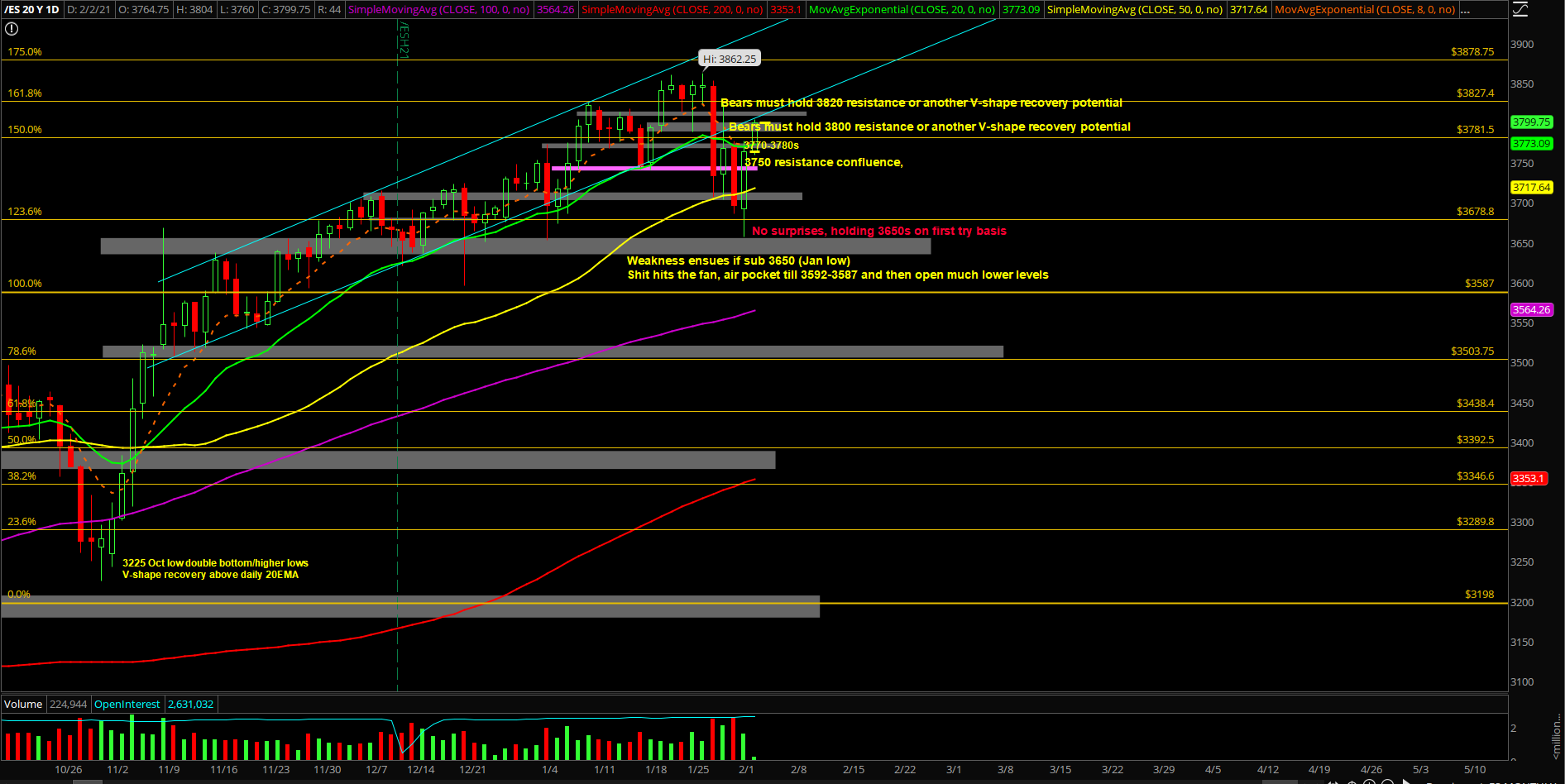

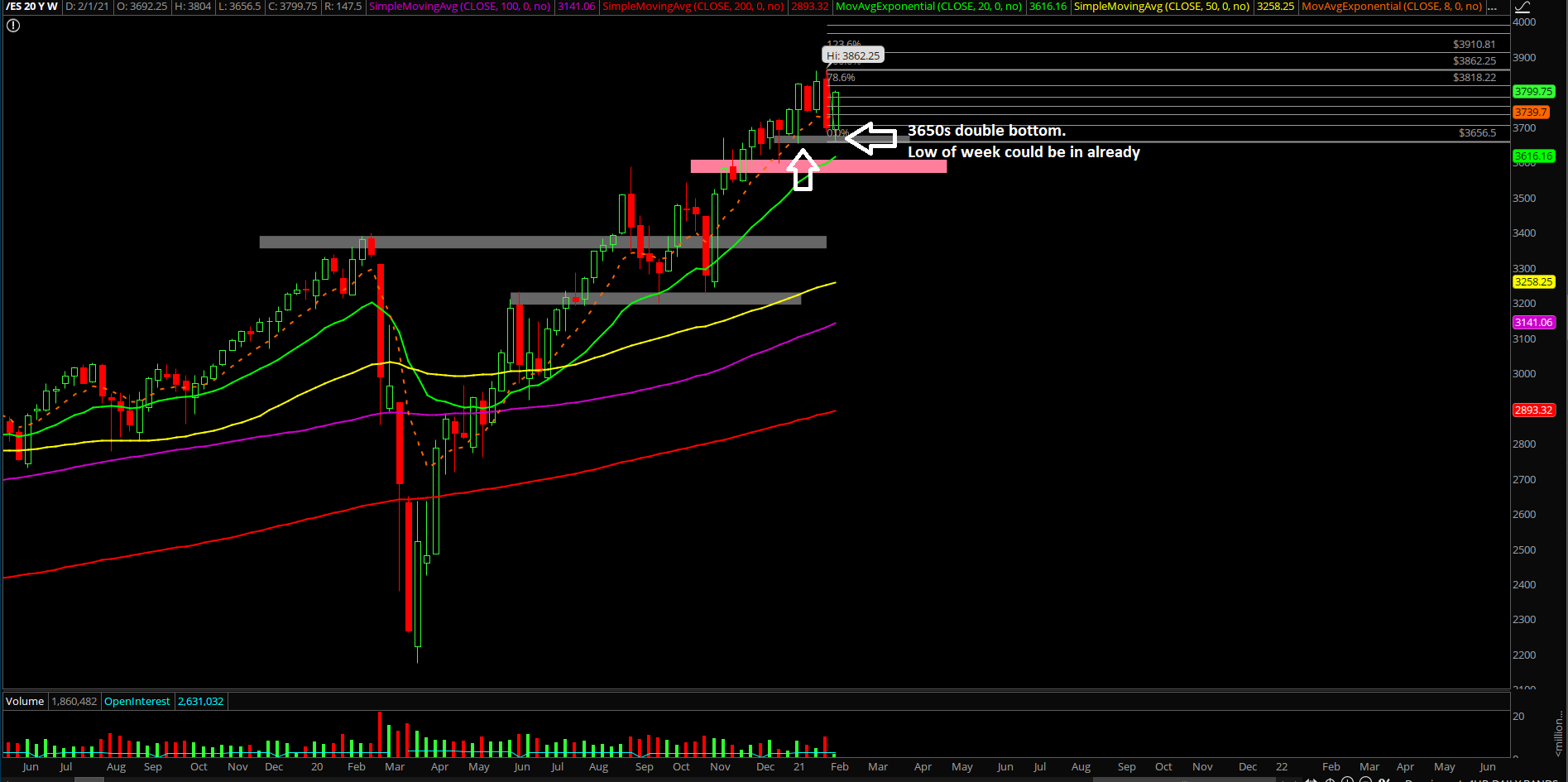

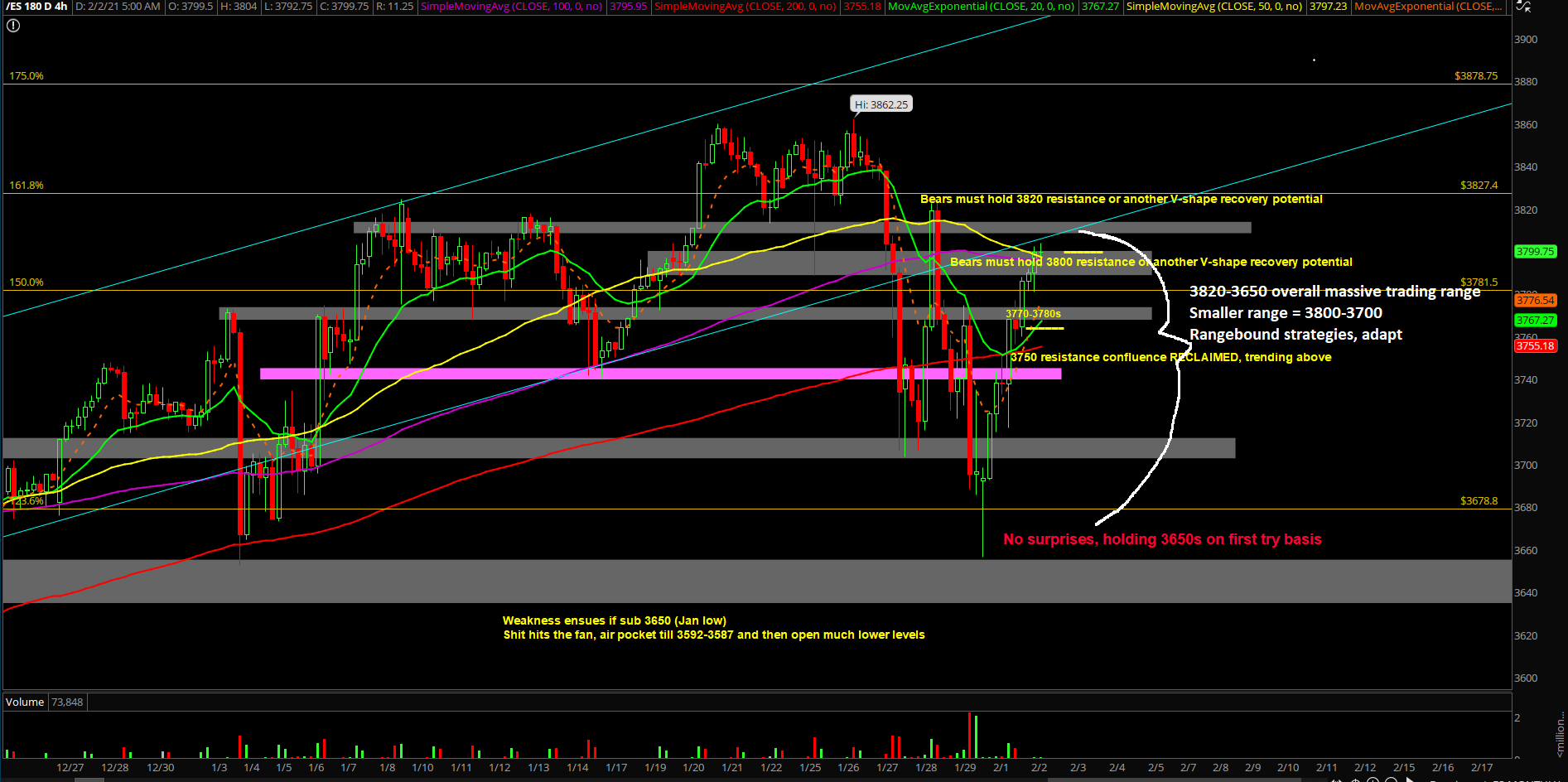

The first part of the week’s action retraced all losses from Friday as the E-mini S&P 500 (ES) formed a double bottom during Sunday night at 3650 key level, reports Ricky Wen of ElliottWaveTrader.net.

