The S&P 500 (SPX) finished on Monday at 4,701, a gain of 0.1%. It was the eighth consecutive daily advance, and the 15th during the last 17 days, says Jon Markman, growth-stock specialist and editor of Strategic Advantage.

To restate the obvious, bulls are on a roll. With the Federal Reserve’s tapering plan now set, and third quarter earnings reports nearing an end, it is going to be tough for bears to gain control of the narrative.

Without an opposing catalyst, trends in motion tend to stay in motion. That said, it’s certain there will be a smattering of down days here and there.

All trends eventually pause to refresh, yet the bears are clearly in trouble. Every meaningful dip between now and the end of the year is going to be bought aggressively by professional money managers chasing performance.

There is support for the benchmark S&P 500 at 4,580. On the upside, I expect that it will take a few days for bulls to clear the 4,700 level in a meaningful way. Beyond that level, the next potential resistance point is 4,800.

The Dow rose 0.3% to 36,432 on Monday, and the Nasdaq was 0.1% higher at 15,982.

Materials and energy shares fared best, while utilities lagged. West Texas Intermediate crude oil climbed 1.2% to $82.27 per barrel. The 10-year US Treasury yield rose four basis points to 1.50%.

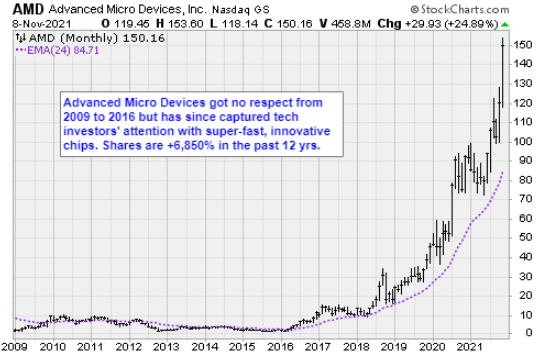

Breadth slightly favored advancers 5-3, and there were 847 new highs vs. 90 new lows. Big caps on the new high list included Advanced Micro Devices (AMD), Linde plc (LIN), Bookings Holdings (BKNG), Ford (F), and Marvell Technology (MRVL).

Kind of a peculiar vanguard crew, which only means that the usual suspects in big-cap tech are not the leaders at this juncture, which is cool.

The House of Representatives late Friday passed the bipartisan $1 trillion infrastructure bill, providing funding for investments in roads, bridges, and rail transport as well as power, broadband, and water infrastructure.

Stocks gaining on the news included asphalt maker Astec Industries (ASTE), which rose nearly 15%, while steelmakers Nucor (NUE) and US Steel (X) climbed 3.6% and 2.7%, respectively.

Electric vehicle charging companies also surged, with ChargePoint Holdings (CHPT) up nearly 12%, Volta (VLTA) 19% higher, Blink Charging (BLNK) advancing 24%, and EVgo (EVGO) 35%.

Speaking at a virtual symposium hosted by the Brookings Institution, Federal Reserve Vice Chair, Richard Clarida, said demand and supply imbalances in the US economy are "likely to dissipate over time."

The risk to the inflation outlook is to the upside, and personal consumption expenditure inflation represents a more than "moderate" overshoot of the Fed's target, Clarida said.

In company news, Advanced Micro Devices said Monday it released "the world's fastest accelerator" for high-performance computing and artificial intelligence workloads. Shares jumped 10% to lead the S&P 500.

Penn National Gaming (PENN) led S&P 500 decliners, down 4.5%. Morgan Stanley cut its share price target for the casino’s operator to $69 from $85, while maintaining an equal-weight rating.

Peloton Interactive (PTON) shares shed 7.9% on top of Friday's 35% slump. CNBC reported on Friday that the interactive exercise equipment provider froze hiring to cut costs after lowering its annual revenue guidance. Roth Capital cut Peloton's share price target to $70 from $125, but kept its buy rating.