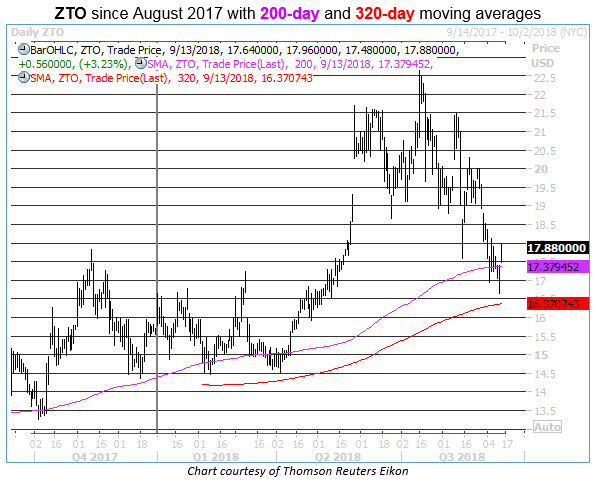

ZTO Express (ZTO), a Shanghai-based delivery service, has undergone a steep pullback from its July 16 year-to-date closing high of $22.43. In fact, as of its closing low of $17.20 Sept. 5, the stock had shed more than 23% in less than two months, says Elizabeth Harrow.

Since that rapid slide into formal bear market territory, though, ZTO appears to be bouncing back fast.

Specifically, the shares bottomed out in the aforementioned $16.80-$17.20 zone through the first half of September, before surging higher in Thursday’s session amid revived U.S.-China trade optimism. This chart zone had previously marked tops for ZTO since its NYSE trading debut in October 2016, but now appears to be switching into a supportive role.

Plus, at its lows earlier this week, ZTO stock came within one standard deviation of its 320-day moving average. On the one prior occasion where the equity pulled back to this trendline after a lengthy period of trading above it, the shares went on to rally 10.98% over the next month, according to Schaeffer’s Senior Quantitative Analyst Rocky White.

And Thursday’s bounce has also propelled ZTO above its benchmark 200-day moving average, which had been threatening to emerge as resistance in recent days.

If ZTO shares continue to bounce from support, it could shake loose some short sellers. Short interest on the stock rose 5.8% in the most recent reporting period, and now accounts for 4.5% of the equity's float. At ZTO’s average daily trading volume, it would take 7.3 days for all of these shares to be covered.

The stock isn’t an ideal call-buying candidate at the moment. Trade-Alert pegs the stock’s 30-day at-the-money implied volatility (IV) at 42.1%, which lands in the 77th percentile of its annual range. In other words, short-term options on ZTO are pricing in higher-than-usual volatility premiums.

And puts are particularly rich relative to their call counterparts, with the 30-day IV skew arriving at 11.0%, in the 82nd annual percentile.

Plus, our own Schaeffer’s Volatility Scorecard (SVS) for the stock stands at a low 19 (on a scale of zero to 100). This reading means that, over the past year, ZTO stock has consistently realized much lower volatility on the charts than what its options premiums have priced in. Essentially, it’s been an exceptionally unrewarding target for premium buyers.

As such, speculative players may want to capitalize on expected ZTO upside over the next month -- as well as the equity’s rich put option premiums -- by selling short put spreads on this China-based stock.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here