Political news causes people to wonder if progress is real or just a facade by both sides for show. Hopefully that’s not the case. Everything is inconclusive. If we can get a renegotiated NAFTA that would help for now, writes our roving Trader Gene Inger from Mykonos.

Movers and shakers continue influencing the political world but little is traumatizing the financial markets as the S&P 500 (SPX) treats everything from the speech of Chairman Powell to revelations by Trump Organizations CFO or New York State litigation, as favorable news apparently whether it is or isn’t.

So, it is for the vacillating reports about trade talks with China, or even Trump cancelling Secretary of State Pompeo’s upcoming North Korean foray.

Reuters: S&P 500, Nasdaq rally to record highs Monday on talk of US-Mexico trade deal.

Caution: Internally the market does NOT have to equal January’s peak.

Meanwhile as markets climb, the higher standard deviation band is still in an ascent that borderline remains dangerous while it at-minimum retains a sort of bated-breadth anxiety about when we get a respectable shakeout.

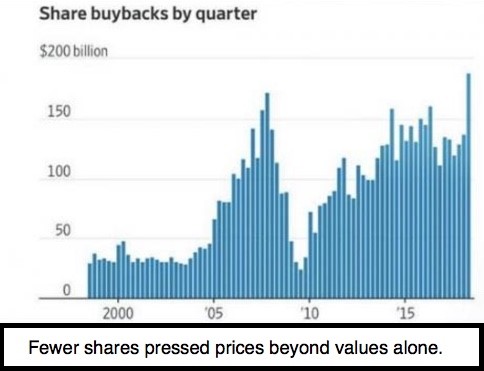

You’ve had a gargantuan move in the handful of stocks leading the charge while some are projecting a huge move in almost giddy fashion now. Does that mean we’re near the end of the run? A bit hard to say but basically it remains the same overpriced issues continuing to power illogical rallies, at the same time that anyone using logic to short stocks gets hammered.

So, we continue skeptical at the same time we won’t actively short S&Ps in this market. That means we hold core (and speculative) positions from long ago especially immediately in the wake of Trump’s election when a key point was to separate one’s political views from investment decisions if indeed the two weren’t in-sync.

This year’s moves were rotational from the parabola back in January with the market rotating higher often in less than synchronous ways. It is likely working on borrowed time.

Widespread strength in corporate earnings suggests to some analysts that we are far from the final stages of this bullish market cycle. That’s possible if we get extreme continuity of growth trade deals a political solution that does not rock the markets too much and the Fed’s limited rate moves.

All that is exclusive of implications of midterms barely over two months hence.

Don Kaufman: Midterm elections won't cause market correction.

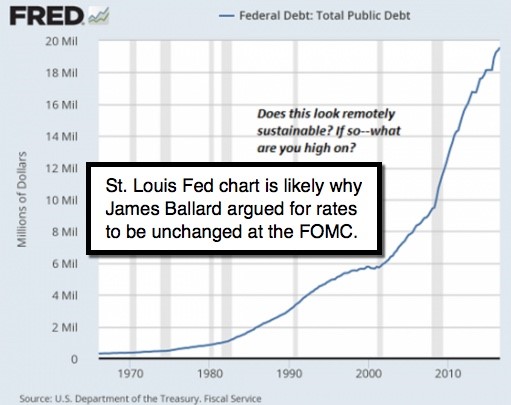

I’m aware the market moved up in-part on the idea that Chairman Powell’s speech at Jackson Hole was sort of dovish but I didn’t hear anything that really suggested the Fed departing from intentions, or the U.S. dollar (USD) slipping in any persistent way.

Powell simply expressed concern about currencies and of course there is a concern that China not manipulate the Chinese yuan (CNY), or use a firm U.S. dollar as a continuing excuse to do so.

Friday’s Durable Goods numbers and other retail data have some saying it is a paradise for consumers although that’s not what most charts show.

I do concur that inflation is not a problem but Powell’s sort of neutral stand on that isn’t sufficient to change the macro picture. Watch Oil incidentally as it’s starting to firm again, and a slightly softer dollar might add to that.

In-sum: Rounds of tariffs are about to kick in. Gaining strength in corporate earnings is broadly being called for while pundits suggest we are far from the final stages of this bullish market cycle. That can only be the case in a stable environment that also includes pressure on China to make a deal.

If we can get a renegotiated NAFTA for-instance that would help for now.

Generally, this is getting frothy again. There is too much unanimity of bullish enthusiasm (mostly from pundits who disputed our optimism 18 months or so ago.) We think it’s again a Greater Fool Theory for those chasing.

(The brief midday report was recorded in the Internet Lounge as I demonstrated to Celebrity ship staff the challenge of super-slow upload speeds. They advertised fastest at sea. Hardly. I am now in Mykonos, Greece on an extremely hot day so can use my cellular hotspot as a back-up.)