Current market conditions, especially looking at investment grade bonds, are similar to 2008, reports Joon Choi.

Elevated equity valuation along with the Coronavirus panic is leading to volatility that we have not witnessed since the financial crisis of 2008. In some respects, current volatility is worse now as the S&P 500 Index (SPX) fell 19% from the high in just three weeks (Feb. 19 to Mar. 11). A similarity to the 2008 bear market is that the iShares Investment Grade Corporate Bond ETF (LQD) started to fall at a rate not seen since then. As of March 11, LQD saw a three-day change of -7.7%, which coincidentally happened on Sept. 16, 2008 (a day after the Lehman Brother bankruptcy). That is not the only similarity between the 2008 credit crisis and current market conditions.

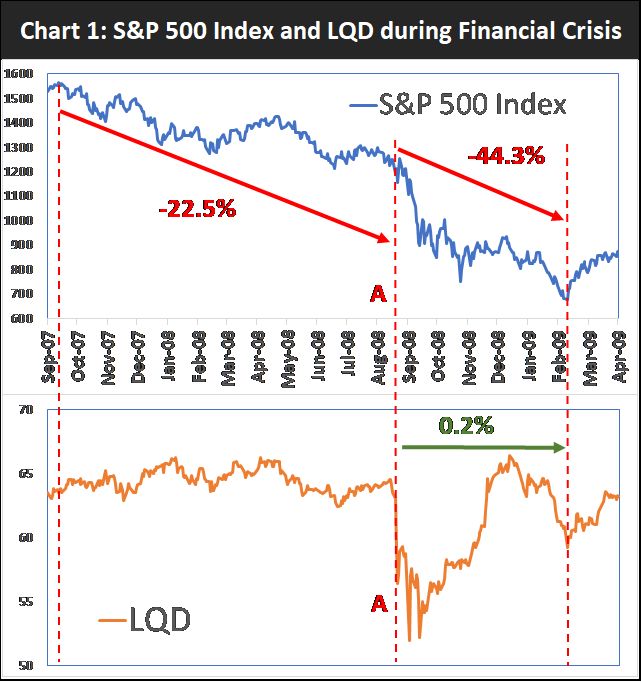

The 2008-09 Bear Market

As the housing market was starting to unravel in 2007, SPX made its peak in October and drifted lower by 22.5% until Sept. 16, 2008 (Point A). This is when a three-day change of LQD hit -7.7%; the largest loss since the ETF debuted in 2002. SPX proceeded to fall an additional 44.3% until the stock market hit bottom in March 2009. However, LQD gained 0.2% during the same period. Notice how investment-grade bonds rallied starting in October 2008 even as the stock market continued to fall (see chart).

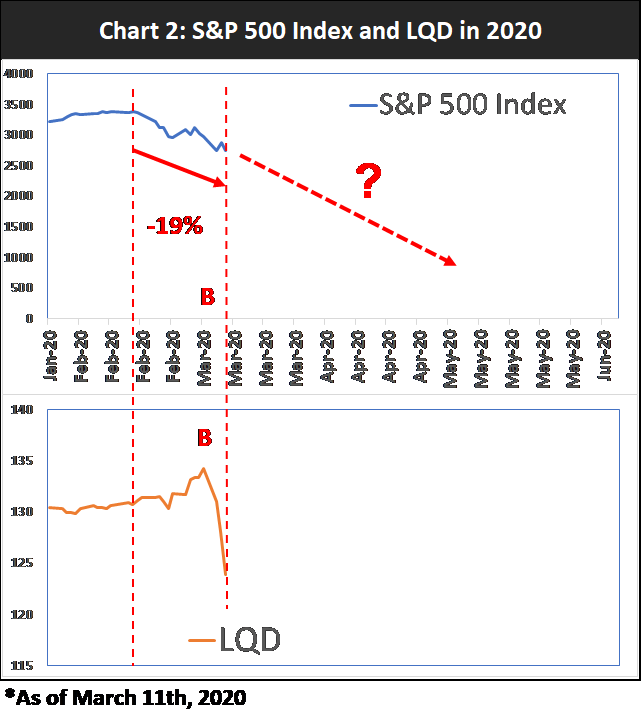

Current Look

As of yesterday, LQD reached the same 7.7% three-day loss as it did in 2008 but the speed at which the SPX fell is much more severe (Point B in Chart 2). The index fell 19% in three weeks in 2020 as opposed to 22.5% in 49 weeks in 2007-2008.

Conclusion

It’s anybody’s guess when the Coronavirus will be contained and how much the pandemic will affect global economic growth. But based on how investment-grade bonds are faring, we may not be out of the woods yet. The mere thought of a possible 50% correction seemed laughable few months back; however, it seems probable if stock prices follow the similar path outlined in 2008. Stock volatility will likely persist for weeks, if not months, to come. Investment-grade corporate bonds may offer a great buying opportunity after some further selloff, even if equities continue to fall. I will keep you updated on this topic in future issues.

And remember to remain calm if your investment horizon is 15+ years because the stock market will likely be higher by the time you retire. However, if you are close to or already in retirement, then seek an active manager.

We are happy to report that we were completely out of our elevated high yield positions as of Feb. 27, saving our clients 4.5% to 7.5% since that sell (as of March 12, 2020). Joon Choi is Senior. Portfolio Manager/Research Analyst at Signalert Asset Management.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.