Everybody knows that markets and individual financial instruments oscillate between bullish and bearish cycles, but less well understood is the transition between periods of low and high realized volatility, explains Ian Murphy of MurphyTrading.com.

As volatility waxes and wanes, trading strategies go through dry periods and busy periods so it’s good practice to have a few strategies in our armory to choose the most appropriate for current conditions.

When working with traders, a common issue I notice is how we put all our eggs in one basket by constantly defaulting to our favorite strategy. This is often because we trust it, but also because we get lazy or do not have the time to learn something new. This is all well and good when the market and the strategy are aligned, but when they fall out of sync, losses build up and it undermines our confidence in the strategy. For this reason, we need to know when to stand a strategy aside and when to use it.

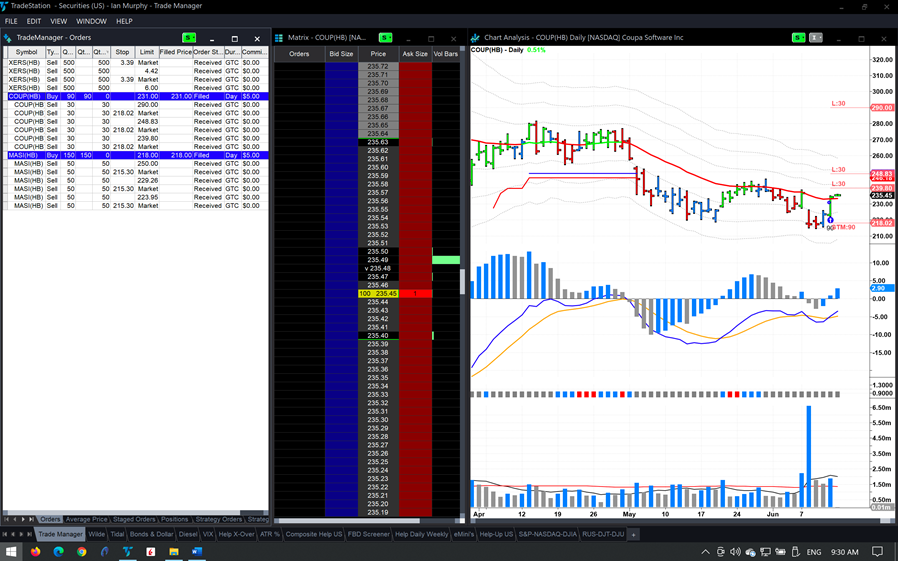

The FBD strategy went through a dry spell earlier this month but sprang back to life last week as highlighted in Friday’s post. There are currently three positions open (above left), and I expect more triggers to follow this week.

Learn more about Ian Murphy at MurphyTrading.com.