I recently took a hit on the Moderna (MRNA) trade, which was mentioned in the November newsletter and I wanted to share with you what took place, states Ian Murphy of MurphyTrading.com.

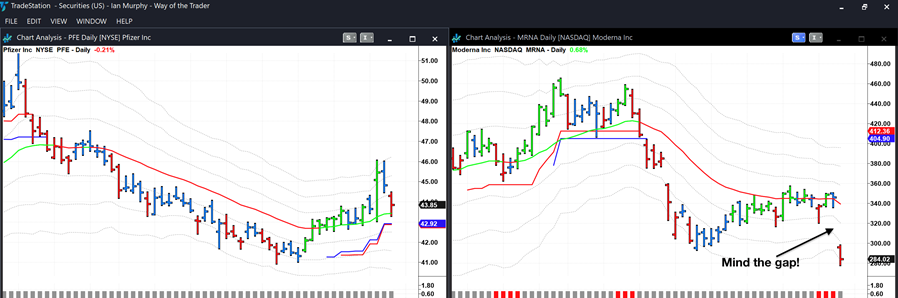

Two factors influenced by decision to hold a position through the earnings announcement. MRNA closed at $345.92 on Wednesday and the protective stop was at $297.45, meaning a gap down of more than 14% would be required to trigger the stop. Also, Pfizer who produce the other mRNA shot for Covid had already reported strong earnings.

On daily swing trades I never hold a full position through earnings, but weekly trend following trades are a different matter because we must sit through numerous announcements as the trend develops.

When the position was opened, I allocated my usual 1% risk to the trade buying 20 shares at $350 for $7,000 in my €100k ($115k) Interactive Brokers account. The protective stop order executed at the open for $294.07, netting $5,881.40 and giving a loss of $1,118.60 (plus $0.76 round trip commission), which was just under 1% of my account. Thankfully the three Micro E-Mini contracts in the same account are doing well and this dulled the pain.

On reflection I allowed an emotional opinion on a stock to influence the trade. I like the stock, I like the company, and I like the mRNA story but none of that is a valid trading strategy with proven back-tested results. Also, even though the loss was within my risk profile, I don’t usually suffer the full 1% loss because I mostly have an opportunity to scale out of a position or move up the protective stop.

I made three errors: (a) opening a long-term “buy and hold” position so close to earnings (b) holding the full position through earnings without the price having made a sufficient move to the upside to accommodate a deep pullback (c) failing to remember Pfizer is a huge firm with many irons in the fire and global manufacturing capacity, whereas Moderna derives all its non-grant income from vaccine sales and they are new to the manufacturing game.

P.S. To add salt to the wound, Pfizer is up over 10% in pre-market on the announcement of a new Covid pill.

Learn more about Ian Murphy at MurphyTrading.com.