Two weeks ago, it appeared the bears had control of the market. But if they did, they fumbled it badly, asserts Larry McMillan of Option Strategist.

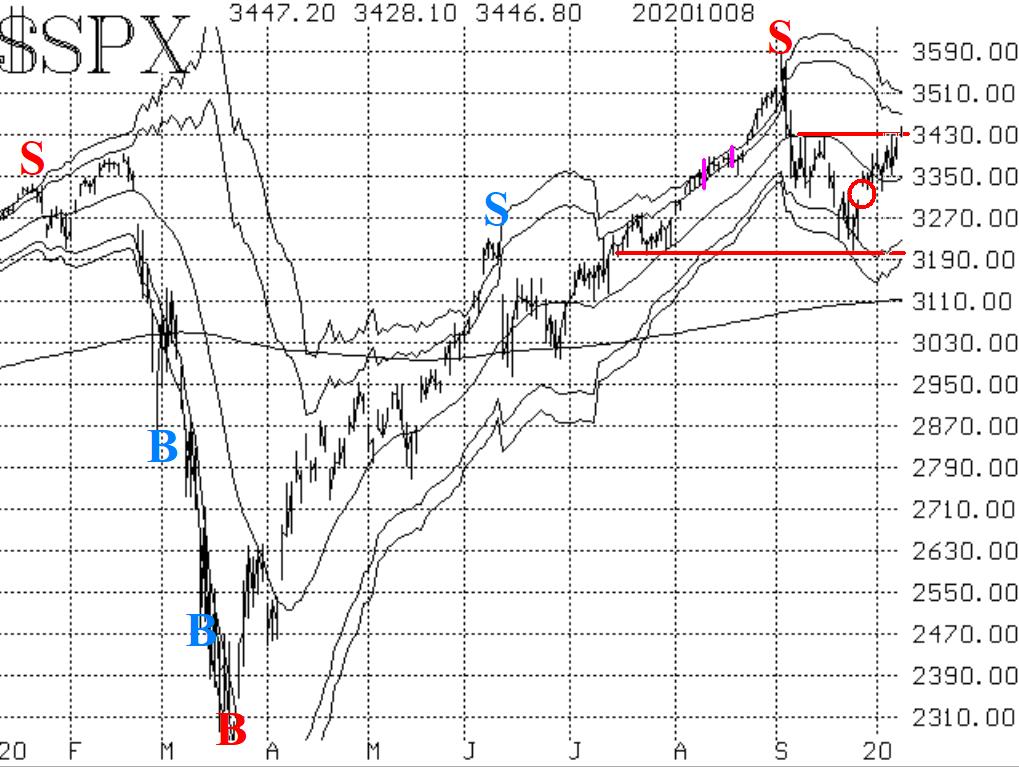

Beginning with a modest oversold rally on September 24, the broad market has staged a strong rally, backed by some of the strongest breadth we've seen in while. Now, S&P 500 (SPX) has broken out over what had been multiple resistance in the 3425-3430 area. That has changed the SPX chart's designation to "bullish."

