When seeking to add a technology presence to our covered-call writing and put-selling portfolios, we can do so by using exchange-traded funds (ETFs) based on technology benchmarks, explains Alan Ellman of The Blue Collar Investor.

Two such reliable ETFs are Technology Select Sector SPDR Fund (XLK) and Invesco QQQ Trust (QQQ). This article will compare the two funds to assist in determining which, if either- would make a better candidate for our portfolios.

XLK

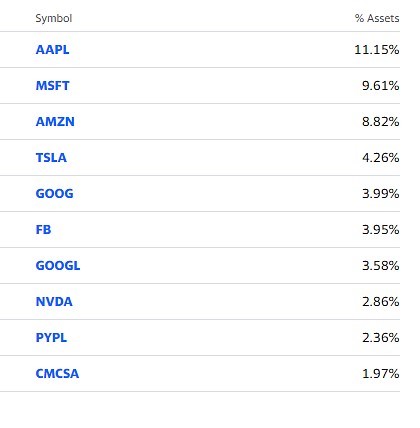

This is a fund based on the technology stocks present in the S&P 500. Here is a list of the fund’s top 10 holdings as of May 2021:

QQQ

This is a fund based on the top 100 non-financial companies listed on the Nasdaq exchange Here is a list of the fund’s top 10 holdings as of May 2021:

The top two holdings (AAPL and MSFT) are the same in both securities and one other (PYPL) is also found in both top 10s. There is no apparent security advantage based on holdings.

Comparison Chart in One and Three-Month Time Frames

QQQ slightly outperformed in a one-month time-frame while XLK slightly out-performed in a three-month time-frame. This fairly typical of these securities. There is no apparent security advantage based on price performance.

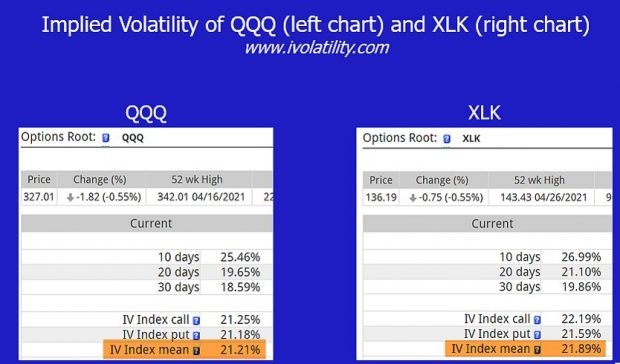

Implied Volatility Comparison Measuring Risk and Premium Returns

Once again, there is no apparent difference between the two securities as the risk and premium returns, as measured by IV, is similar.

Pros & Cons

There are little differences between these two securities as they relate to option-selling. XLK has a much lower price-per-share and QQQ has the Nasdaq 100 Volatility Index (VOLQ) associated with it which can be leveraged into a strategy I developed in 2021:

Discussion

QQQ and XLK are both outstanding securities to integrate technology companies into our portfolios for option-selling. Both consist of quality companies and our well-diversified. Price and strategy goals may play a role into final decisions.

Learn more about Alan Ellman on the Blue Collar Investor Website.