Exit strategies for covered call writing is the 3rd required skill that must be mastered to achieve the highest possible returns, states Alan Ellman.

In January 2020, a member shared with me a trade she executed with BlackRock, Inc. (BLK). The stock was trading at a cost-basis of $500.00 when the February 21, 2020, deep out-of-the-money (OTM) call was sold for $5.59. Shortly after entering the trade, shares moved higher ($570.00) resulting in the ask price cost-to-close rising to $23.40. The question posed to me was should the option be re-purchased since this BCI member wanted to retain the shares.

Initial Structuring of Trade

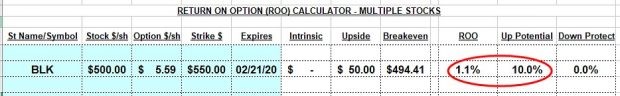

BLK: Initial Calculations with The Ellman Calculator

The spreadsheet shows an initial 1-month time value return of 1.1% with a possible additional 10% return if share value moved up to the $550.00 strike. With the stock trading at *$572.48, a maximum return of 11.1% was looking good.

*The original article had current market value at $570.00 but it had actually moved up to $572.48 when the image of the spreadsheet was created.

Time Value Cost-to-Close

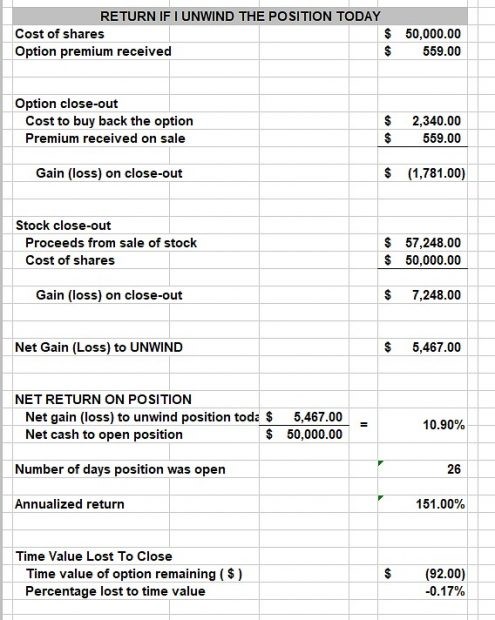

BLK: Cost-To-Close the Original $550.00 Call

The option cost to buy back the $550.00 call is $23.40, $22.48 of which is intrinsic value. If we close the original short call, our share value moves from the $550.00 strike to the current market value of $572.48. This results in a 0.17% time-value cost-to-close.

When would we opt to close early in the contract?

If we were willing to part with the stock, using the mid-contract unwind exit strategy (MCU) would make sense. This involves closing both legs of the covered call trade and using the cash to enter a covered call new position with a different underlying security and the same expiration date. As long as that new position would result in an initial time-value return of 1.17% or more (1% greater than the time-value cost-to-close), the MCU exit strategy would be beneficial.

What if share retention is a priority?

In this case, we wait until expiration approaches and roll the option prior to 4 PM ET on expiration Friday. We can roll-out to the same strike or roll-out-and-up depending on overall market assessment and calculation goals. We use the “What Now” tab of the Ellman Calculator to assist with these decisions.

Discussion

When our covered call strikes move deep in-the-money early in a contract, we have the following courses of action to consider depending on our goals:

- Mid-contract unwind exit strategy

- Rolling options as expiration approaches

- Take no action and allow assignment