Yesterday’s positive earnings from the banking sector coupled with better-than-expected employment numbers saw the S&P 500 (SPX) gap up at the open and remain bullish all day, states Ian Murphy of MurphyTrading.com.

Is this a temporary blip in the recent bearish trend and will we sell off again, OR are we over the pullback and heading to the bull ring? As always, we should avoid the temptation to make predictions and focus instead on trying to identify if a recognizable trend structure has formed.

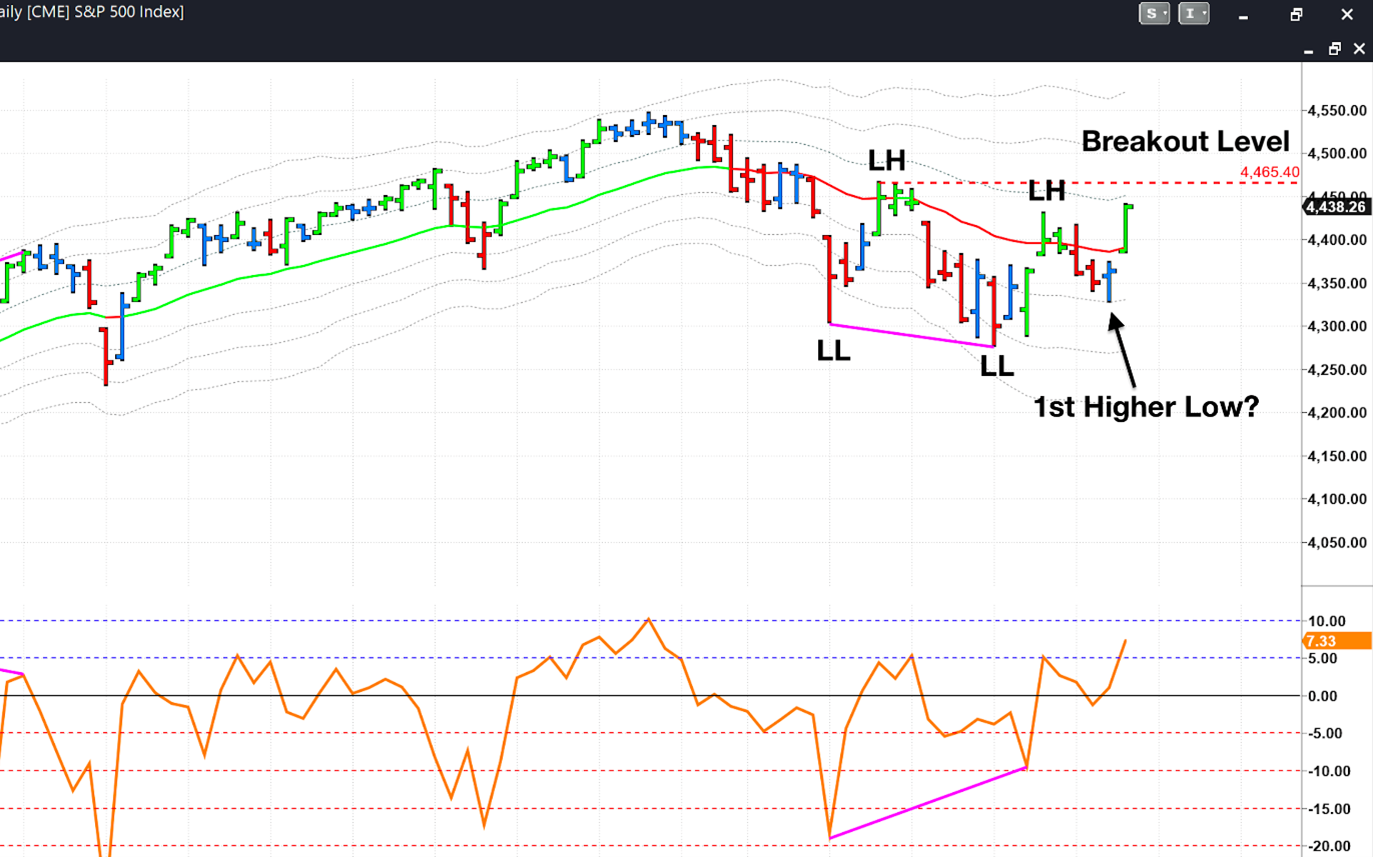

In mid-September we entered a classic bearish trend when the S&P 500 broke below the 1ATR line and made a lower low (LL). This was followed by a lower high (LH), then one more of each. On Wednesday we may have found support when a first higher low (1HL) pattern formed at the -1ATR line. If this is a first higher low, then we have a picture-perfect foundation to relaunch the S&P 500 into its bullish trend, which may go to new highs leading into the year end.

The breakout level to watch closely is the previous high of 4465 (dashed red line), which coincides with the 1ATR channel at 4451. A move and close above this level will confirm we have resumed the bullish trend.

