Darden Restaurants (DRI) has a bullish technical outlook with bargain priced option premiums, reports Elizabeth Harrow.

Olive Garden operator Darden Restaurants’ (DRI) stock ended 2018 just shy of $100, but the restaurant stock has since put together a year-to-date gain of 15.6%. A pullback from the mid-September record highs appears to be terminating around support in the $113 to $114 area, a 10% correction from the Sept. 9 closing high of $127.57, which served as resistance during the fourth quarter of 2018 and the first quarter of 2019.

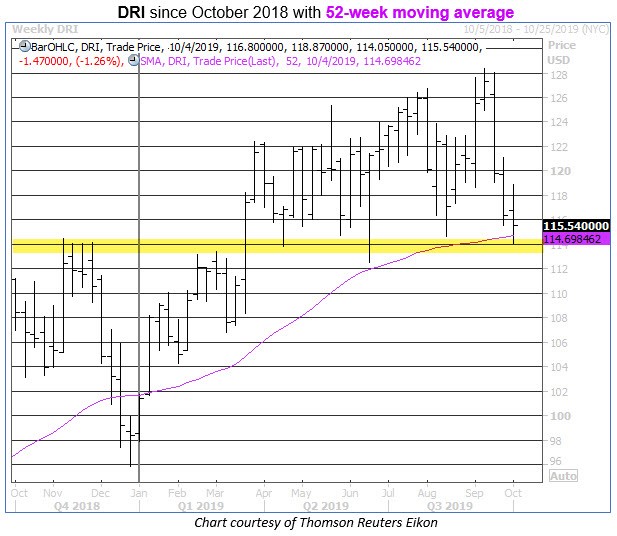

While DRI may be spooking some bulls today with a dip below its 200-day moving average, the stock remains poised above the longer-term 320-day moving average that contained its late-December lows -- as well as a key weekly trendline that boasts bullish quantified results, based on historical returns (see chart below). Specifically, Schaeffer's Senior Quantitative Analyst Rocky White reports that DRI has pulled back to trade within one standard deviation of its 52-week moving average after an extended period of time above this level. In fact, DRI has managed a 39-week streak above its 52-week trendline, having last closed a Friday beneath it on Jan. 4, 2019.

Previous pullbacks by DRI to its 52-week moving average have had bullish implications in the past 15 years, according to White. There have been 27 prior signals, and the stock was trading higher three months later 67% of the time. More impressive is the average three-month return for DRI following a 52-week pullback, which stands at 4.52%. From the stock's current perch, a similar bounce would place DRI near $122 three months from now.

However, there's plenty of pessimism priced into the shares, which suggests a sharp rebound from technical support could shake loose some bears from their losing positions. Short interest accounts for 5.5% of DRI's float and represents 5.5x the equity's average daily trading volume. That's a substantial supply of sideline cash to fuel future upside.

Options players are also skeptically aligned. Schaeffer's put/call open interest ratio (SOIR) for DRI stand at 1.45, with puts outnumbering calls among options set to expire within three months. Plus, this ratio ranks in the 86th percentile of its annual range, as short-term options players have been more put-heavy only 14% of the time during the past year.

Likewise, during the past 10 days, speculative traders across the International Securities Exchange (ISE), Cboe Options Exchange (Cboe), and NASDAQ OMX PHLX (PHLX) have bought to open 1.54 puts for every call on Darden. This ratio registers in the 87th annual percentile, underscoring the pessimistic slant among options players.

Nevertheless, DRI call options can still be purchased at a relative bargain, for contrarian traders looking to bet on the stock's next leg higher. Currently, Schaeffer's Volatility Index (SVI) is 23%, in the 15th annual percentile -- revealing that front-month options are pricing in unusually low implied volatility expectations (a boon for premium buyers, who gain increased leverage when option prices are modest).