We spent weeks and months listening to the Fed tell us inflation was transitory. As you know by now, they had to take the word out of their dictionary, explains Jeff Greenblatt of Lucas Wave International.

As it turns out, US inflation is at its highest level in 60 years at least, perhaps the highest in the history of the republic. So, if you go by the Fed’s own logic, they should be raising rates as the economy heats up.

Only problem, the economy is not heating up, not with supply chain issues to name one challenge. There are some similarities to the current US situation and Weimar, Germany. In fact, I told many of you four years ago that if Trump didn’t succeed in his mission, what followed him would be much worse in economic terms—which rings true right now as everything he attempted has been or is in the process of being unwound.

Most notable is the inflation. We are not experiencing hyperinflation yet, but there is not one responsible policy maker doing anything about it. Here’s the bottom line, we are now reaping what we’ve sown based on the quarantines, censorship, and money printing since March 2020. According to Gary Kaltbaum on FOX, Powell has created this inflation and they are still printing money with no end in sight. 2.6% inflation a year from now? You can put that in the ‘transitory bin.’

Should you be surprised? William Strauss and Neil Howe saw this coming 25 years ago. I fear the people promoting the current conditions read that book as well. My bottom line on the Fed is the following: there is nothing they will be able to do to stop this inflationary surge. If the economy (which was relatively good in 2018) could not absorb interest rate hikes, how are they going to be able to absorb a projection of seven hikes (three in 2022 and 2023, one in 2024) into 2024? I believe in trading the chart as I see it. That being said, under the current environment, its hard for me to get bullish here. If you want to prosper in 2022, it will be important for many of you to upgrade your skillset when it comes to being short in the market.

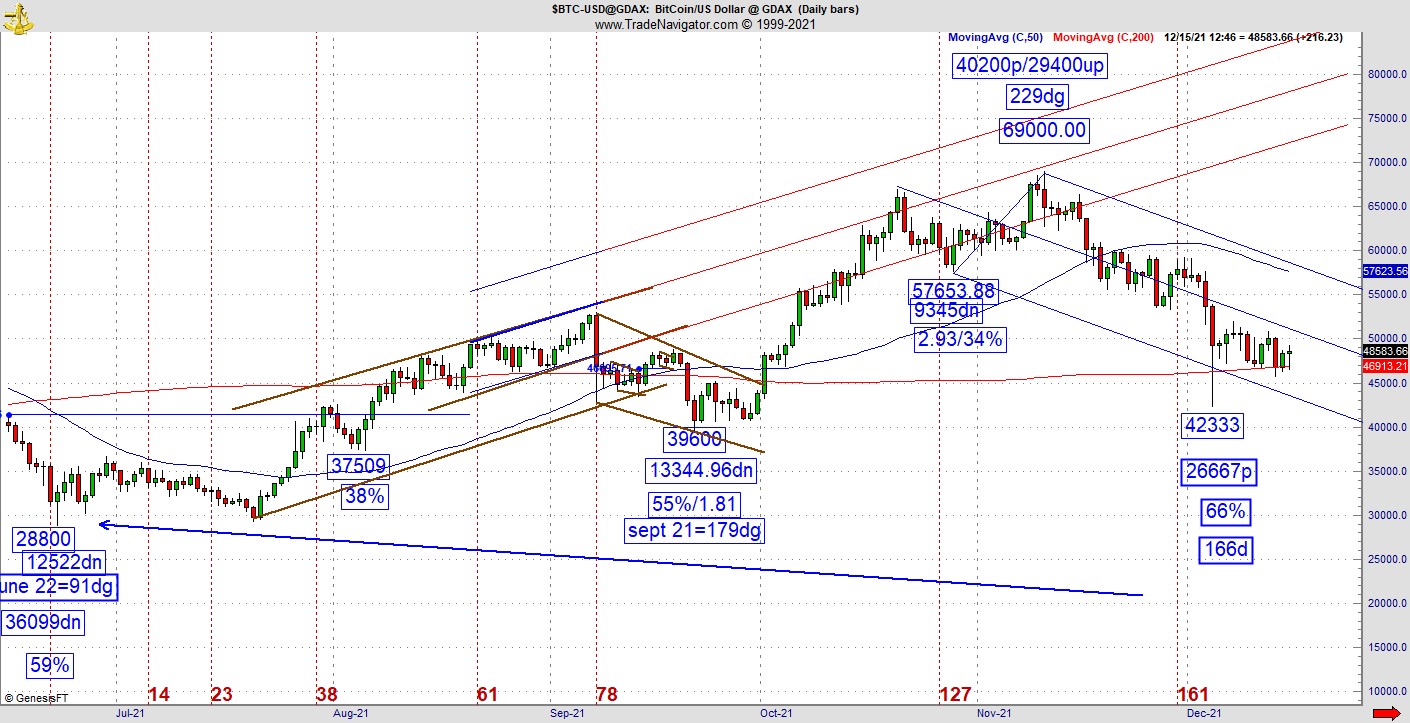

Recently I warned the Ten Year was in a heads I win, tails you lose scenario, given that lower prices means a higher cost of capital and higher prices show a potential for the next recession. There is a decent setup at the recent high. I can’t yet rule out the December third high being the beginning of a new higher rate environment. The best thing this chart can do is go sideways for an extended period of time. One of the other key charts right now is Bitcoin (BTC).

