent dollar paper. Again, exchange rates and nearly zero rates abroad in many countries makes investing in American financial assets lucrative. The problem arises when (like with China this month) you hear begging for deposits, by bankers, because a liquidity drain is now encroaching.

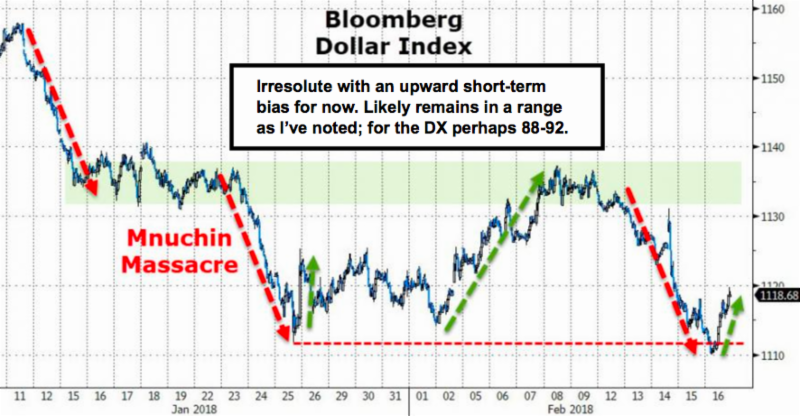

In-sum: the market is holding together at high retracement levels for the S&P. Yields reflect a stable dollar at the slightly lower levels. (We were bullish for four solid years on the dollar from 79 to 100. Then Goldman came forth to say they liked it at 102; and I said game already played sell it to them. Now down here in the high 80s I’m not particularly bearish on the dollar; so moved to a stabilization call.)

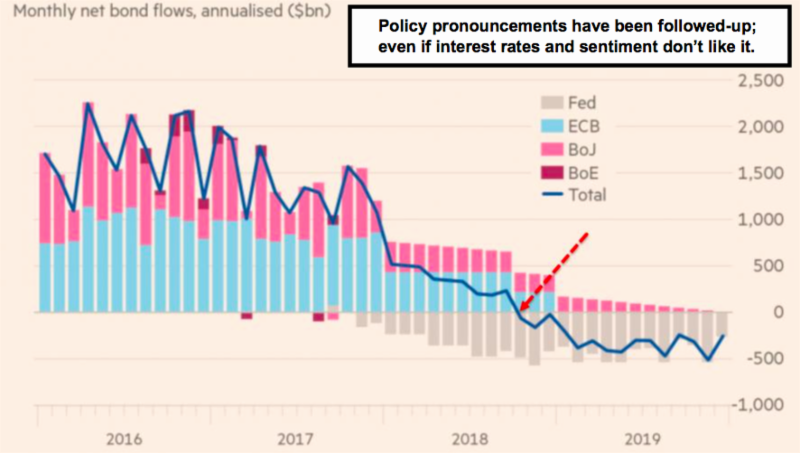

Low yields mean people are widely interested in buying the particular bond or instrument. High yields generally suggest people have to be enticed to buy bonds with lower bond prices; but that equates to lower currency value. This relationship prevailed for years while the Fed overstayed their so-called emergency low rates. The pattern has been shifting as they forewarned it would with respect to unwinding the Fed’s balance sheet; but so far demand has absorbed supply fairly well; just as perhaps flight-safety Treasury buying also helped provide demand.

It’s an unfolding challenge many contend should impact equity prices as things shift; but I’ve contended it would short-term while not impeding at all U.S. business with rates firming slowing as called for from relatively low levels. While the Fed does not need to officially hike rates so long as supply rolling-off gets absorbed with only nominal moves higher in rates; it can still firm like we've explained. Though yes, it's at an inflection and it would seem surprising if we don't get a formal rate hike in March.

Also, I’ve noted the myopic view of domestic economic activity probably didn't justify the Fed's snugging-up; but we projected it based on global relationships, while the Fed nearly always tries to explain it domestically. It’s not just disintermediation or the like; it’s also concern about China or others moving to essentially moving to competitive policy regimes.

Recent protectionist sentiments didn’t even ruffle the market as much it is said, as the Russian indictments did. Then when those were stated not to involve the White House, the market stabilized for the rest of Friday. The late action was firm but inconclusive with respect to meaningfully taking-out the March S&P 2750 level, which should occur next week.

Speaking of next week, I mentioned that I was charmed by a delightful event coordinator into accepting an invitation right in the middle of winter, to give a stock market talk at the TradersExpo next week at the Marriott Marquis in New York Times Square.

It’s Sunday-Tuesday February 25-27. My presentation will be around 2:30-3:15 Tuesday, Feb. 27. If you’re in New York and would like to join in, it would be great to say hi. I won't attend Sunday, attend Monday (at the evening Networking Gathering).

A link is posted above if you wish to attend or invite friends. I appreciate the TradersExpo invitation, and opportunity to visit family from Paris (currently with the French UN Legation) during this rare trip to NYC. I’ll update as I finalize schedules; intending reports here regularly, as I always try.

Enjoy trading and more Olympic Gold for the USA!