Trade the long side while planning for what comes next. Here’s a hint: When liquidity dries up, so will the rally in stocks, says Joe Duarte of In the Money Options.

Last week, I noted: “The stock market could well crash and burn on November third. But what if it doesn’t?” Specifically, I noted that the recently positive action in the market’s breadth and the options market could well provide a set up for a market rally, after the Fed’s post FOMC meeting announcement and press conference.

And in fact, that’s exactly what happened, as most of the news about the tapering was already baked into stock prices. So, the big question, of course, is what’s next?

As it turns out, and as I will detail directly below, the answer lies in both the stock and options markets, as well as on the opposite side the banking system from the Fed, private banks.

Can This Rally Last?

Judging by the breakout in the market’s breadth, and the growing bullishness in the options pits, we are back in an uptrend. Moreover, as I detail below, the action in the options market shows that money is flowing back into the buy side aggressively. Thus, the rally could last a while.

But caution is not a bad thing. That’s because the recent rally is at least partially due to short covering from hedge funds and CTA advisors (algo traders), who were caught off guard by the lack of a market crash in the wake of the Fed’s official tapering announcement on November third.

So, what will happen when the short covering runs its course? After all, the central tenet in stock investing is, “DON’T FIGHT THE FED.” And the Fed is clearly removing liquidity from the system by tapering, although it’s not going nuclear by raising interest rates, yet.

What’s Next Depends on Liquidity

Liquidity is the amount of money that is available for lending in the banking system. This includes so-called “shadow banking” entities, such as mortgage lenders, as well as other “off the books” entities, like market brokers, REITs, and anyone involved in derivative transactions or margin related trading of stocks, futures, and related financial instruments.

Yes, even though an institution or a private party may have plenty of cash on hand or on its balance sheet, it only adds to system liquidity if they are willing to lend.

And it is when lenders won’t lend that you get a liquidity crisis.

Banks Hold the Key

The Federal Reserve injects liquidity into the system, by buying bonds – usually from banks. This puts reserves, presumably lendable money, into the bank balance sheets.

In reality, however, the cash on a bank’s balance sheet is not really indicative of liquidity, since it’s only the amount of money a bank wishes to lend that contributes to the system’s liquidity. So, when the Fed buys fewer bonds, as it’s about to do by tapering, the banks are also likely to be less willing to lend.

Now, that’s not exactly because they have less money to lend – at least not the big ones like JP Morgan (JPM), who are flush with cash. A liquidity crisis happens when banks don’t lend money to borrowers because they fear that they won’t get paid.

In other words, the liquidity crisis that will end the rally in stocks will come when banks fear that they don’t have enough money to lend while keeping enough on their balance sheets to remain solvent, and when they sense that their customers are struggling to pay them back.

How Much Tapering Can the System Handle Before a Liquidity Crisis?

As the Fed starts tapering in November, by reducing its bond purchases by $15 billion per month, the big question is whether the system can handle reduced liquidity. More specifically, how long before the system buckles, as banks become resistant to dip into their reserves to lend.

Another way to put it is this, there isn’t really a whole lot of slack in the system.

So, if the Fed drains too much money from the system via its tapering, and if one major party defaults, then the default chain grows, and you get the Lehman Brothers 2008 crash.

Stay tuned.

There are still some stocks and option strategies which may yield sizeable gains when properly managed, even in negative markets.

Waste Management: Where Automation is a Perfect Fit and a Route to Increasing Profits

I recently recommended shares of Waste Management (WM), a leader in waste collection and related businesses as the shares are trading in an excellent price area.

I had recommended this stock earlier in 2021 and sold it for a nice profit as shares entered a consolidation pattern. The story then was pretty interesting, with solid waste volumes rising due the changing habits of people and businesses that were adjusting to the pandemic.

But now that the pandemic has evolved and has become a part of daily life, the waste business has continued to change. Interestingly, WM is still seeing higher volumes, which suggests that its business is not likely to stop growing anytime soon.

In addition, as with most other businesses, WM is experiencing higher labor costs and supply chain disruptions. While that may be a negative for some businesses, WM is adjusting better than many.

That’s because its business is actually quite adaptable to the changing landscape. For one, with rising waste volume and supply chain disruptions, there is an increased demand for recycled products. This has increased the company’s recycling business. Moreover, even with high labor costs, WM is increasing the automation at its recycling plants, and is starting to deploy more AI throughout its entire business platform.

What that means is that at some point, automation will cut costs which will be additive to the bottom line during a period when volume is increasing. Indeed, the most telling metric for WM is the fact that they added twice the number of new customers in the most recent quarter than they lost.

As a result, the company offered yet another quarter of upbeat guidance, as it expects strong business demand to continue and no real resistance to price increases from needy customers.