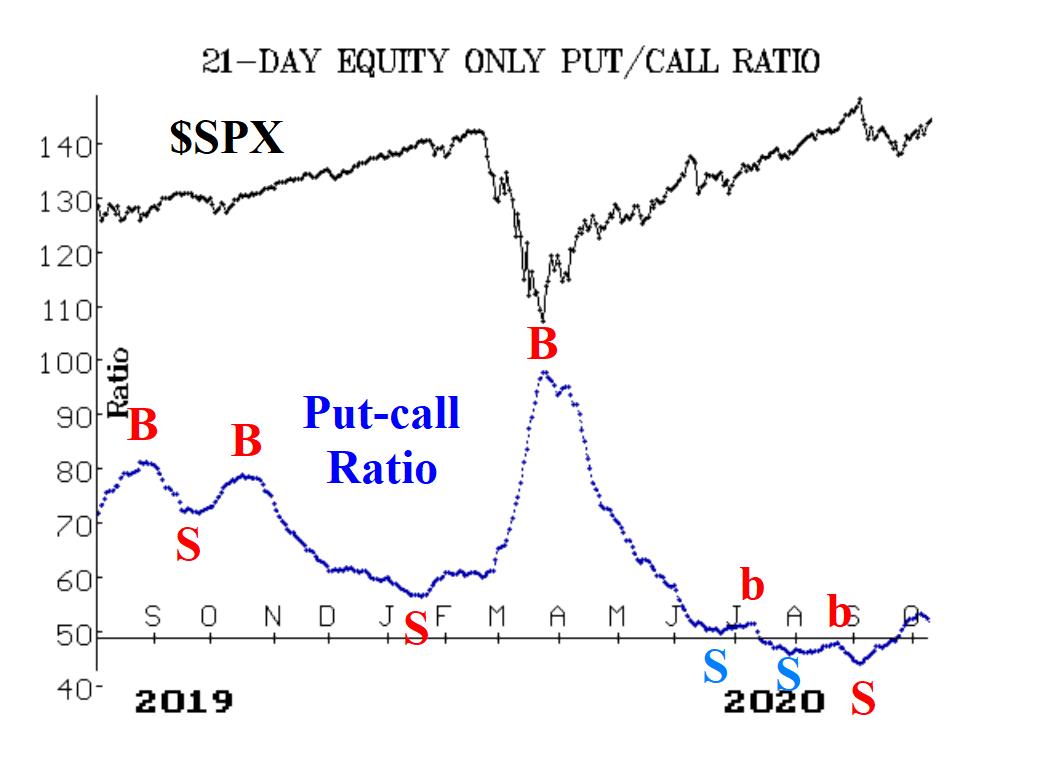

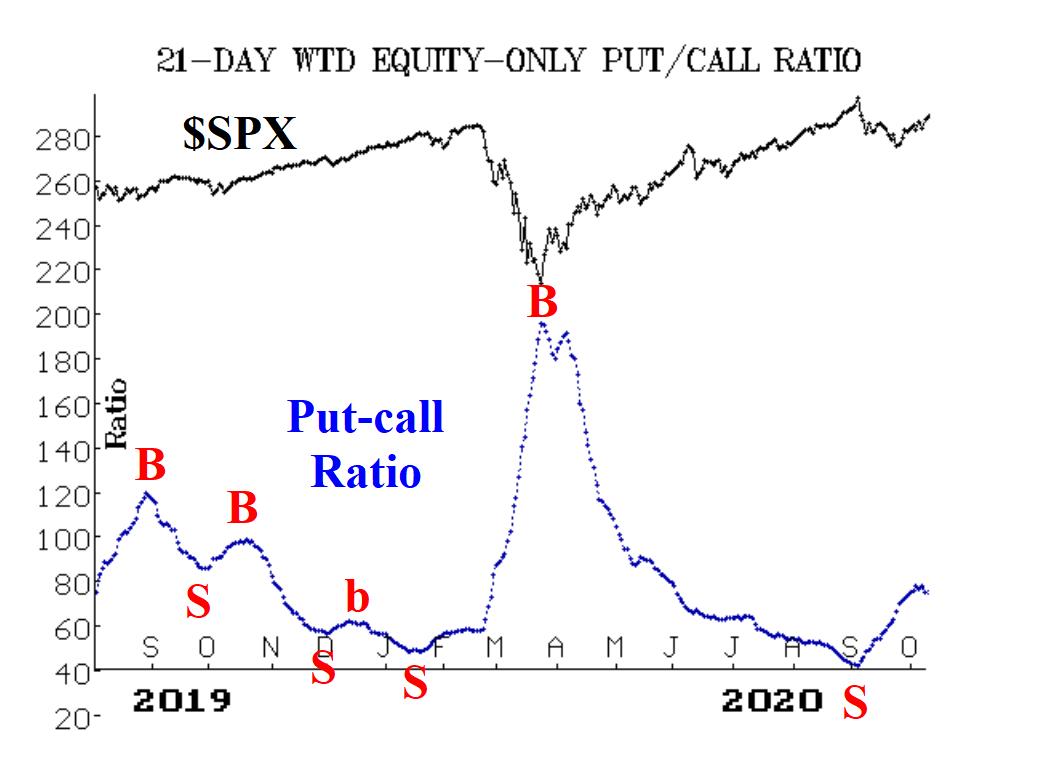

Equity-only put-call ratios remain on sell signals, according to the computer analysis programs that we employ. Although, both ratios have curled over and look like they might be forming a local maximum (i.e, a buy signal), to the naked eye (Figures 2 and 3).

Breadth has been spectacular on this rally. The breadth oscillators turned to buy signals on September 28. Now, those buy signals have expanded into overbought conditions. But overbought is a good thing when SPX is beginning a new leg higher, as it appears to be doing now.

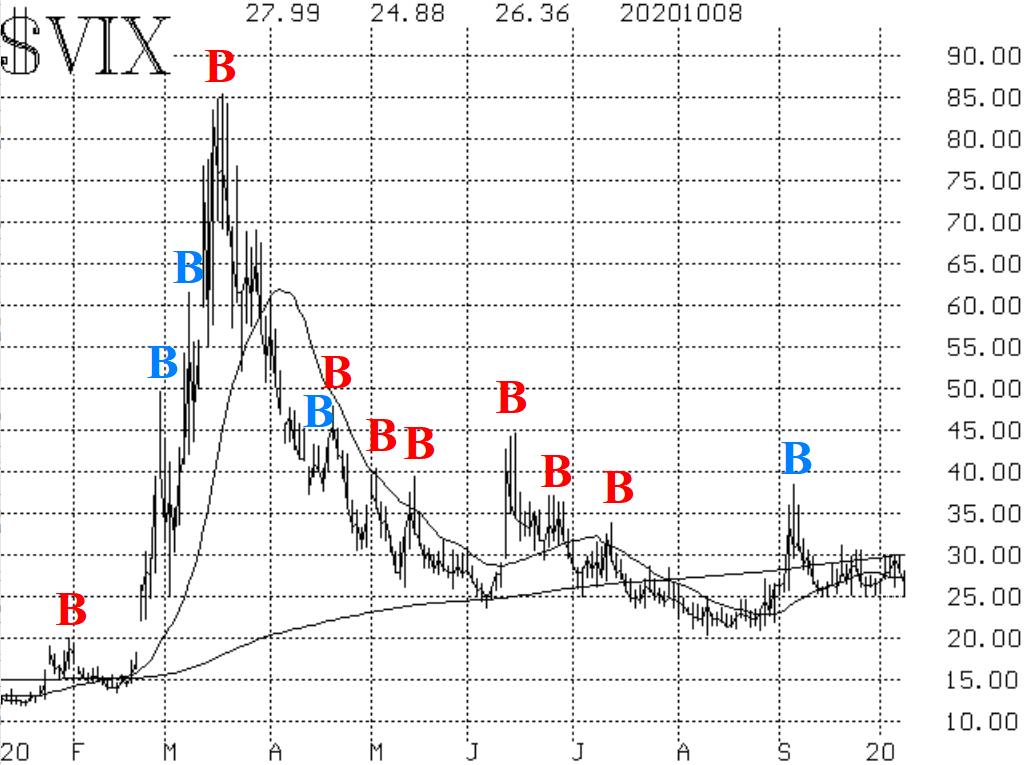

Volatility continues to live in a world of its own—largely because of the election and the expected volatility that is going to occur afterwards, if the election is contested. Regarding the trend of CBOE SPX Volatility Index (VIX), it remains slightly below its 200-day moving average, and that is a bullish sign for stocks.

In summary, we have enough bullish signs—primarily the breakout over 3430 and the strong breadth readings—that we have changed our short-term outlook to bullish. As long as SPX remains above 3400, say, that outlook will remain in place.

To learn more about Larry McMillan, visit Option Strategist