We enter a covered call writing trade for a particular strike and then that strike disappears. What happened? Is this a bad dream? Actually, this is a bit unusual but not an extremely rare occurrence, explains Alan Ellman of The Blue Collar Investor.

Contract adjustments are associated with corporate events like stock splits, mergers and acquisitions, and special one-time cash and stock dividends. This article will highlight a contract adjustment for ARK Next Generation Internet ETF (ARKW) resulting from a special one-time cash dividend. Thanks to Ted for sharing his trade with our BCI community.

Ted’s Trade

- 12/17/2020: Buy ARKW at $145.50

- 12/17/2020: STO the 1/15/2021 $145.00 call at $5.30

- 12/28/2020: The $145.00 strike is changed to a $141.11 strike…why?

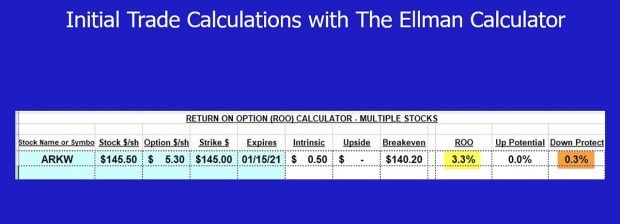

Initial Structuring of ARKW Trade With the Ellman Calculator

ARKW: Initial Trade Calculations

The spreadsheet shows an initial one-month time-value return of 3.3% with a small 0.3% downside protection of that profit.

How to Access Contract Adjustment Information

- Go to www.theocc.com

- Search on top left

- Information memos on right side

- Search by keywords (ticker) on left

- Search on bottom

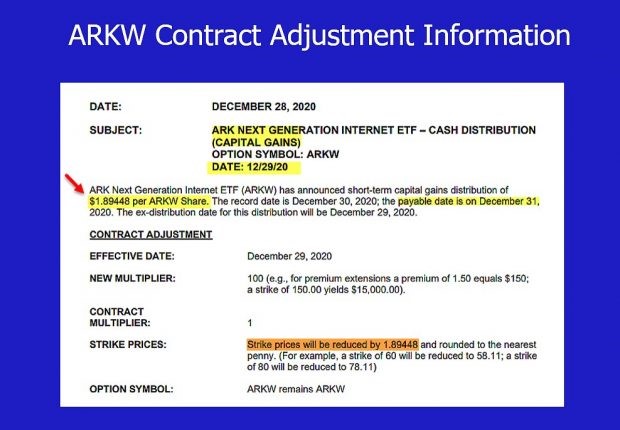

Contract Adjustment for ARKW Explaining the Strike Reduction of $1.89

ARKW: One-Time Special Cash Dividend Contract Adjustment

Discussion

Option contract adjustments are the result of corporate events. In the case of ARKW in December of 2020, there was a one-time special cash dividend of $1.89 which resulted in both a share price and call strike price reduction by the dividend amount. The Options Clearing Corporation makes sure that buyers and sellers of calls and puts are made whole by these adjustments.

Learn more about Alan Ellman on the Blue Collar Investor Website.