There may be some bargains lurking on the market carnage of the last month, reports Joe Duarte.

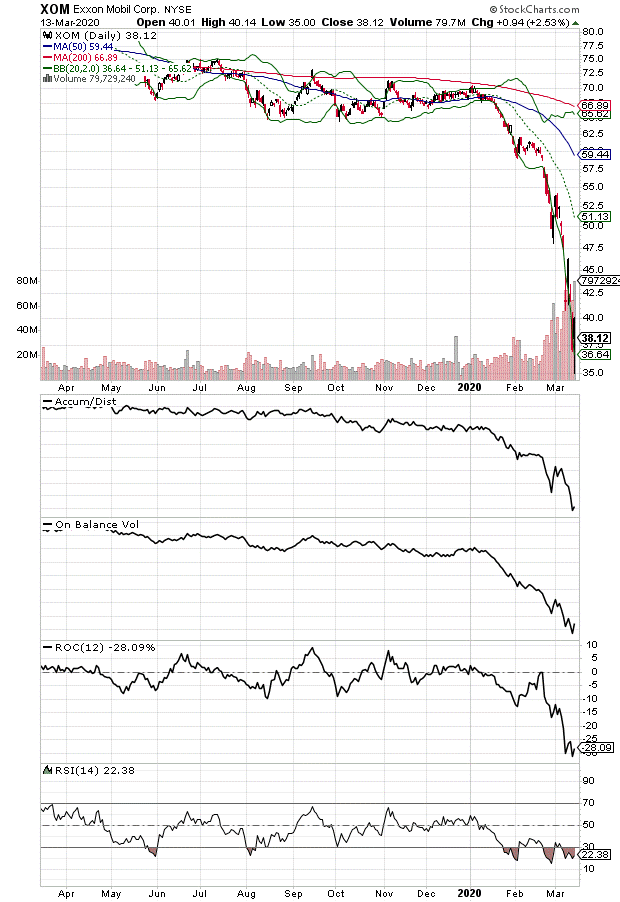

Exxon Mobil (XOM) with an early 10% dividend yield is trading as if no one will ever fill their tank again. I am in no hurry to rush out and buy stocks at the moment. But I am noticing that there are some potentially enticing prospects shaping up in the market.

For example, shares of the world’s largest oil Company, XOM, have been cut in half over the last few days as investors flee the energy sector due to the global oil glut and the potential demise of OPEC after Russian President Putin’s Vienna surprise. Nevertheless, as with the rest of the market, it seems as if the selling in XOM is overdone, especially when you consider the dividend yield has risen to nearly 10% due to the recent selling, and the very low odds that Exxon will cut that dividend in the near future.

Certainly, the energy sector had plenty to worry about since the recent failure of negotiations regarding curbing oil output between Russia and Saudi Arabia failed. And there may be more trouble ahead as well, given the precarious state of the U.S. shale boom as fracking companies are increasingly vulnerable to rising debt burdens just as the price for crude has fallen and demand may be slowing due to slowing economic growth.

But this is Exxon Mobil and it will likely survive most of what’s happening at the moment, which means that once the selling abates there may be a once in a lifetime opportunity to buy the stock and to consider holding it for a while. What I’m saying is that like Exxon, there are similar companies out there who have been decimated by an overzealous machine traded market and that at some point, will be bought back, likely vigorously. So as we sit at home and wait out the Coronavirus to play out, hopefully with a safe outcome for as many as possible, a good way to spend the time is to make a shopping list; and Exxon Mobil is a prototype for the type of stock that could well lead the market higher once all this is over.

I am developing a list of companies that meet these criteria at Joe Duarte in the Money Options.com. If you’re not a subscriber yet take a 30-day Free Trial HERE.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.