Interest rates are on the rise again. The yield on the 30-year Treasury just breached 2%. That’s more than double its March low and the highest level in a year, explains Mike Larson, editor of Safe Money Report.

The yield on the 10-year? It’s at 1.29%, a triple off its COVID-19 lows. Fives? They just topped 55 bps, or 0.55%.

This is all happening despite ongoing Federal Reserve commentary reinforcing the organization’s commitment to “ZIRP (Zero Interest Rate Policy) Forever” and “QE Forever” policies.

So, are these moves cause for panic? Will higher rates tank stocks? What about cryptocurrencies, precious metals, and commodities? Are they toast?

In a word, NO. It all goes back to a very important rule I developed during my quarter-century following the interest rate markets closely. I call it the “Three ‘F’ Rule”—and I want to share it with you today.

We all know interest rates are important. They represent the cost of money to borrowers on all kinds of debts, from government and corporate bonds to credit cards and mortgages.

The higher rates are, the more expensive it is to borrow. And the more expensive it is to borrow, the less money consumers, corporations, and even sovereign governments have to spend elsewhere.

Naturally, that acts as a governor on the economy. It slows growth down. That, in turn, hurts revenue and earnings growth—and investors can react by selling stocks, commodities, and other assets.

So...panic time then? Again, no. Because rates haven’t risen FAST enough, FAR enough, and FOR LONG enough to cause chaos. That’s the “Three ‘F’ Rule” in a nutshell. It’s all about speed, magnitude, and duration.

In other words, borrowers and investors can adapt if rates rise gradually, gently, and for a limited time. They only freak out when the moves get out of control.

So far, this move simply doesn’t qualify. If anything, investors are viewing it as confirmation of a gradual economic recovery and an accelerating vaccination effort. That’s why we’ve seen the stock market continue to rise right alongside interest rates.

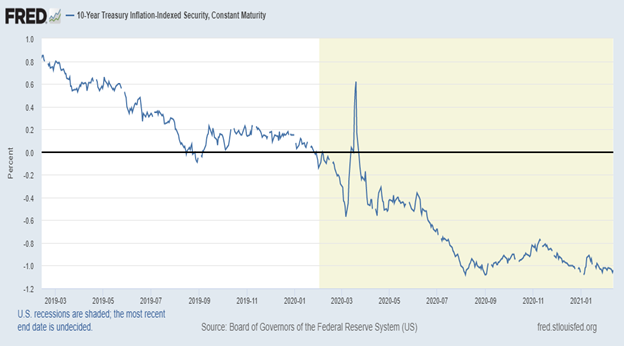

One more thing to keep in mind: “REAL” interest rates remain extremely low, even as NOMINAL rates are rising. Without getting too deep in the weeds here, real rates are simply normal rates minus the rate of inflation. Extremely positive real rates can be bad for the markets, while deeply negative rates can be the opposite.

Right now, the bond market is pricing in negative real yields at every major maturity point. Ten-year real yields are trading around NEGATIVE 1.01%, as you can see in this chart that goes back two years. That means money is still effectively very cheap.

Could things change? Sure. If bond investors really start worrying about the size of the Biden stimulus program, or if inflation data gets much worse, we could see this interest rate move get unruly.

But don’t dump your stocks...especially your Safe Money stocks...until my rule starts being violated. You’ll end up leaving profits on the table that way!

Safe Money Report focuses on these kinds of stocks, which include names in the consumer staples, food and beverage, retail, and healthcare sectors. Visit Safe Money Report here.