Investors who can adapt to the environment will have greater success than those who don’t, writes Joe Duarte.

Complexity is moving the financial world toward its next point of emergence and eventual evolution. On one side is the Federal Reserve while on the other side is the complex adaptive system known as the markets, the Economy and people’s lives (MEL).

The overwhelming presence of Covid-19 has pushed MEL’s components to the edge of chaos. And as the system emerges and prepares to evolve; only those who adapt to the post new normal world will find trading and indeed living success in the foreseeable future.

As I noted last week, the key economic number for now is jobless claims, which has continued to rise and may not turn around for a few weeks. Certainly, other numbers are worthy of note, such as recent retail sales and industrial production numbers, which highlight a contracting economy. Yet, that is backward looking data, which shows where we’ve been, not necessarily where we’re going.

Meanwhile, what we know is that systems adapt. Moreover, in the current stock market, aside from the daily volatility spurred by economic numbers and political developments, the most influential variable affecting stock prices remains liquidity from the Federal Reserve, which for now remains positive, meaning that the Fed is still buying bonds and bond ETFs in order to infuse money into the banking system. That said, as it has been doing for the past few weeks, the Fed has again reduced the amount of money it is infusing into the bond market with this week’s total falling to $6 billion per day from last week’s $7 billion.

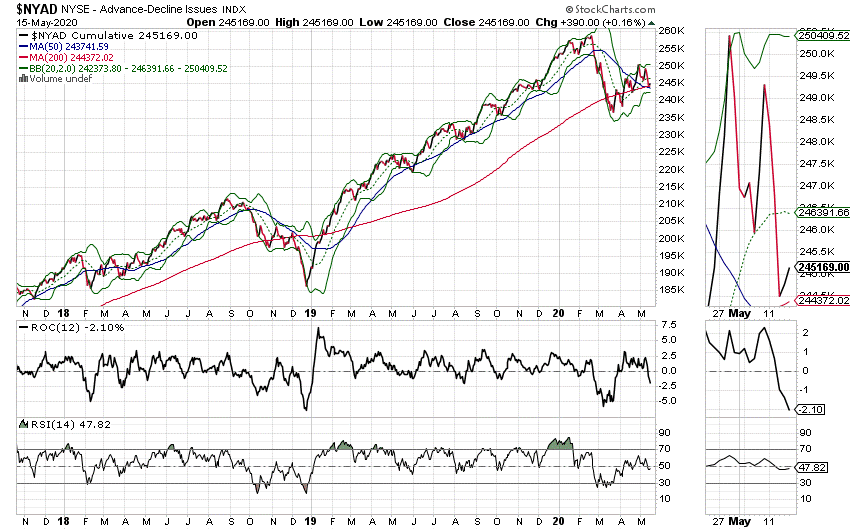

Indeed, there is an excellent correlation between the amount of money the Fed has infused into the system and the New York Stock Exchange Advance Decline line (NYAD, see chart below). What the chart shows is that when the Fed was pouring $75 billion per day into the bond market, in March, NYAD bottomed and the current stock rally began. When the Fed cut its liquidity infusions significantly, about two to three weeks ago and began its current tapering we began to see NYAD struggle.

So, what we are seeing is the Fed trying to figure out the least amount it can put into the bond market in order to keep stocks moving higher, as the Fed seems to be aware of the relationship. Meanwhile, the stock market is not very happy with the Fed pulling back the easy money candy, which is what is mostly accounting for the recent volatility and price stalling.

Regardless of what traditional economic analysis may purport, this is a new era in which new variables are in force and in which the economy, the markets and people’s lives are no longer separate but intertwined in one single system. Thus, given the dire state of the economy, and the fact that the stock market is the only positive game in town, the Fed is playing a dangerous game since the market has nothing else to keep it rising other than Fed liquidity.

Therefore, it’s imperative to fully discuss a set of principles, which will help us all get through this situation, especially if the reopening of the economy does not lead to any significant improvement in MEL.