On this chart we have a good news, bad news scenario. The good news, as you can see, is it holding the bottom of the Andrews channel at the 200-day moving average. More good news is the vibrational situation where this low is 166 days from the June low, also a 66% retracement while it's 26667 points off the high. The current support level is a critical hold. Some insiders believe this initial round of selling might be related to the initial stages of the Evergrande situation. Whatever the case, the bad news here is with all these excellent vibrational square out readings at this low, the pattern has failed to gain traction. In a bullish situation, this pattern should start a move back up that will retest the top.

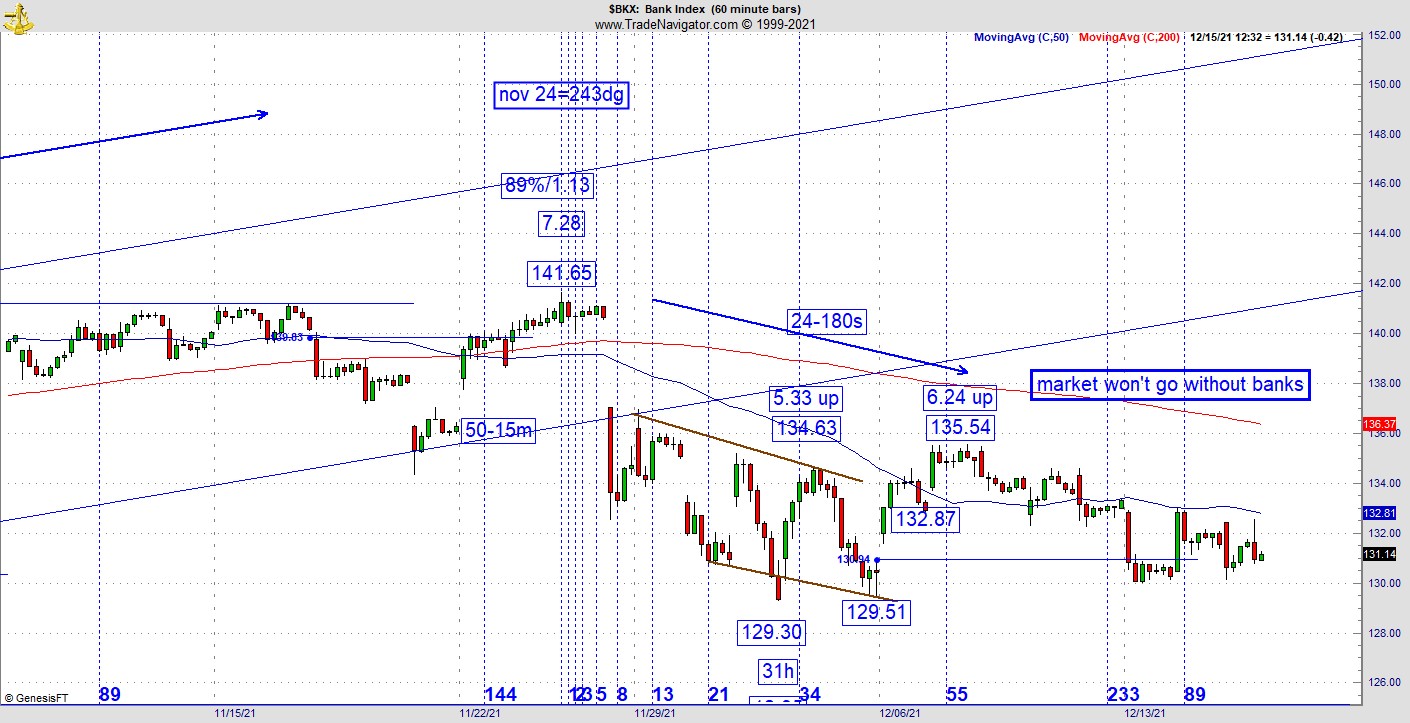

Finally, the discussion this month has been whether a new leg up has manifested. All I can tell you is that the KBW Nasdaq Bank Index (BKX) is completely sideways. It will be very hard for the market to get a sustained move up without the BKX. I wish all of you a great holiday season and happy new year. This is my final column for a while as I will be taking a break until January.

For more information about Jeff Greenblatt, visit Lucaswaveinternational.com.