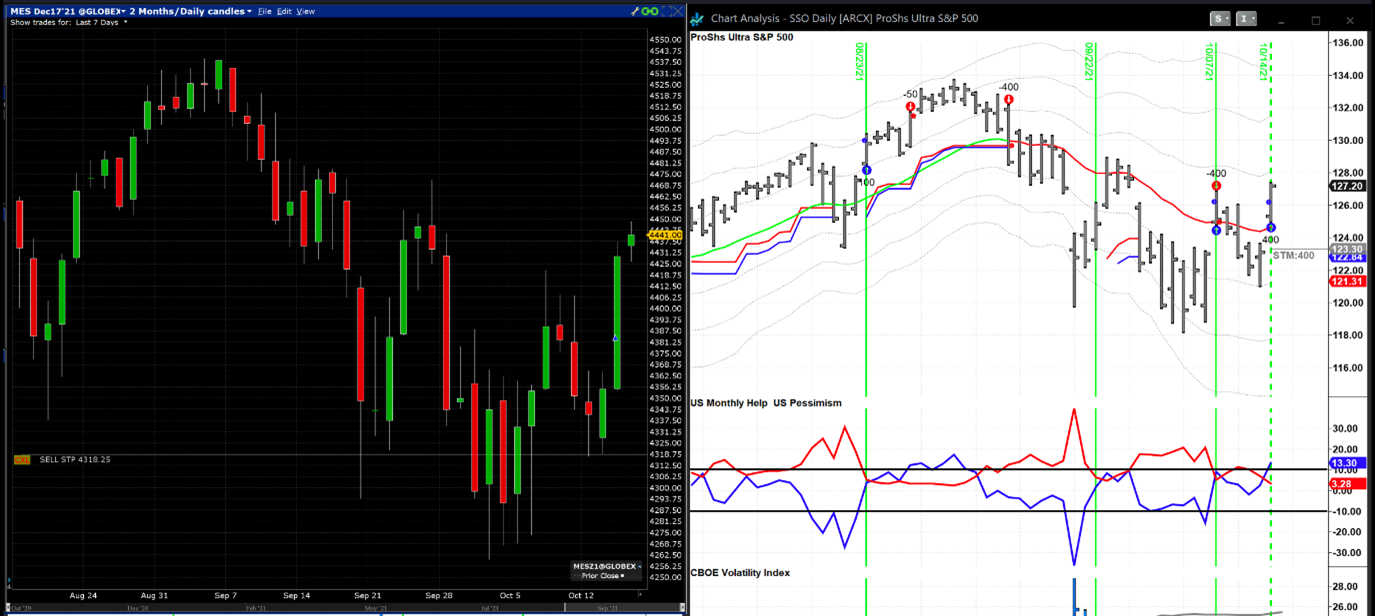

Yesterday’s rally offered a bull trigger on the Help Strategy (green dashed line), and I opened two long positions (SSO on TS and E-minis on IB) based on the bull trigger and possible 1HL pattern. Nothing is guaranteed in the markets and the S&P 500 could reverse from here—therefore we always practice robust risk management, and the initial protective stops on both positions are also shown above. If the market goes higher in today’s session, it’s likely these will switch to trailing stops from Monday onwards.

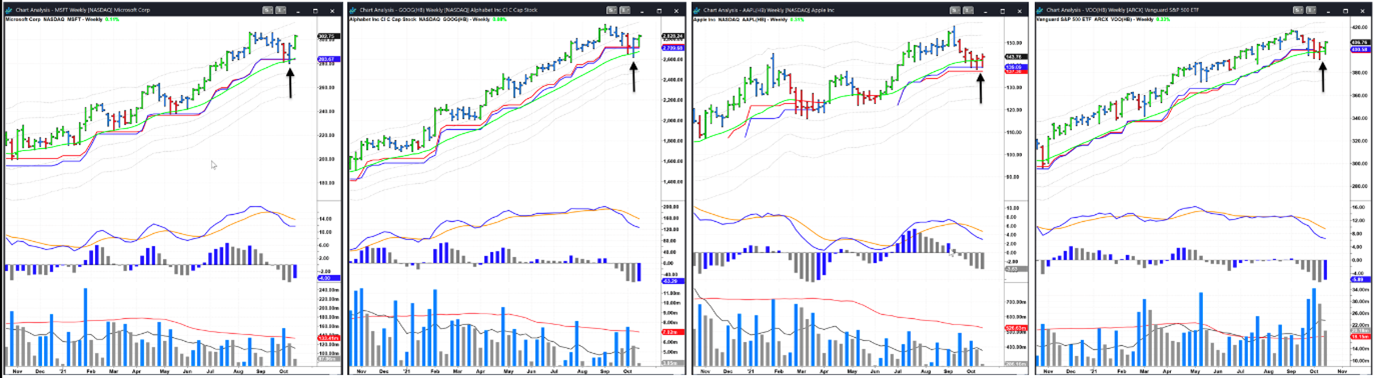

The weekly trend-following re-entries on Microsoft (MSFT) and Alphabet (GOOG) have respected their trailing stops. Apple (AAPL) is still offering a good entry point this week, having also held above the stop. For a pure play on US equities, Vanguard S&P 500 ETF (VOO) is about $4 more expensive today than last week’s entry but is still in the trade zone.

Learn more about Ian Murphy at MurphyTrading.com.