For now, it’s a good idea to sit back with lots of cash on hand, a good buy list in hand, and a big serving of patience. For now, dabbling in inverse ETFs, poaching short-term profits from occasional longs, and trading options makes sense, writes Dr. Joe Duarte Sunday.

Maybe it’s too soon to say it, but it surely seems as if there is blood in the streets and no one is buying. Of course, that old Wall Street adage, “Buy when there is blood in the streets,” is attributed to legendary banker J.P. Morgan as he described periods during which value investors could pick up bargains in the midst of selling panics.

But in this episode, there don’t seem to be any buyers, at least not yet. This makes trading with any certainty a difficult endeavor, even if the short side is delivering some wins. And although there may be a somewhat credible relief rally at any time in the future, all current signs suggest we may be in for a longer than expected period of market volatility akin to a slowly bleeding peptic ulcer.

Here we are in yet another chapter of this time is different, as the stock market continues to crash and there are no signs of any buyers who hang around for more than a couple of hours.

For its part stocks look increasingly vulnerable to further selling, as the S&P 500 (SPX) is off 11.2%, the Dow Jones Industrials (INDU) off 9.5% and the Nasdaq 100 (NDX) indexes are off 14.9% off of their October highs and negative for the year; and may be well on their way to formal bear market territory of 20% losses.

Sure, there is plenty to worry about as the global economy has been slowing for months and recent PMI data and flaky earnings suggest that the U.S. economy is joining the slow growth pack. Of course, the changing political landscape – Brexit, the midterm election, trade war possibilities and a suddenly ambivalent Federal Reserve are also adding to the uncertainty.

With both eyes open, our fingers crossed and our ears pinned to the ground, we head into that traditional time of the year which is better known on Wall Street as the Santa Claus rally.

Moreover, with a large number of Federal Reserve speakers out this week, anything they say which could be interpreted as hinting at a change in the course of interest rates could be a nice Christmas present.

No help from market breadth

The New York Stock Exchange Advance Decline line (NYAD), the most accurate indicator of the market’s trend since the 2016 presidential election, gets the award for calling the market’s decline when it delivered a subtle but correct non-confirmation of a marginal new high in the Dow Industrials in late September, which in retrospect qualified as a sell signal.

Indeed, on Sept. 24, 2018 in this space I noted:

“At this point the potential divergence of the NYAD and the major indexes may be meaningful, or it may be just another installment of this bull market’s penchant for algo triggered fake outs, especially if the line catches up to the Dow and the S & P and if the market continues its gallop higher over the next few weeks.”

“However, I feel compelled to note that if stocks start to retreat wholesale, in retrospect, it may very well be that this very subtle technical development involving the Dow Jones Industrial Average and the New York Stock Exchange Advance Decline line might turn out to have been the proverbial S-E-L-L Signal.”

Flash forward to the present and we see a marginal new low for NYAD, registered last week, along with a rolling over of the RSI and ROC indicators. Furthermore, the line is now below its 200-day moving average, signaling that the benefit of the doubt for the market’s direction at the moment goes to the bears.

Indexes look weak

The market indexes are no help as they are also in what could be long lasting bearish trends. Indeed, both SPX and NDX are trading below their 200-day moving averages amid lower volume which suggests more traders are now on the sidelines and that volatility could spike further.

Furthermore, Accumulation Distribution (ADI), On Balance Volume (OBV) and the ROC indicators are moving lower, suggesting a potential increase in down side momentum.

If there is any positive side to the current situation in the stock market, it may be that the odds of a washout and possibly climactic selloff are increasing or that stocks are so oversold that some sort of bounce that actually lasts takes place.

Either one of these scenarios is equally plausible given the posture of the above noted indicators which are all near their recent lows accompanied by thick layers of bearish sentiment everywhere. Of course, the bounce scenario would be negated or delayed if the market selloff accelerates and prices fall through the recent bottom.

Concern for the U.S. economy is evident in Oil and Bond markets

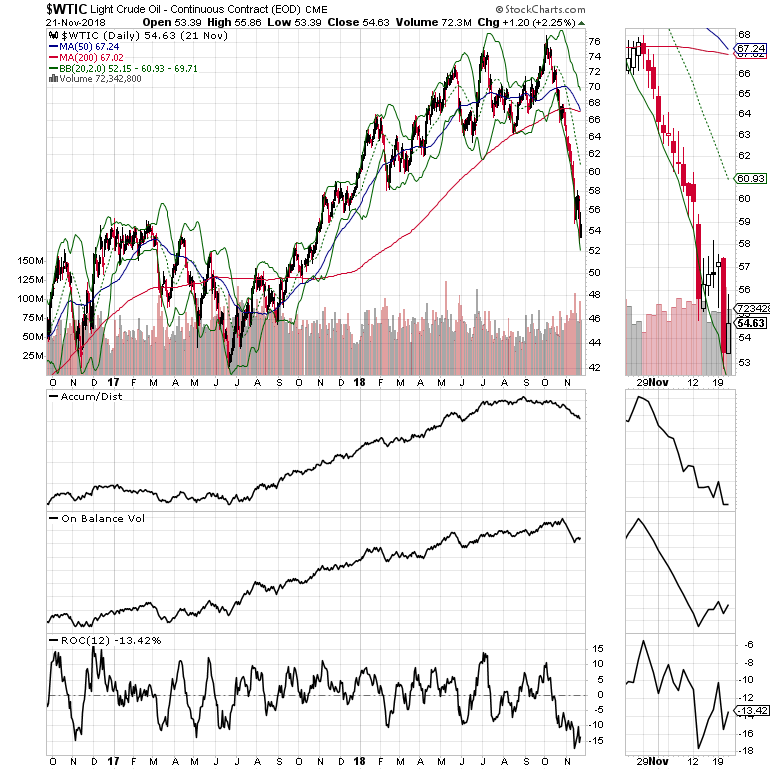

Last week I noted that the crash in oil prices (WTIC), coincident with the fall in the U.S. Ten Year Note yield (TNX) suggested that the market was betting on a slowing of the U.S. economy. Unfortunately, this has not changed much.

TNX is hovering just above the 3% yield after recently trading above 3.2%. That’s quite a drop in yield in a short period of time, a signal that the bond market is increasingly concerned about economic growth slowing, not inflation as the Federal Reserve seems to be.

This divergence between the Fed and the bond market is concerning and suggests that the Federal Reserve is in a box from which there could be no easy policy maneuvering.

Furthermore, oil prices continue to crash with the WTIC now seeming ready to test the $50 per barrel price area. There is the possibility of some type of bounce in crude, but there is plenty of resistance around $60 where there could well be yet another price reversal.

Uncertainty is still the word of the moment

Bear markets are defined as market drops of 20% or more. Cyclical bear markets tend to last 12 months or less, give or take a couple of months on either side.

Secular bear markets last longer, sometimes two years or more. It’s unclear as to whether we are working our way to one or the other, but the thought is clearly sneaking into the minds of traders, which is the reason for the fall in volume and the failure of rallies beyond the short covering phase.

There is no point in trying to pick a bottom here as it will be self-evident if and when it comes.

Above all, do whatever it takes to avoid peptic ulcers.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com - now in its third edition, The Everything Investing in your 20s and 30s and six other trading books.

To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit us here.