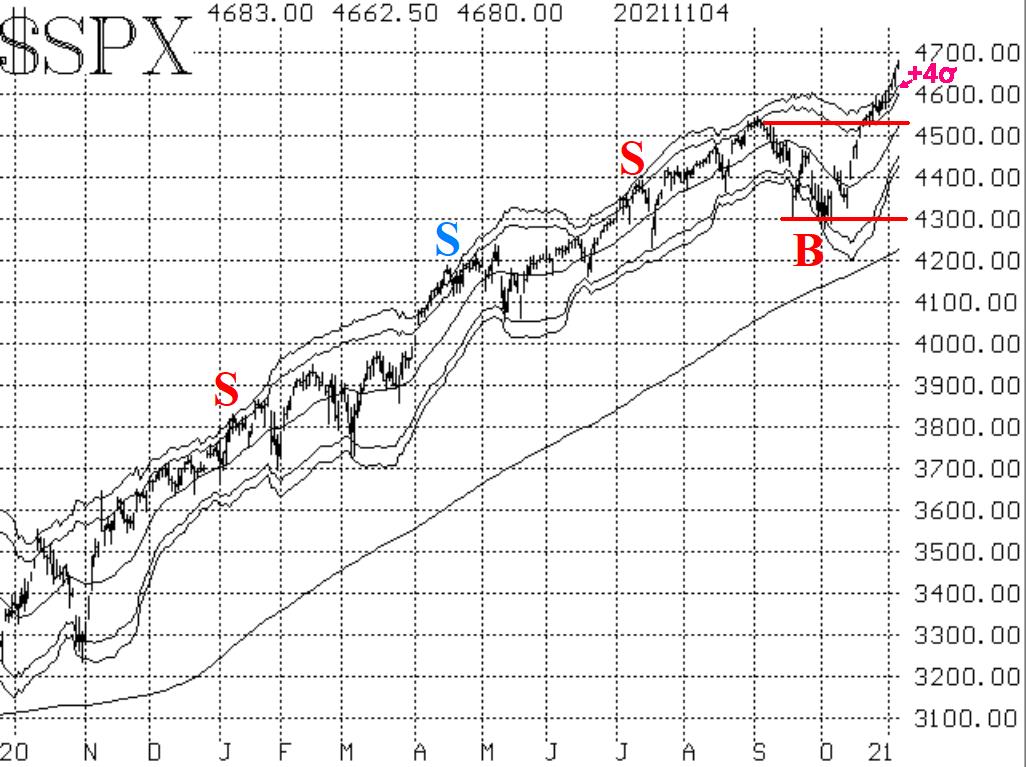

All of the major Indices have broken out to new all-time intraday and closing highs to close out last week, says Larry McMillan of Option Strategist.

This includes the "usual" S&P 500 (SPX), Dow (DJX), and Nasdaq (NDX), but now they have been joined by the Russell 2000, although RUT and DJX did not join the party on Thursday (November fourth). These charts are positive, and that dictates holding a long "core" position. There should be support at the breakout levels, which for SPX is the 4525 - 4550 area.

