Inflation momentum is negative and year over year growth decelerated even though August had the easiest comparison of the year. Keep in mind that the investment banks could be underestimating the impact tariffs will have on inflation, writes Don Kaufman Saturday.

The August Personal Income and Outlays report showed modest inflation and moderate income and spending growth. The inflation data is way behind the new trends because the latest tariffs and the spike in oil prices happened more recently.

I was disappointed by the core PCE reading just like the CPI and PPI readings. PCE headline inflation was up 0.1% month over month which missed estimates for 0.2% growth and was the same as July. Year over year headline PCE inflation was 2.2% which missed estimates and July’s reading of 2.3%.

I think we will see a smaller downtick in inflation than I initially expected because of oil and tariffs. This won’t alter Fed policy. Because of the tougher comparisons, a slow deceleration is decent. Core inflation slightly below 2% means the Fed will stay with its current guidance.

Core PCE was flat month over month which missed the consensus for 0.1% growth and July’s reading of 0.2%. Year over year core PCE missed Capital Economics’ projection to accelerate because of medical costs.

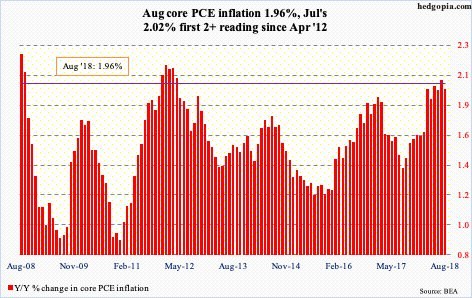

As you can see from the chart below, it was 2% which met the consensus and last month’s reading. Technically, it fell from 2.02% to 1.96% which is a disappointment because inflation fell 9 basis points from July 2017 to August 2017, meaning the comparison was easier. From August to December 2017, core inflation went up 23 basis points, meaning the caparisons will get tougher.

Tariffs could catalyze more rate hikes

The chart gives a visual of the past few inflation ramps which were held back by tough comparisons. This time we have tariffs to help inflation.

According to Bank of America Merrill Lynch, year-end 2019 core PCE will be 2.2% instead of 2.1% because of the tariffs. JP Morgan expects the China tariffs to increase core PCE inflation by 0.2% in 2019. JP Morgan thinks although the Fed should treat this uptick in inflation as a transitory effect, it could raise rates 4 times instead of 3 in 2019.

I agree with the uptick in inflation because wage growth should accelerate in 2019, but I’m skeptical of 3 or 4 hikes. I’m expecting 1 or 2 hikes which is what the Fed fund futures are showing.

By October 2019, the highest probability is 1 hike (35%) and the second highest is 2 hikes (29.7%). There’s only a 14.8% chance of at least 3 hikes by October 2019. The CME website only goes up to October of next year. It will show the entire year after the December meeting.

Updated Phillips Curve

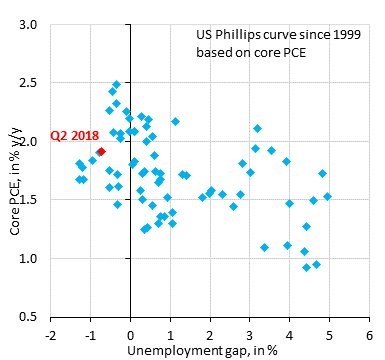

The Phillips Curve is the relationship between inflation and the unemployment rate. It has been maligned in the past few quarters because the unemployment rate is very low, but inflation isn’t that high. As you can see in the chart below, Q2 2018 had very low unemployment, but had core PCE inflation below 2%.

There’s a possibility Q4 core PCE is lower than Q2 and the unemployment rate is lower. As you can see, there has been quarters with much higher unemployment with higher inflation. To be clear, the unemployment gap measures the difference between the current rate and the long run rate. Since the current rate is lower than the long run rate, it’s negative.

The current situation would be unlike any other if it used jobless claims instead of the unemployment rate because they are so low.