Covid-19 Survival Guide

The situation is serious and fluid as complex systems adapt and emerge to new levels of operation based on which of their components are able to achieve dominant success. In other words, evolution is defined by winners and winners are attracted to winning strategies based on the payoff. When the payoff is achieved, the system gears its efforts to achieving more of the payoff. Moreover, the major constant in evolutionary history is that the winner takes all.

Thus, when the rules of complexity are translated to stock trading and investing, the payoff is all about picking winners. The payoff in this market results from the ability of individual traders to discern where the MEL system seems to be going and where the market is putting its money.

That said, here are some key emerging dynamics that seem to be influencing money flows:

- The post new normal world is here

- Things will never be the same again

- COVID-19 isn’t likely to be going away anytime soon, vaccines notwithstanding

- The MEL system is adapting to the new reality

- Global governments were unprepared for the pandemic and it shows

- Populations will make their opinions known all over the world either via the ballot box or other means

- People are likely to return to work but much work is likely to be done remotely

- Some jobs will be permanently lost to automation or obsolescence

- New jobs will be created

- Even if the government isn’t preparing for the next round of the pandemic, people are quietly preparing for it by changing their lifestyles, and priorities

- This adaptation by the world’s population will create opportunities for investment

- Businesses and individuals which adapt to the new reality will likely survive and have the greatest chance of thriving

- Investors who can adapt to this environment will have greater success than those who don’t

If, as investors, we keep those broad measures in mind and search for companies which will provide the tools, services and materials with which to live and work in the new world, the odds will be in their favor.

Agilent Technologies

Agilent Technologies Inc. (A) is one of those companies that few people have heard of. In fact, it’s an old Hewlett Packard spinoff. Moreover, Agilent is one of those old fashioned science companies, which designs and manufactures the machines and related materials, such as chemical reagents, DNA analysis tools, and other things used in scientific research and applied laboratory work (see our expanded coverage of Agilent Technologies in tomorrow’s report.

Nine Lives: NYAD Lives to Fight another Day

The NYAD has nine lives apparently, as it delivered a scary intraday break below its 50- and 200-day moving averages on May 14. But by the end of the day, the indicator had bounced back above these key support levels and NYAD ended the week on an up note.

Of course, NYAD is nowhere near a new high and continues to trace a lower high and lower low chart pattern, which if not resolved to the upside soon, will likely weigh heavily on the markets (see chart above). Nevertheless, because the line did not break support, the trend, battered and bruised, remains to the upside.

