This recent IPO is a favorite low-priced ticker Danielle Shay trades due to its volatility.

One of my favorite tickers to trade is the topic of today -- Chewy.

Why?

I absolutely love trading this ticker because it’s a low-price ticker. In fact, I’ve actually alerted my Mastery members that I’ve bought shares on this in addition to the options trades because it’s just that cheap of a ticker.

I also like trading Chewy because…

It's a recent IPO (which naturally makes it very volatile), and it’s a COVID stock.

What’s Chewy Again?

Chewy is an e-commerce name for people to order pet care supplies. With the ongoing global pandemic people are adopting pets at a much higher rate than normal, and as a result, you need to feed those pets. Where do you get the supplies for that while limiting your exposure? Well here comes Chewy (CHWY), the online pet supply store.

It’s important to know the background of these tickers that you’re interested in because that can help you determine which direction it may move or what type of news may impact it directly.

With This In Mind...

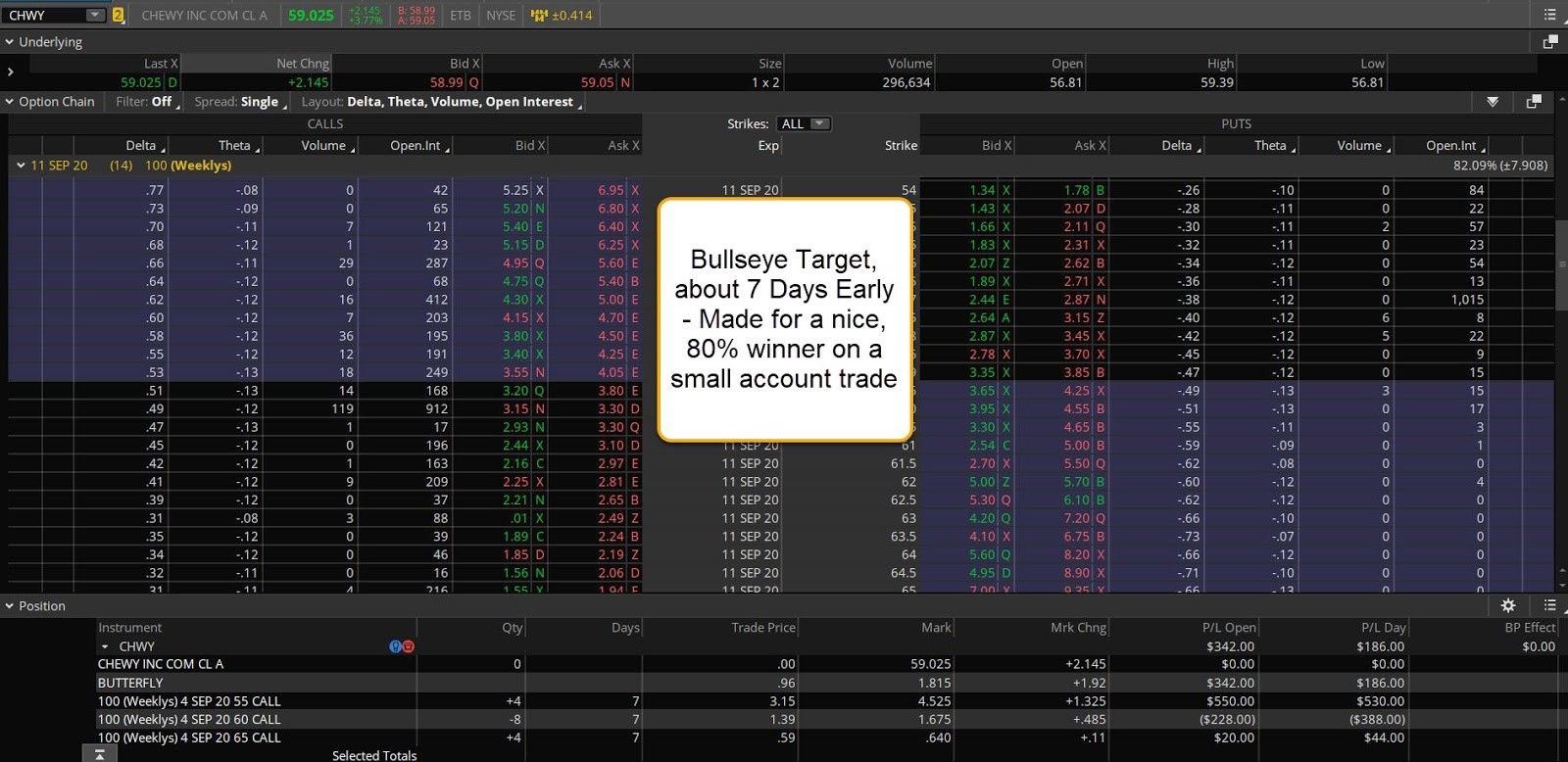

I decided to get into a butterfly.

(I alerted my Mastery members that I was entering the trade, so they could get in on the action too. Want my next trade? Join Us Here.)

I was trying to pick up the long calls as well, but I didn't get them when I wanted, so I went with a lower priced butterfly that was targeting the $60 price point.

Why $60?

Because that would’ve been a new all-time high for Chewy. I also thought that it’d go higher due to the earnings report coming up, the green Trend Strength Candles, the positive volume that was present on the chart, and there was a 195 min and a 78 min squeeze (some lower time frame squeezes).

But The Primary Reason?

- Recent IPO

- COVID stock

- Run into Earnings

A favorite combination of mine lately.

Why?

Typically, with an approaching earnings report on a stock like this, it rallies into earnings. And the kicker? This one had 25% high short interest. What I’ve found through my analysis, is that these more recent IPOs are really heavily shorted, which can produce some really volatile moves.

So, I got this pretty small butterfly because I was wanting to get in on the pullback… but it never pulled back.

The Profit…

I started out with a position that was only $96 a contract (one of the cheapest trades that I’ve done in a while), and I ended up getting out for just shy of a double. It worked out to be an 80% winner to be exact. I had targeted the $60 price point, and you can see in the screenshot that Chewy traded directly up to $60.

So why wasn’t it a 5X winner then?

I still had 7 days left on the trade. Had I gotten the target at the exact right expiration date… that’s how I would’ve made 5X. But 80% isn’t bad whatsoever. It’s really clean, solid, and consistent.

That’s what I love about these “stacked profits” trades after all. You don’t necessarily have to get everything perfect -- like the target at the exact right expiration date. You can still walk away with a really nice profit. (And it only gets better if you do manage to trade it ‘perfectly.’)