Adding to the bond exposure of a typical portfolio with high yield bonds can improve both returns and risk, writes Joon Choi.

High equity exposure feels great when stock prices are trending up, which was the case during the first four months of this year when the S&P 500 Index soared 17.5%. However, it may be nerve wracking during severe downtrends like the fourth quarter of 2018. As a result, financial advisors typically use asset allocation as a tool to select a mix of stocks and bonds to meet clients’ expectations of return and risk. Typically, a mix of 60% stocks and 40% investment grade bonds is recommended because this allocation significantly reduces risk at the expense of a slightly lower return compared to holding only stocks. It’s a common approach to investments. But what if there is a way to increase returns while reducing risk? A high yield model may help your portfolio outperform the S&P 500 Index with significantly less risk.

Overview

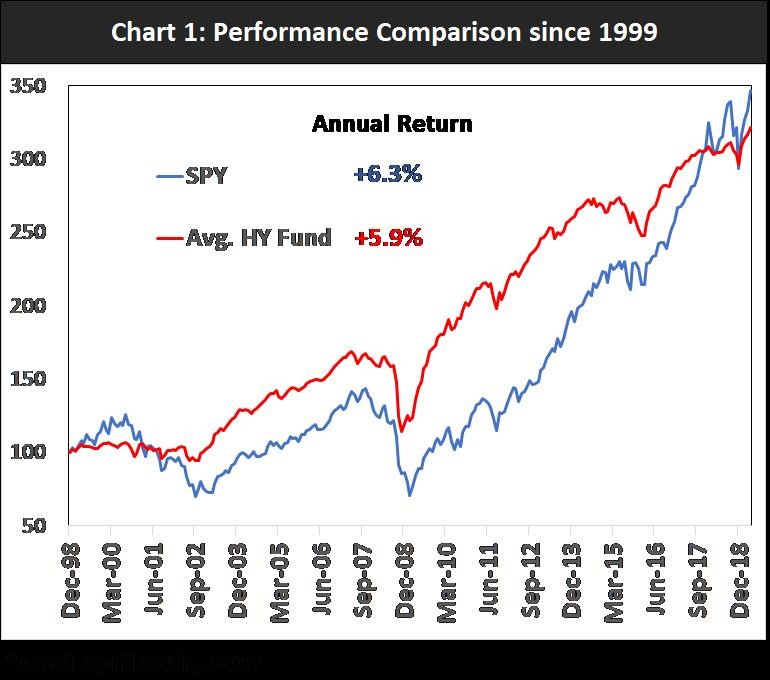

For the past 20 years, the average high yield bond fund returned 5.9% annually which is slightly less than 6.3% for SPY (See Chart 1 below). Moreover, the standard deviation for the fund was significantly lower than SPY: 5.2% vs. 22.9% respectively. Adjusting for the volatility difference, high yield bonds seem to have been a better bang for the buck than holding SPY.

Asset Allocation

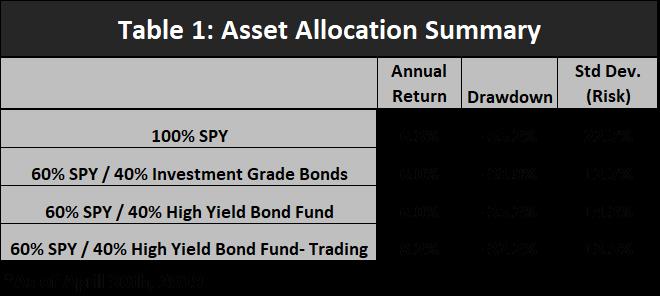

An asset allocation of 60% stocks and 40% investment grade bonds may be the most frequently recommended due to the mix’s ability to retain most of the return while cutting the drawdown. While the annual return falls from 6.3% to 6%, drawdown (worst peak-to-valley percentage loss) improves by almost 40% (-55.2% worst drawdown for SPY vs. -33.9% for a portfolio of 60% SPY and 40% investment-grade bond index fund, the Vanguard Total Bond Market Index Inv. (VBMFX). Similarly, standard deviation (another risk measure) decreases almost by half (22.7% vs. 12.7%). When investment grade bonds are replaced with high yield bond funds, the results are very similar (Table 1 on next page).

However, when the high yield bond portion is traded on our proprietary model, the return shoots up by more than 2% while lowering drawdown and risk. This portfolio has had almost a 2% higher annual return (8.2% vs. 6.3%) with significantly reduced risk as compared to owning 100% SPY.

Even lower equity exposure?

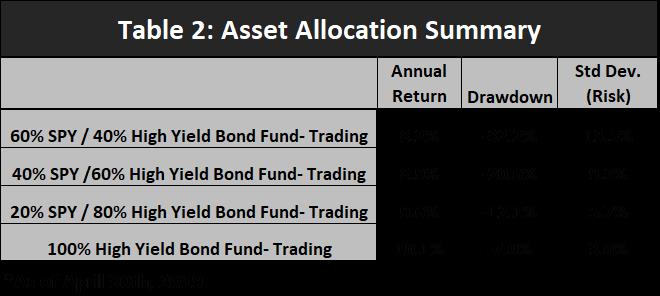

When the equity allocation was lowered to 40%, the portfolio return improved 0.7% with a further reduction in risk. At the 20% level we have even better numbers, and the best returns and lowest risk occurred with no equity allocation at all. So why not trade 100% in high yield? Two reasons. One, there are years like 2013 and 2017 when SPY had a much better relative performance to high yield bond funds. Two, although our high yield model is well tested and has a successful 20-year hypothetical track record, it’s not good to put all of one’s eggs in one basket.

Conclusion

As the current economic expansion enters extra innings at almost 10 years since 2009, it may be prudent to revisit your portfolio allocation. Although the traditional allocation of 60% stocks and 40% investment grade bonds may be a good option for many portfolios, replacing some of your equity with high yield bonds may be beneficial. If you can successfully trade high yield bond funds like we have for many years, then you may be able to add a couple of percentage points a year with further reduction in risk. Don’t hesitate to contact us if you are interested in our portfolio management service.