I’m going to say what should be obvious: Apple is not a luxury brand. It’s upscale, sure, but it’s more Nike than Louis Vuitton. Not that there is anything wrong with that, writes Jon Markman.

Apple has benefited greatly from its ability to raise prices just short of alienating its most loyal customers. However, it is starting to learn that those customers have limits.

It has been a frightful time for Cupertino lately. Its iPhone suppliers warn that sales are below plan. So, there was great relief last week when the company said its new iPhone XR is outselling the XS and XS Max variants.

That’s cool except that, at $750, iPhone XR is the cheap one.

It should keep shareholders awake at night that Apple is discovering the limit customers are willing to pay for its brand.

Since 2014, Tim Cook, chief executive officer, has been hiring product managers away from the world of fashion and luxury brands. His goal has been to remake the innovative tech company Steve Jobs built into a new-age consumer electronics luxury brand.

In fairness, there have been plenty of success stories along the way …

One of the greatest feats of the fashion world is getting consumers to adopt iconic, but ugly, things. Apple replaced the bell bottoms and leisure suits of yesteryear with today’s Watch and EarPods. Then it convinced customers these eyesores were beautiful.

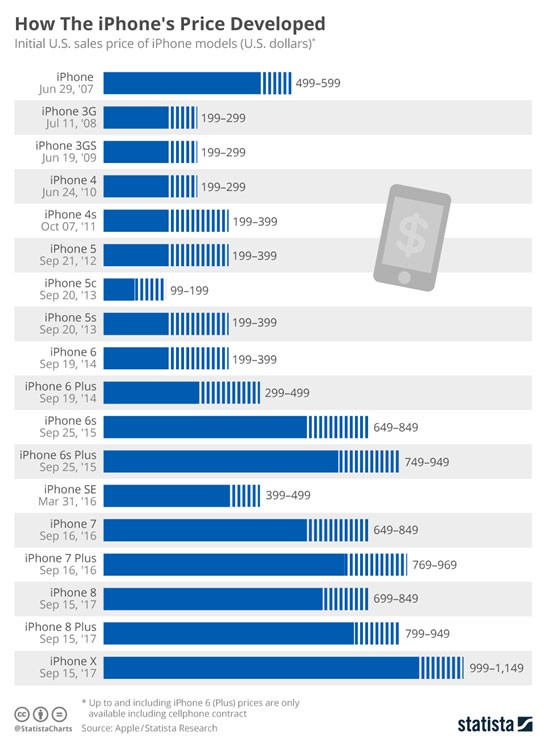

When the company launched iPhone X last year, the other side of its branding strategy began to take shape: Massive price increases. In an era where smartphones have reached saturation in most developed markets, Apple began to raise prices dramatically. The iPhone X started at $999 — 80% more than the groundbreaking, original iPhone.

This was a bold plan to increase revenues. And it worked.

The headlines from this time last year were that the new, expensive iPhone was the best-selling device. In February, when the company released strong fourth-quarter financial results, Cook said the iPhone X had been the top seller every week since it was released the prior November.

Contrast that with the current official company line …

Greg Joswiak, vice president of product marketing, told CNET Nov. 28, the XR has “been our most popular iPhone each and every day since it became available.”

That calculated soundbite is Apple failing the luxury brand test. It’s the discontinued $10,000 Apple Edition watch all over again.

I suspect the company will have trouble selling XS and XS Max devices, with prices that range upward to $1,500. Same goes for its expensive Macs and iPads, too.

Cook and his gaggle of luxury brand managers are finding out that hardware with an Apple logo does not command the premium they thought.

The good news is it’s unlikely that iPhone customers are leaving the brand. According to The Wall Street Journal, Apple is aggressively cutting prices and offering large subsidies for XR. This means there is a good chance the company will achieve its internal unit sale targets and keep customers, despite all the negative headlines.

Apple’s brand is not dying. Far from it. It’s just not Hermes. It can’t raise prices at will.

The company is still going to sell a lot of iPhones. Recognition of its true brand value may even lead to an increase in overall market share. But that will come at the expense of reduced margins and lower profitability. In the end, its handset business will likely look a lot more like Samsung’s, with less innovation.

Without the unfettered cash cow that is iPhone, Apple is left with the growth of its services business. I respect its ecosystem. The App Store is a sales juggernaut. But it faces an existential crisis as anti-monopoly activists earned a hearing before the U.S. Supreme Court. And I’m less enthusiastic about the rest. Seriously, how is Apple Music a great business when Spotify, a superior platform, is not?

Ultimately, Apple is a victim of its own gaudy success. It makes a great smartphone that customers love, yet feel no immediate need to upgrade, especially when it is charging significantly higher prices.

I get it. The market is mature. Going upscale, pushing the luxury brand angle was a shot Apple had to take to maintain revenue growth. However, customers are not playing along. Not enough of them are willing to pay the premium.

Apple shares trade at only 12x forward earnings, and 3.3x sales. On paper, the stock is cheap. It is likely to bounce. However, longer-term investors should look for a new story. The luxury brand angle is not going to work for this company.

Best wishes,

Jon D. Markman

P.S. My Tech Trend Trader subscribers recently banked a fat 47.3% trading profit on Apple. But as an investment, the stock does not quite meet the criteria to be what I consider a Power Elitestock. What does that mean, and why do my Power Elite stocks offer bigger profit potential than the Apples of the world? Find out here.

View these MoneyShow videos featuring Jon Markman.

Watch Jon Markman’s latest presentation: How to crush the post-IPO trade for emerging Tech companies here. My top 7 picks now.

Recorded: TradersExpo Las Vegas, Nov. 14, 2018.

Duration: 51:17

My sectors for a bear market: growth stocks, technology, healthcare.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:34.

How to profit now from robotics, autonomous cars, AI and the cloud.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 37:31.

Jon Markman: Stock Picks in Industrial Tech, Video Games.

At MoneyShow Dallas, Jon Markman picks in industrial tech include Lockheed Martin and Northrop Grumman. And another part of tech: video gaming: Electronic Arts, Take-Two, Activision Blizzard.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 6:15.

Jon Markman: Self-driving cars offer surprise investing ideas.

At MoneyShow Dallas, Jon Markman shares tech stock ideas with Neil George of Profitable Investing. What's ahead in self-driving cars, a lot of spin-off positives for investors. A commuter cocktail?

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 2:24.

Jon Markman's 5 tech stock picks, in a short video.

Picks: GOOG, AMZN, MSFT. Companies turning the hardware of the cloud into software: Arista Networks (ANET), Nutanix (NTNX).

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 5:13.

Jon Markman: S&P 3300, Tech, Healthcare Picks

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:33.

Jon Markman: What can end the Bull Market?

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 1:58