While markets have reacted positively to the change in policy stance from the Fed, Bob Savage points out that it is not an active measure.

Not doing anything isn’t the same as actively trying to make things better.

The spin on markets today is that neutral is enough but for many the uncertainties over geopolitics and policies supporting growth gnaw away at the latest joy from the FOMC turnabout from normalization to neutral.

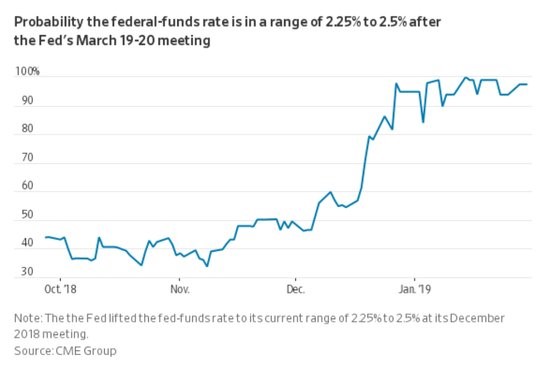

It’s not a surprise that the Fed pauses and shows patience after nine hikes. The confirmation of the FOMC moving from tightening to neutral bias was sufficient for a risk-on rally in the United States to two-month equity highs. It continued in Asia bringing further relief to shares from Japan and China, but it stalls in Europe. The significant data overnight explains some of the divergence. Korea and Japan both saw lower industrial production, the BOJ meeting summary highlights the doubts from US/China trade disruptions and how its hitting the consumer. The inflation drop in Europe makes clear that the ECB isn’t going to get to its target in 2020 and it begs the question: Are they doing enough.

The China National Bureau of Statistics Manufacturing PMI was good enough to squash the worst fears about imminent economic slowing but make clear that its more about US/China trade deals still. Further deregulation of foreign investment rules may help, but better Alibaba (BABA) profits maybe more important than either amidst a host of warnings on earnings from other Chinese companies. The German retail sales collapse, the expected weak Eurozone GDP crawling at four-year lows and confirmation that Italy is in a technical recession – all these economic data points make clear that neutral in the United States may be less than needed elsewhere. Throw in the pesky political stories from populist politics to Brexit and you get the sense that the USD dip from yesterday maybe more a consolidation in trend and that the bulls for the EUR will just have to wait it out further.

Spain’s far right Vox party surges in the latest polls even as the socialist remain in the lead. UK gets an EU counter offer on Irish backstops contingent on a permanent customs union. The French, UK and German set up a non-USD trade mechanism with Iran. These aren’t the stories to inspire confidence that Europe will attract new growth and investment over and above the usual month-end noise. The EUR is the bellwether to watch today with any failure at the 1.1535 resistance essential to the view that neutral FOMC is more important than a confused ECB.

Is the FOMC neutral bias sufficient?

The probability is for the FOMC to do nothing in 2019. Markets have led the FOMC thinking. Many would suggest that the fears of a recession in late 2019 or early 2020 have changed accordingly. This leaves the feedback loop of policy and expectations in play with the ECB talking about the potential need for more stimulus, with the PBOC doing perpetual bond swaps and with the BOJ and others continuing their plans to buy bonds – we are still in a world of easy money.

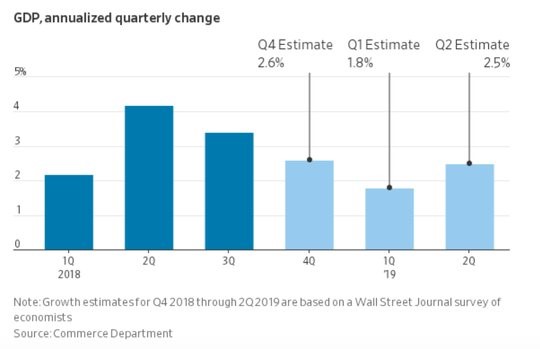

The issue for investors rests on the growth outlook for the United States post this FOMC shift in bias. There is every reason to believe that the overshoot in selling risk in December has been corrected in January. This leaves less room for error in economic and earnings forecasts going forward. The Fed downgraded its assessment like the street – we have moved from “strong” to “solid.” What hasn’t happened is that uncertainty over data may drive volatility higher even as risk on positioning returns. As the FOMC warned – “The timing and size of future adjustments to the target range for the federal-funds rate" will be determined by economic data.”