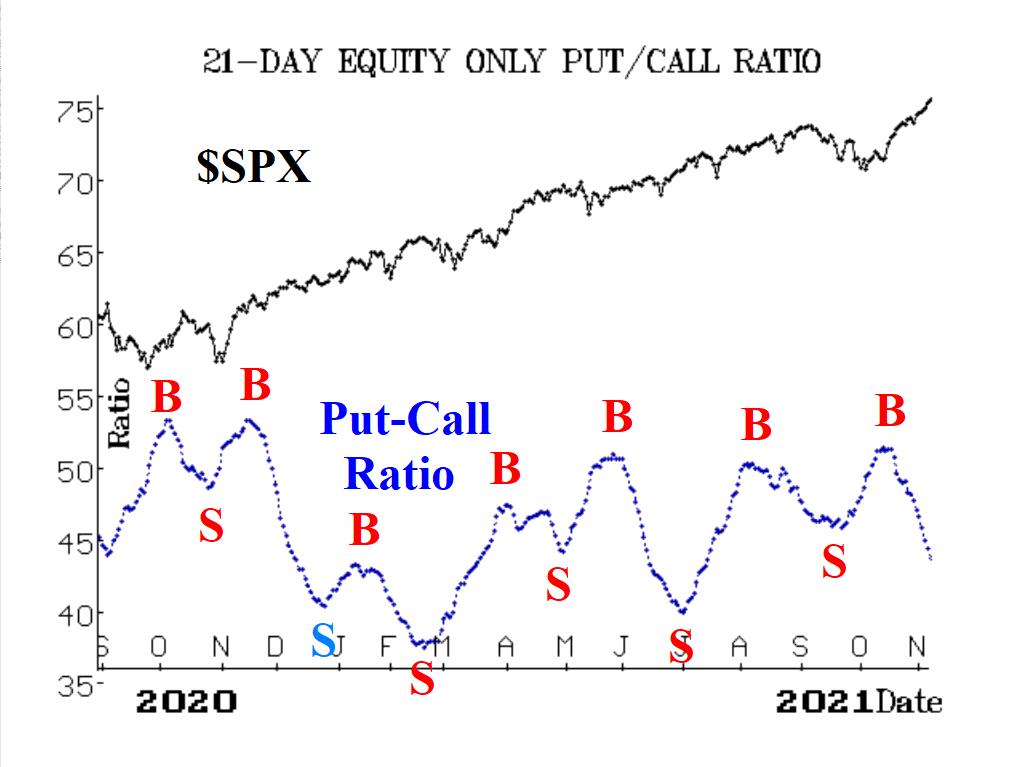

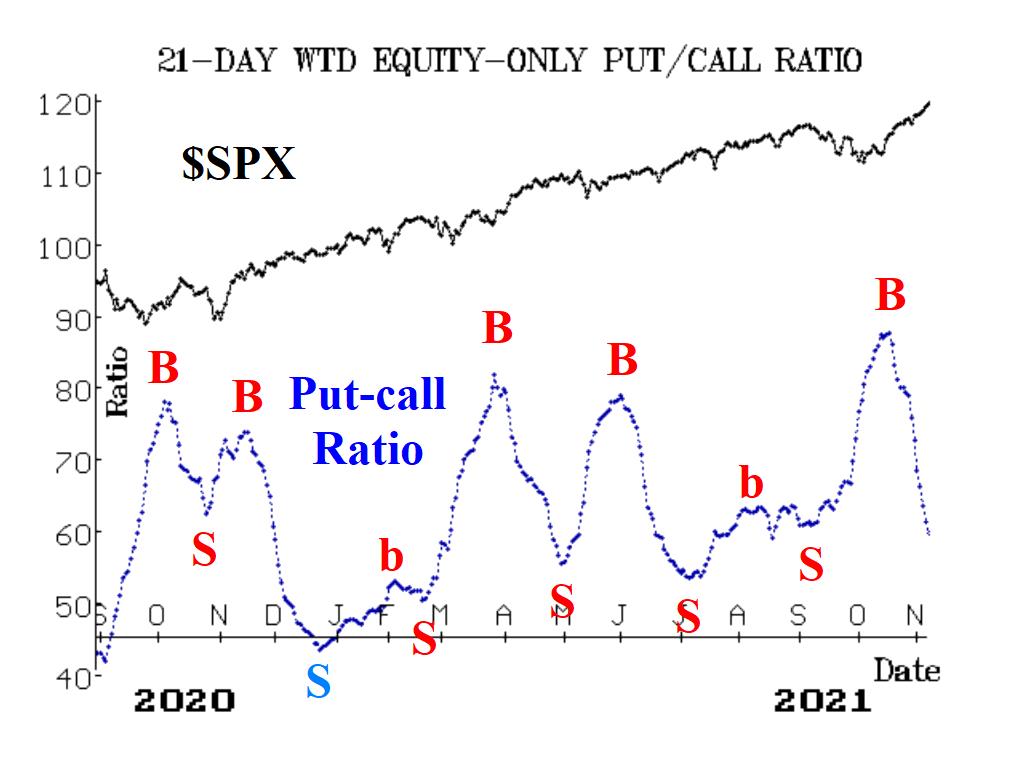

Equity-only put-call ratios remain on strong buy signals that were first generated in mid-October. They are falling rapidly now, since call buying in stock options has skyrocketed again. Eventually, they will bottom out and begin to trend higher. Then, and only then, will a sell signal be in place.