The stock has backed off after a recent breakout, but is holding well above support, which offers an opportunity to buy on the dip. Accumulation Distribution (ADI) and On Balance Volume (OBV) have bottomed out, which means that profit taking is almost over and that buyers are coming back in.

I own shares in WM as of this writing.

Options Traders Turn More Bullish

For the last few weeks, I’ve noted that call buyers have been steadily returning to the market, which is a bullish development. In fact, last week I wrote that if this pattern continued on Monday and Tuesday, and it accelerates after the Fed’s announcement, the odds of the market moving higher will increase. In other words, if by any chance the market’s response to whatever the Fed says is positive, the ensuing market rally may be quite impressive.

How does it work? Here are the simple steps:

- Call buyers force market makers to sell calls.

- Market makers hedge their call sales by buying stocks and stock index futures.

- The cycle self-reinforces as long as call buyers persist, and the stock market moves higher.

And that’s what we’re seeing fairly aggressively at this point.

Market Breadth Extends Breakout. Consolidation in Short Term Likely.

The New York Stock Exchange Advance Decline line (NYAD) has finally delivered a convincing breakout, although it could enter a short-term consolidation pattern in the next few days. Still, for now, the indicator remains bullish, although slightly overbought.

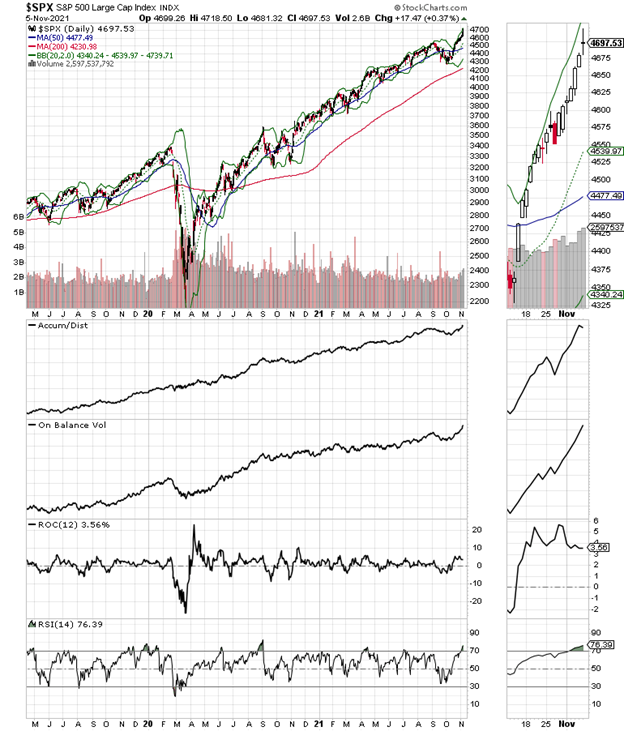

The S&P 500 (SPX) confirmed the new high on NYAD and remains well above its 20, 50, 100, and 200 day moving averages, with good confirmation from Accumulation Distribution (ADI) and On Balance Volume (OBV). As with NYAD, we could see a short-term pullback.

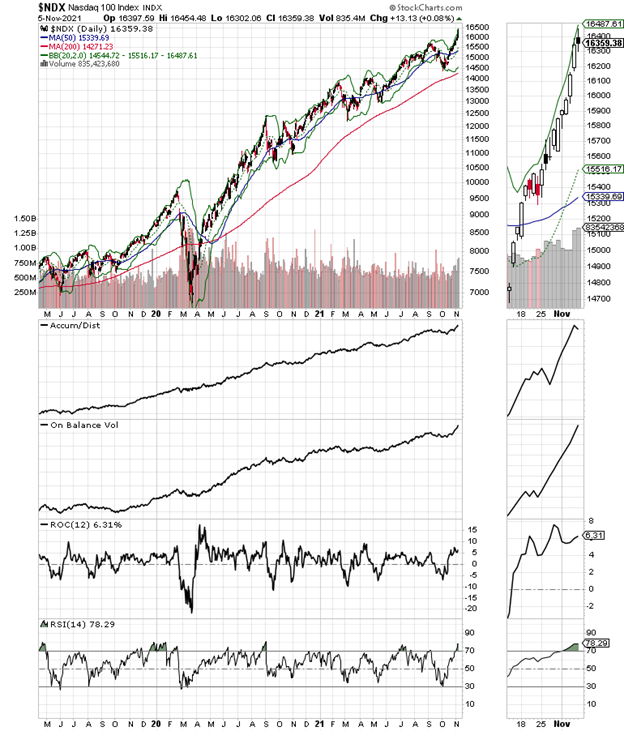

The Nasdaq 100 index (NDX) also confirmed the recent high on NYAD. Even better, the NDX breadth line made a new high, with Accumulation Distribution (ADI) and On Balance Volume (OBV) confirming.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.