Hopefully SARS-CoV-2 will finally be brought under control in 2022 and market watchers can return to familiar concerns such as a possible war in Ukraine, a currency crisis in Turkey, and impending interest rate hikes, states Ian Murphy of MurphyTrading.com.

The latter will occupy minds in the first quarter as money managers tweak portfolios in response to a new rate regime. A rotation out of tech is well underway as investors cozy up to value plays in defensive stocks and industrial firms.

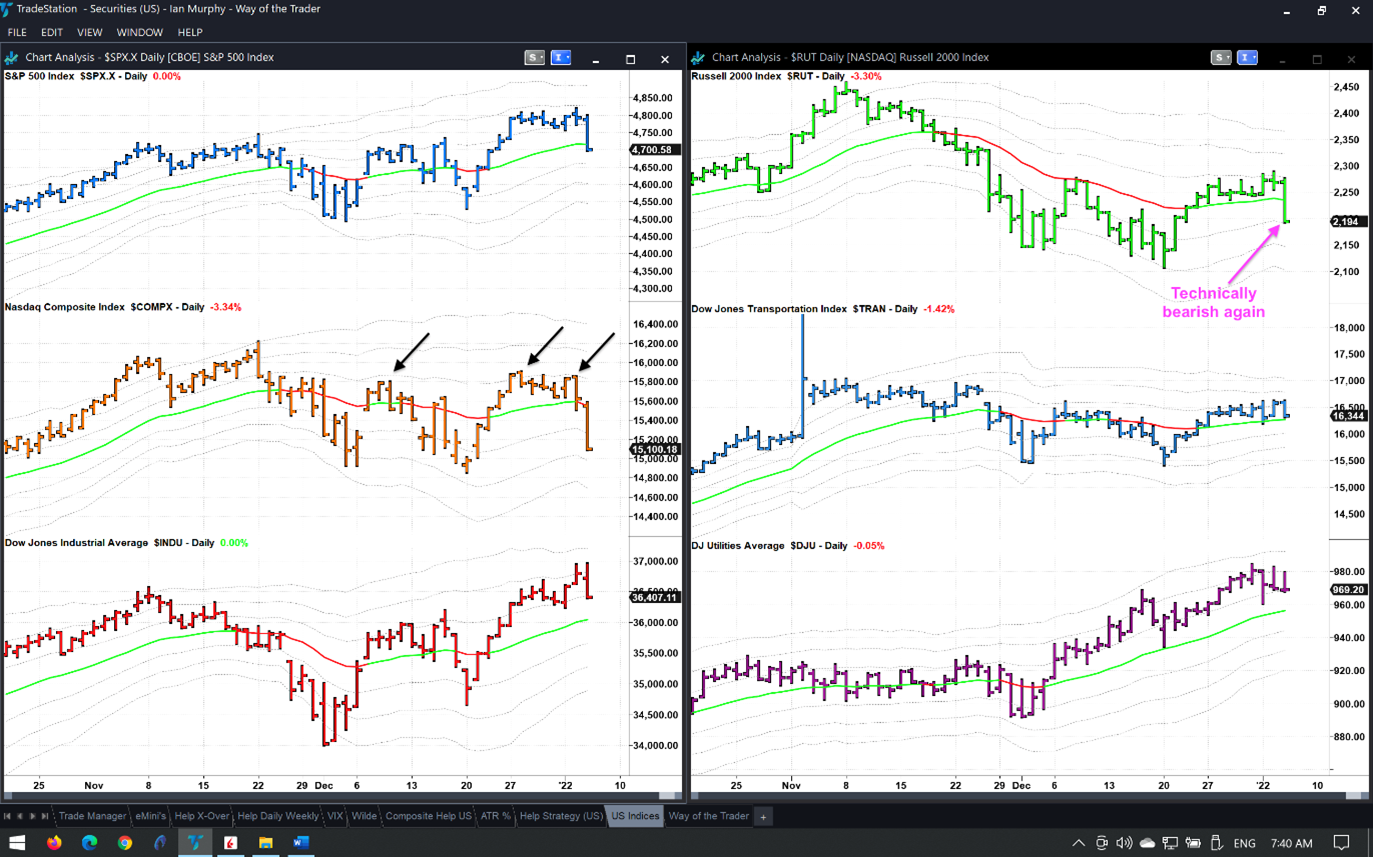

Note how the tech-heavy Nasdaq index failed to close above its 1ATR line (black arrows) on three occasions, yet the Dow Jones Industrial Average below it did break through. Also look at the DJ Utilities Average, these defensive stocks have been bullish for over a month. Mid-cap stocks in the Russell 2000 have not fared as well and the index is technically bearish again when it closed on the -1ATR line in the selloff.