Market breadth is still skittish. It is noticeable that there has been negative breadth a couple of times this week, even while these Indices are all making new all-time highs. Normally, that would be a danger sign, but on alternating positive days, breadth has been tremendously positive. So that is keeping the breadth oscillators on buy signals and this time.

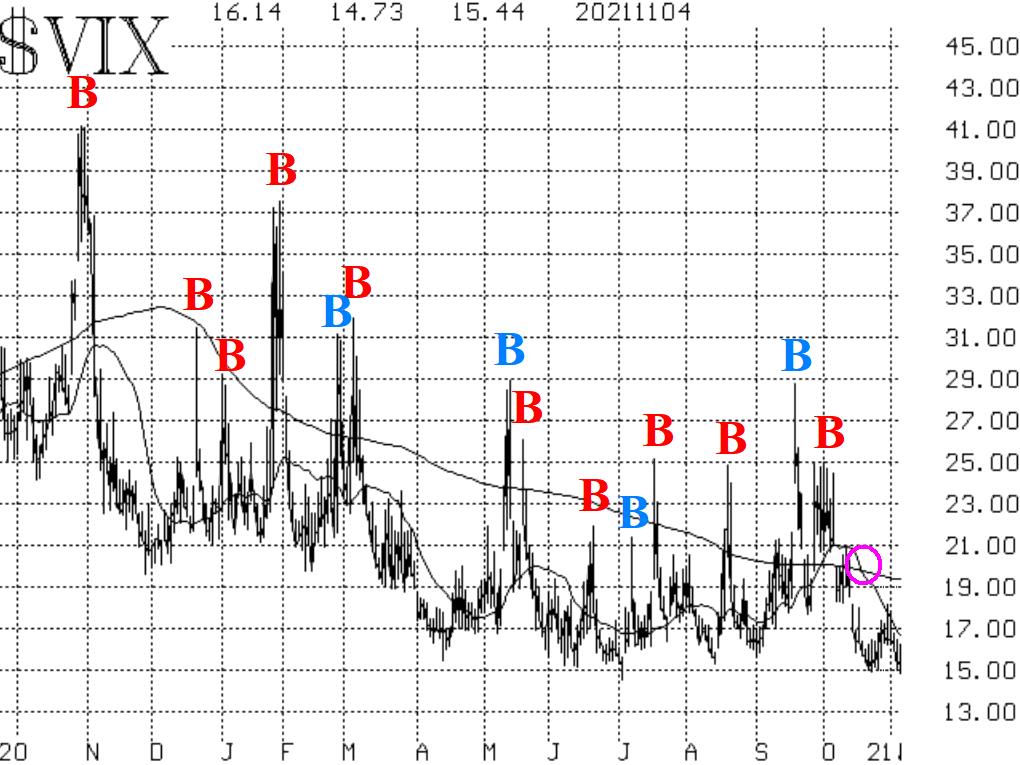

CBOE SPX Volatility Index (VIX) indicators have remained bullish for stocks, but VIX itself is reluctant to give up too much ground. It is holding at 15, roughly. In a typical bull market like this, VIX would be in the 12- 14 range, or even lower. But big-money SPX option traders are still a bit leery of what lies ahead, and so are buying enough puts to keep VIX somewhat elevated.

I am becoming more and more convinced that we are going to have to see VIX below 12 before this current bullish phase terminates. These VIX bulls are going to have to give up their game. For our purposes, we are retaining a "core" long position, in line with the bullish SPX chart and the almost unanimous bullish signals from our indicators.