A question which comes up all the time is how to deal with exposure to foreign exchange fluctuations when trading and investing in stocks listed in a currency other than our own, states Ian Murphy of MurphyTrading.com.

A highly successful European-based trader once advised me to stop thinking in terms of a ‘home currency’ and a ‘foreign currency’. People who live in a foreign land don’t see themselves as foreigners, that’s our perspective. We should forget the notion that the currency we use to fund our account is on solid ground and all other currencies are moving relative to it.

We should see currencies (and all other assets) as a group of boats at sea, all moving relative to each other, and none of them are fixed. A market participant observes the movement of assets from above, detached from them. So, when we fund our account in our local currency, we are pushing that boat out to sea, and we must let it go.

When we sell a stock in our home currency, strictly speaking we don’t go ‘back to cash’, we move from a long position in an equity to a long position in a currency which coincidentally happens to be the same currency used in our country, but it could just as easily be dollars, pounds, euros, or yen. When we sell a stock, we are not jumping off a boat onto dry land, we are jumping from one boat to another.

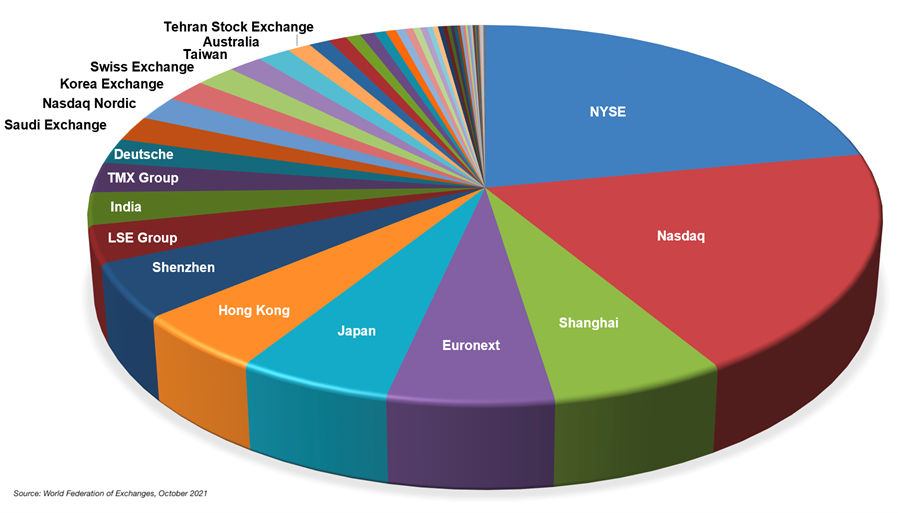

Total market cap in USD of largest global exchanges

On the subject of home currencies, national bias among equity investors and traders in countries with small stock markets is a huge problem and can be a very costly mistake. For trading equities, we should only be looking at the largest markets for the liquidity and regulation they provide. First and foremost is the US equity market, followed by the European exchanges and then Japan (China’s equity market is large but difficult to access for overseas retail traders). Investing in equities in small markets is a different story - but we should always remember to diversify our portfolio.

S&P to 5000

Last week, the world’s largest equity index reached 4,600 for the first time in history and the idea of the S&P 500 (SPX) at 5,000 by year’s end no longer sounds crazy. Stocks are not the only asset class in the clouds and commentators are talking about the ‘bubble of everything’ - commodities, property, collectables, etc.

Source: stockcharts

The annual inflation rate in the US for September was 5.4%, while the Euro zone is expecting a rate of 4.1% for October. In ‘normal times’ such elevated levels would have triggered interest rate increases by now, but central bankers believe inflation is transitory due to supply constraints with Covid. On the charts above, the Yield Curve (red line on the left) should be rising by now on its left side as rates are hiked up. What if inflation falls next year, but not below the target rate of 2%? Will we see interest rate hikes in the order of 1% or 2% next fall to make up for lost time?

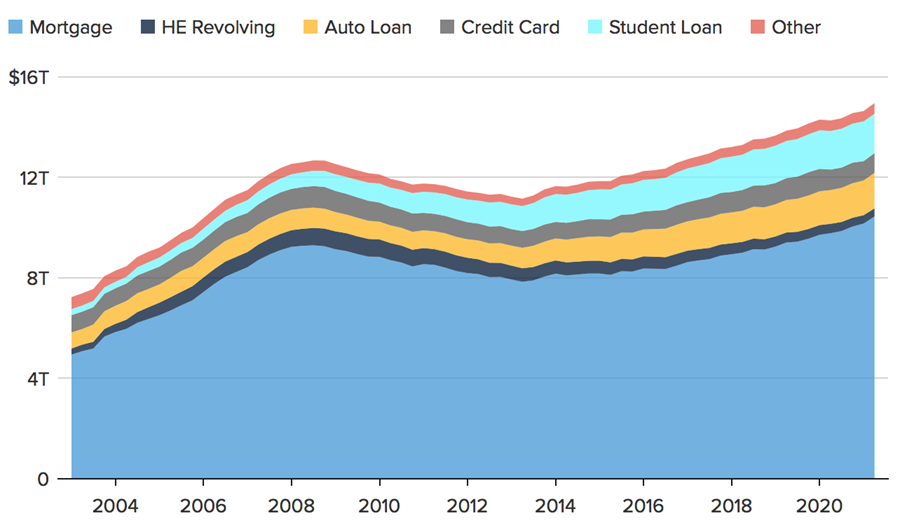

Source: Federal Reserve Bank of New York, CNBC Website

US households were carrying almost $15 trillion in debt by Q2 of this year, and the burden has been climbing steadily since the great deleveraging of loans between 2008 and 2013. The era of rock bottom interest rates and QE has gone on for so long, a generation of new borrowers who have never experienced interest rate increases may be in for a shock in 2022.

Learn more about Ian Murphy at MurphyTrading.com.