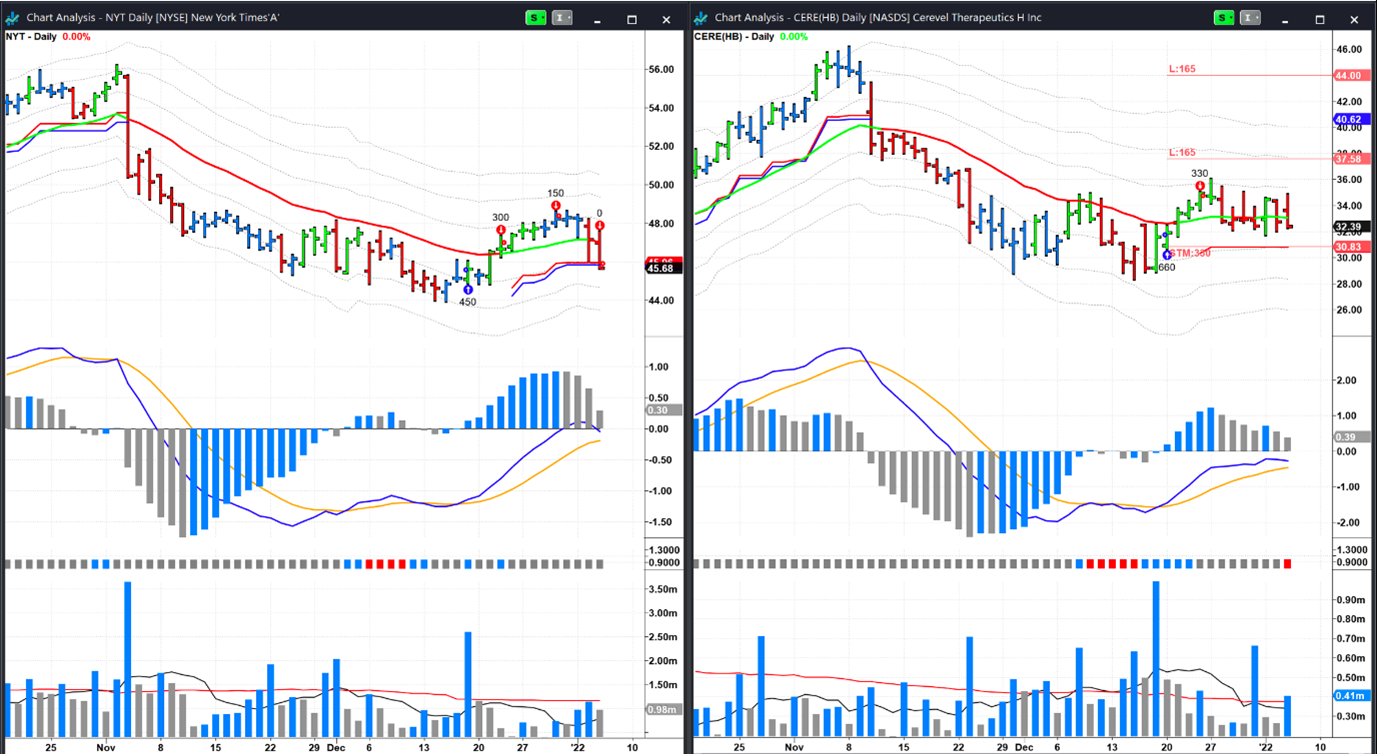

The New York Times (NYT) was mentioned in the mid-month review on December 17, and it set up again for a valid trigger on the FBD strategy that afternoon. I bought 450 shares at $45.60, sold 150 at $47 after a 1ATR move to the upside, sold another 150 at $48.39, and was recently stopped out on the final 150 at $45.92 for a gain of $676.50 or 3.3% on the original position.

Cerevel Therapeutics (CERE) triggered on the FBD strategy also and ⅓ of the position has been scaled out so far. The protective stop and second target are shown above, earnings are in the first week of February.