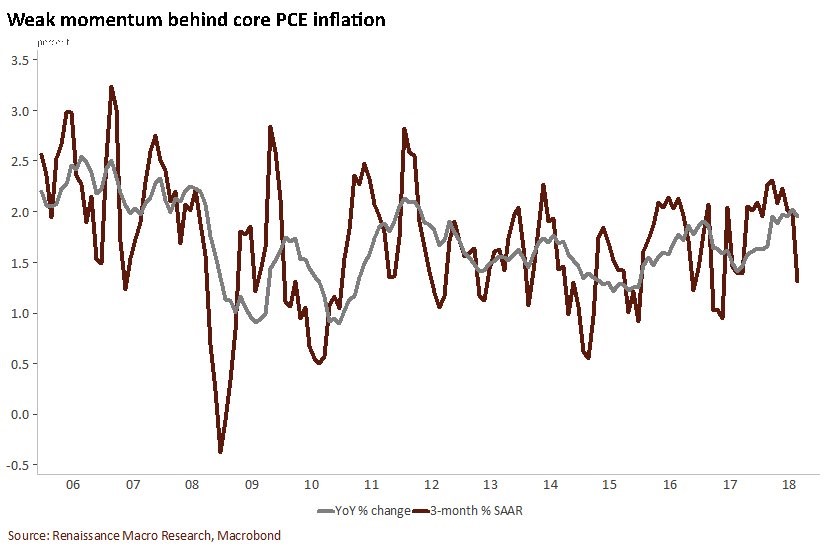

Weak inflation momentum

The chart below shows the 3-month seasonally adjusted annual run rate for core PCE suggests the momentum behind core PCE is weak as it is only 1.3%. Even as nominal wage growth has been strong, it hasn’t acted as a catalyst for higher inflation yet. The metals tariffs affected manufacturing but haven’t come close to driving overall inflation as Powell said it his testimony on Wednesday.

The regional Fed manufacturing surveys’ price metrics have been off the charts, but show no correlation with PPI, CPI, and PCE inflation.

Personal income & consumer spending growth

Personal income growth was 0.3% month over month which missed the consensus estimate for 0.4% growth. It was the same as July’s reading. Month over month consumer spending growth was 0.3% which met the consensus and was 0.1% below July’s reading. Income growth was suppressed by the decline in interest income and the marginal gain in dividend income.

That suppressed the great wage growth as it increased 0.5%. When you include inflation and taxes, income was up 0.2%.

The savings rate was unchanged at 6.6%. As you can see, the savings rate is remaining high despite the strong economy. When you pair the high savings rate with the declining leverage, households are in very good shape.

The biggest problem is the lack of wealth gains from the bottom 50% who don’t own stocks. About 50% of houses aren’t worth more than the 2007 peak.

If a person never owned stock, lost his/her job in 2008 for one year, and has a house that’s worth less than 2007, he/she still isn’t in great shape despite the 9-year expansion.

The best bet for people in that situation is to pay down any credit card debt and start investing even a small amount in the stock market.

Spending growth was brought down by the 0.1% decline in durable goods which was caused by the weakness in vehicle sales. As I mentioned previously, the destruction from Hurricane Florence thankfully wasn’t large enough to cause a spike in auto sales like we saw in September 2017.

Non-durable goods spending was up 0.5% because of increased energy prices. That will spike even further in September if oil doesn’t hurt other segments of retail. Spending on services was up 0.4% for the 2nd straight month. Including inflation, spending was up 0.2% month over month.

Conclusion

This was a status quo report which is how most of the PCE reports are because they are delayed. Inflation momentum is negative and year over year growth decelerated even though August had the easiest comparison of the year.

Keep in mind, that the investment banks could be underestimating the impact tariffs will have on inflation. The Fed is following the situation closely.

Subscribe to TheoTrade here...

View a brief video interview with Don Kaufman on volatility for traders and investors here

Recorded at TradersExpo New York Feb. 25, 2018

Duration: 2:34.