While Delta is an important element while choosing what strikes to trade, it is not the only element, explains Alan Ellman.

Strike selection is the second required skill when writing covered calls or selling cash-secured puts. Over the years I have been asked to suggest a specific Delta for strike selection implying that this statistic would be the sole criterion determining your strike. Delta, although important, should not be the exclusive benchmark for strike price selection.

Delta, one of the fie option Greeks, can be defined from three perspectives:

- Delta is the amount an option price will change for every $1.00 change in share price

- Delta is the equivalent number of shares represented by the options position

- And, Delta is the percentage likelihood that, upon expiration, the option will expire in-the-money or with intrinsic value

Option buyers may be most interested in how much their long positions will appreciate as share value moves up. Portfolio managers frequently seek to achieve Delta-neutral portfolios, making them less susceptible to market risk. Option-sellers, like us, may want to evaluate the percent chance of the option expiring in-the-money making us vulnerable to assignment. We must develop a plan to integrate Delta into our selection process without over-emphasizing this option Greek.

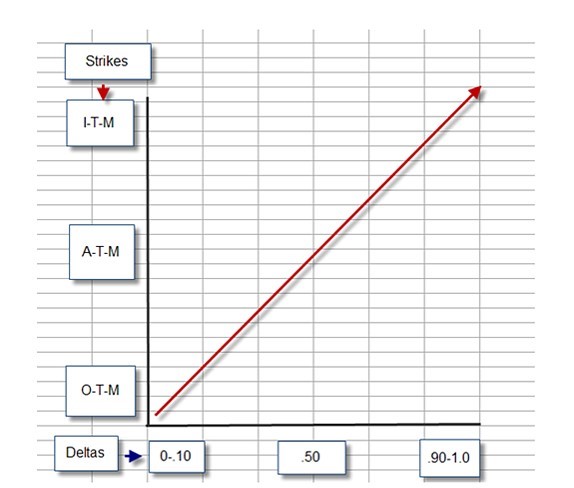

Delta as it relates to the “moneyness” of our call strikes

Delta and the “Moneyness” of Strikes

Delta runs from 0 to 1 (or 0 t0 100 for a contract). The chart demonstrates:

- The deeper out-of-the-money the strike, the lower the Delta

- The deeper in-the-money the strike, the higher the Delta

With this information, we can make the following conclusions:

- Low-Delta options are less likely to be assigned and offer the greatest opportunity for additional share appreciation in addition to the option premium

- High-Delta options have the highest exposure to assignment (of course, we have our exit strategies to mitigate) and offer additional downside protection because of the intrinsic-value component of the option premium. They offer little or no opportunity for additional share appreciation.

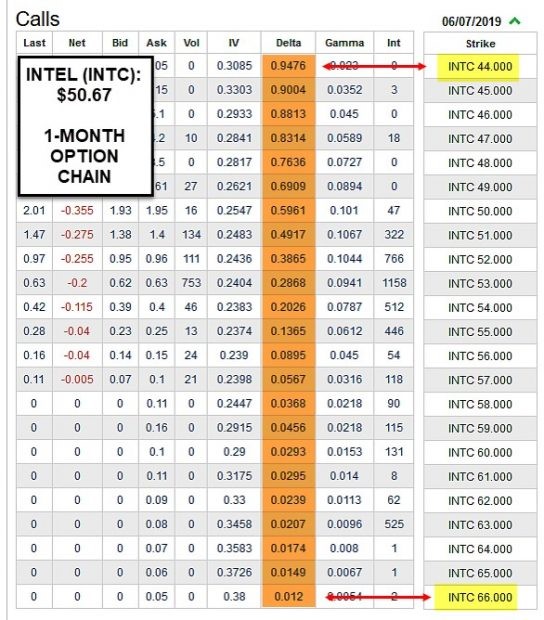

Where can we locate Delta statistics?

Most brokerages incorporate this information into their option chains. There are also many free sites we can access like www.cboe.com.

INTC Option Chain with Delta Stats

Look at the above example of an option chain in Intel Corp. (INTC). The deep in-the-money $44.00 strike has a Delta of 0.9476 while the deep out-of-the-money $66.00 strike has a low Delta of 0.012. Option-sellers must understand the relationship between Delta and the “moneyness of strikes” before incorporating Delta into covered call writing decisions.

Delta and strike selection: A viable plan

Every investment strategy should have an intended goal. I prefer a goal-range. In my case, I seek to achieve a 2% to 4% one-month initial time-value return when initiating positions. I use 1% to 2% in my mother’s more conservative account. Once that has been decided, we decide on our overall market assessment and personal risk-tolerance. If we are bullish, we favor out-of-the-money calls. If bearish or have a low personal risk-tolerance, we favor in-the-money strikes. It doesn’t matter on the “moneyness direction” we choose, our intended goal range must be satisfied. Using the “multiple tab” of the Ellman Calculator is a great way to complete these calculations.

Delta will come automatically. Let’s say we seek a 2% initial time value return and are currently bullish. We check the option chain for strikes that are out-of-the-money and generate that 2% initial time-value requirement. In the option chain above, we may select the $52.00 strike (bid price of $0.95) which shows a Delta of 0.3865. In a different market environment, we may have used an in-the-money strike with a much higher Delta. Perhaps our goals will differ from the 2% hypothetical. One size does not fit all investors or circumstances.

The option Greeks, including Delta, are important to understand but shouldn’t be over-emphasized. Our investment plan should include a goal-range, market assessment and a defined personal risk-tolerance. Once those decisions have been determined, Delta will come automatically having the emphasis placed on the most important investment criteria.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. FREE Beginner’s Corner Tutorial for Covered Call Writing has Been Enhanced and Updated here:

Elite version of the Ellman Calculator