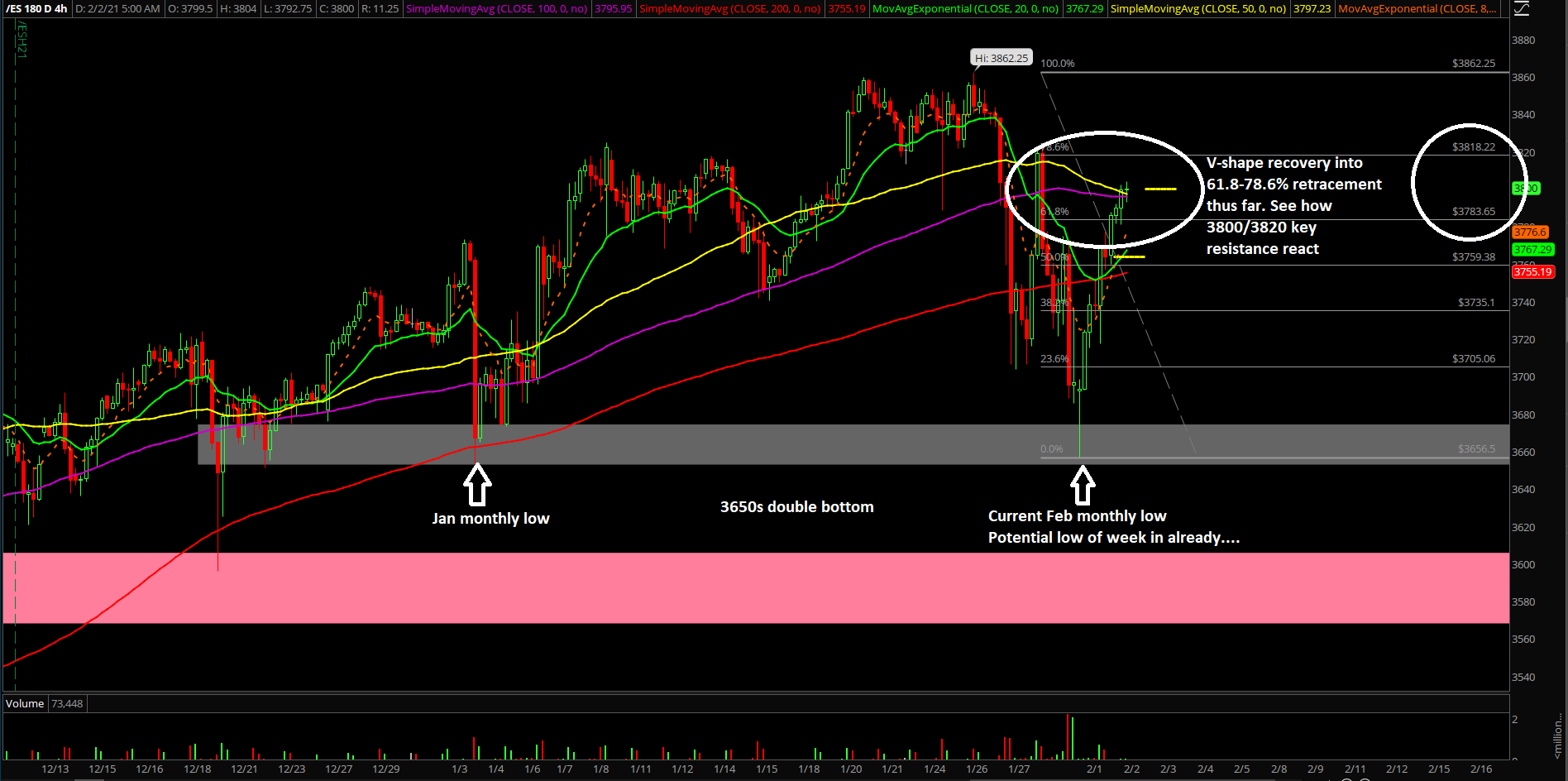

The next two sessions appeared to be pivotal in confirming whether it's risk on again or whether we need to wait a bit. Right now, bears are losing the battle before price action is back to neutral mode given the V-shape recovery into 61.8-78.6% retracement of the 3860s-3650s range.