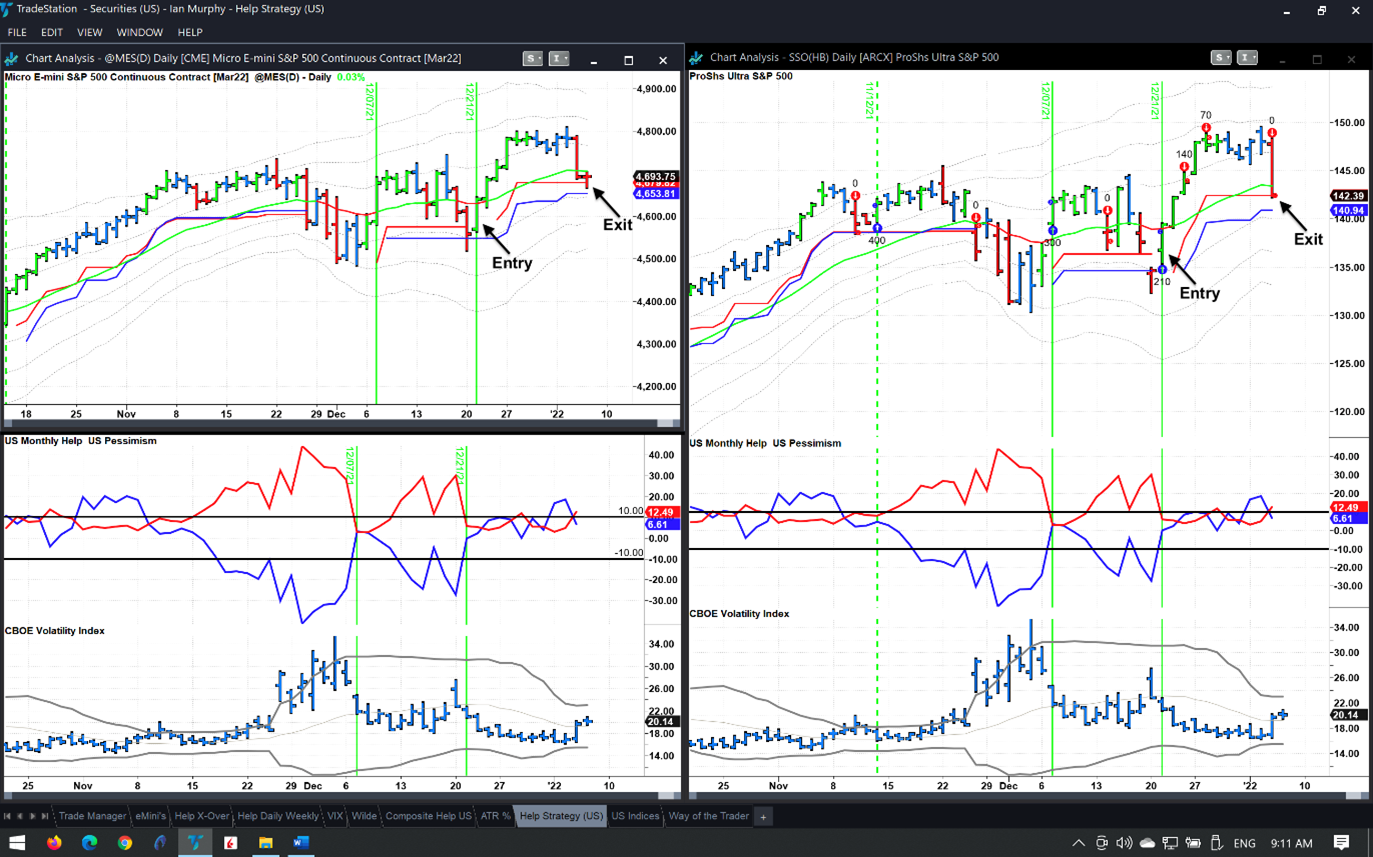

The third position was in the ProShares 2x ETF (SSO) using the Help Strategy, and it was also stopped out having banked a few bucks along the way, entries and exits are shown above. A similar position in Micro E-Mini futures was stopped out overnight.

The year ahead will be challenging for traders and in order to succeed, we will need a strategy which can adapt to changing market conditions while remaining profitable. On this day next week there will be a free presentation on the MoneyShow® Virtual Expo where I will share what I believe to be the perfect strategy for monetizing market moves in the year ahead. This reliable and consistent strategy is not complicated, and recent trades will be demonstrated on charts.

Book your free place now as these presentations are very popular and attendance is limited.

Learn more about Ian Murphy at MurphyTrading.com.