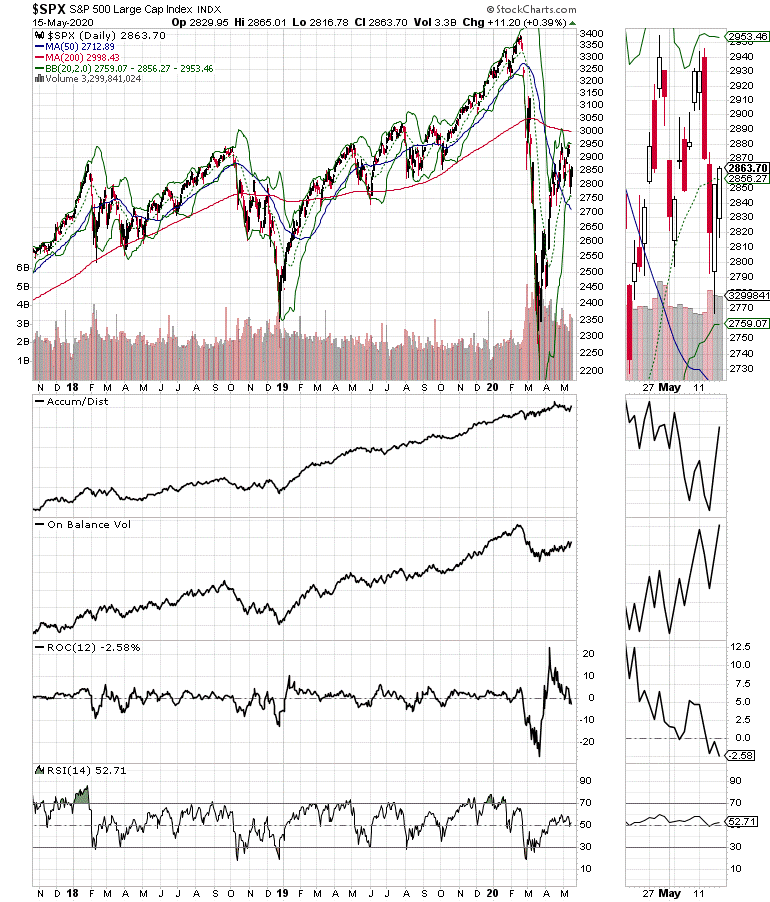

The S&P 500 (SPX) remains below its 200-day moving average, which sits near 3000.

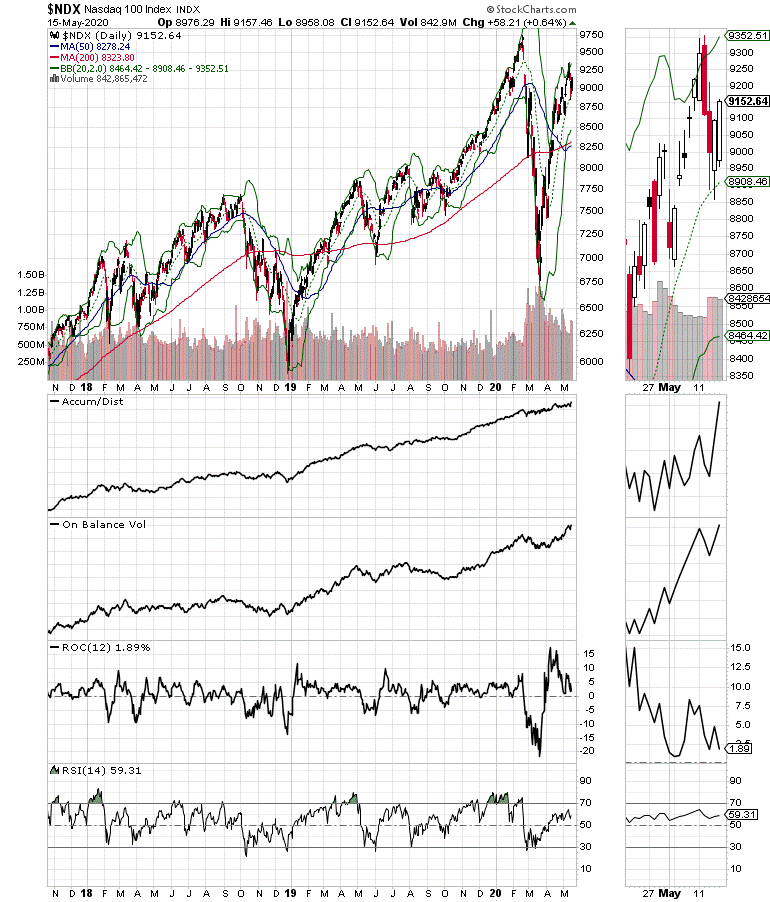

The index is still — by definition— in a bear market, even as the Nasdaq 100 (NDX) and the NYAD are not, given their status above the 200-day line (see chart below).

Financial and industrial stocks continue to pull SPX down as money is now moving into housing related, technology, and to some degree the very oversold energy sector.

NDX for its own part has pulled back from its recent highs as new trade restrictions were placed on semiconductor companies as the U.S. changes trade policy regarding China. NDX, however, remains in bull market territory trading above its 20-, 50- and 200-day moving averages.

It’s Hard but Not Impossible to Trade this Market

The daily grind of stock prices can easily take its toll on active traders. That’s why it’s important to focus on companies whose businesses are likely to do better during these challenging times where hard core biological sciences are increasingly important to the wellness of the entire world. That said, the intraday volatility can make daily account values fluctuate significantly, which often makes for a tough night’s sleep.

The bottom line is that by sticking with the trend and focusing on the strongest stocks in the strongest groups, it’s still possible to trade this market successfully.

But, write this down. If the Fed pulls away its money spigot much further, there isn’t a whole lot that will keep stocks moving higher.

I own shares in A.

If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.