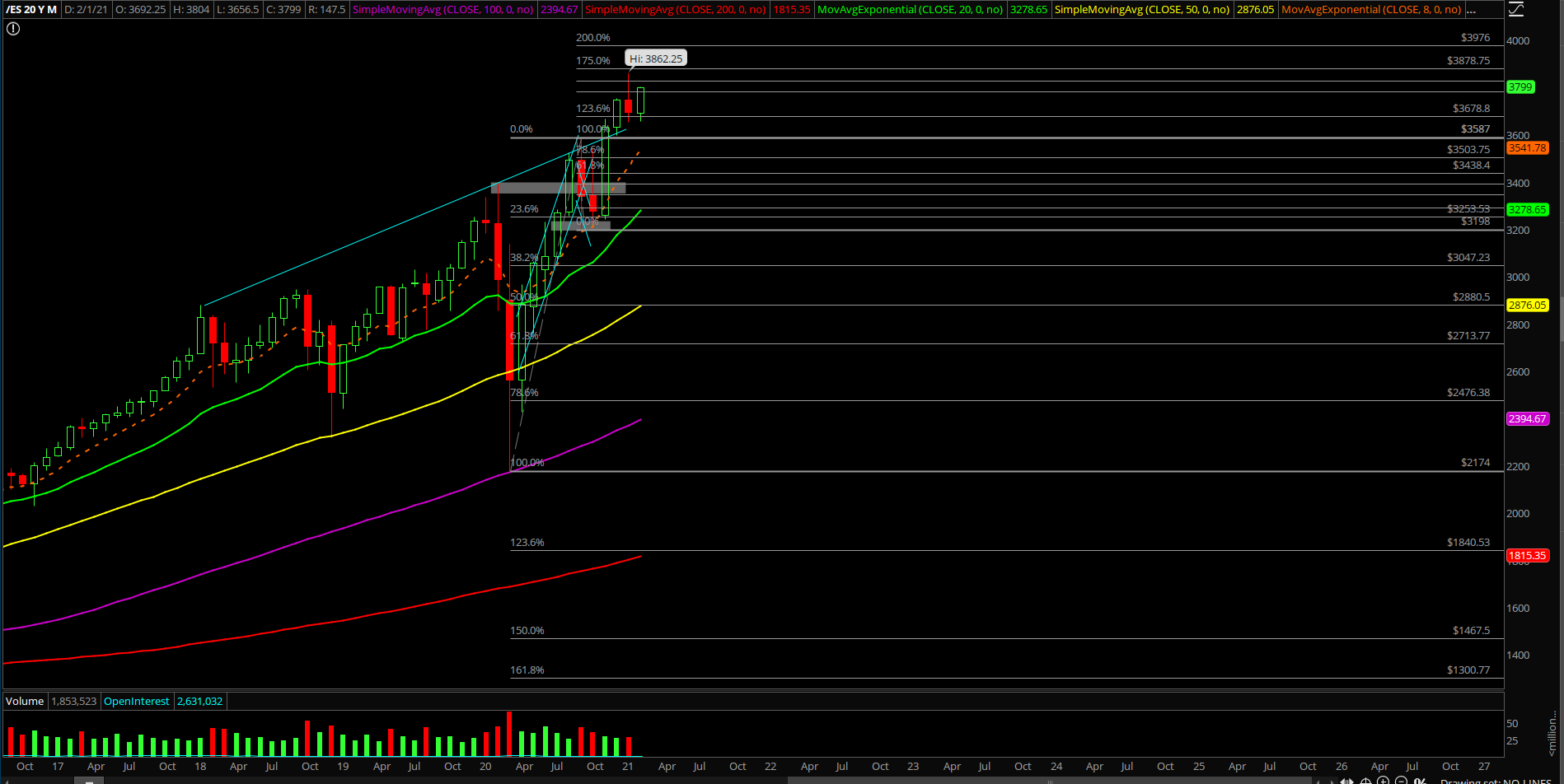

The main takeaway is that this is healthy consolidation in the bigger picture because it allows the market to reset and take out some novices and shake the tree a bit. It clears out the newish traders that keep on buying calls and getting paid easily for the past few months. It isn’t going to be as easy and simple as that going forward. At least not until price action confirms the stabilization/higher lows. During Sunday night, the market held the 3650s and formed a temporary double bottom setup. This was no surprise because we’ve been saying the 3650 area has been a key level for the past few weeks. It is the confluence of the January monthly lows.

What’s next?

Monday closed at 3763.75 in the ES as the low to high range since Sunday was +120 points or +2.95%. Bears are facing a V-shape recovery and extinction risk again. Feels like déjà vu so let’s see what happens here at 3800/3820 key resistances. Let the price action dictate your actions. Know your timeframes.

Summarizing Our Game Plan:

MoneyShow’s Top 100 Stocks for 2021

The top performing newsletter advisors and analyst are back, and they just released their best stock ideas for 2021. Subscribe to our free daily newsletter, Top Pros' Top Picks, and be among the first wave of investors to see our best stock ideas for the new year.

- Price is back to neutral mode and starting to turn bullish as short-term bearish momentum is failing and bears are facing another extinction risk given how price action has been reacting since the Sunday 3650s temp bottom…another V-shape recovery thus far.

- Given the price action clues from Monday Feb 1st, the market has temporarily stabilized by a double bottom of the 3650 pre-determined key level. If you recall, it’s the Janurary monthly low and also our s**t hits the fan level.

- Market has retraced all of Friday Jan 29th losses and now looking to reclaim 3800 and 3820 to double confirm that the 3650s bottom is likely in and the train is back on its way towards 3976.

- Reclaim = a daily closing print above 3800, followed by 3820. Could do it or need a couple days more consolidation. Wait and see as bears will try their hardest to disallow the push above 3800 intraday.

- If bulls fail this feat, then price action is still stuck between the current range of 3820-3650 or the smaller range of 3800-3700 that we identified from prior reports/charts.

- Again, this is a day-by-day market now as price action remains below the trending daily 8/20EMA resistances, so we have to be nimble and adaptable with the adjusted volatility.

- This is going to be a large rangebound market for the foreseeable future, so treat as 3650-3820 bigger range and smaller range 3700-3800. Know your timeframes as this is being treated as a shakeout on the weekly chart before price action could confirm a stabilization event to move into new all-time highs again (3900+).

- Mainly watching 3800 key level this morning, if above it, opens up 3820 then 3830.

- Below 3800, opens up a back test into gap fill 3768 also known as Monday’s closing print area.

- Both sides are tradable in this overall range as volatility creates many great opportunities.

See charts on E-mini S&P 500 that accompany this article, below.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription services.