Despite the strong two-day rally to finish the month, January was the worst start to the year for the Nasdaq Composite (IXIC) (down 19% peak to trough) since 2008, states Jesse Felder of thefelderreport.com.

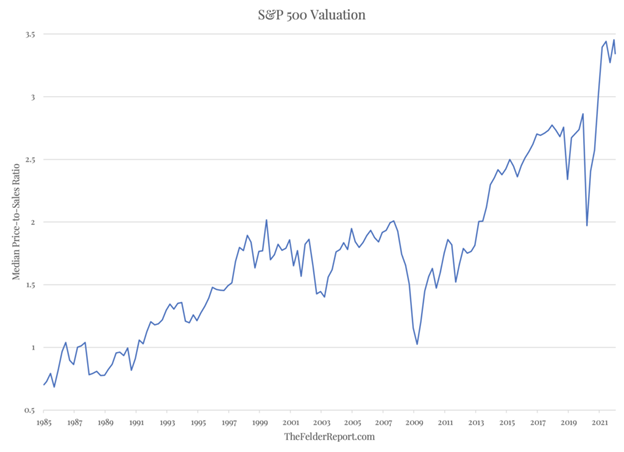

And if not for that two-day rally, it would have been the worst start for the Nasdaq ever—and ever, as they say, is a very long time. As a result, you might have thought that the decline would have made some progress in normalizing valuations, but you would have been wrong. The median stock in the S&P 500 Index (SPX) is still roughly 20% more expensive than it was pre-pandemic and 70% more expensive than at the peak of the dotcom mania in 2000.

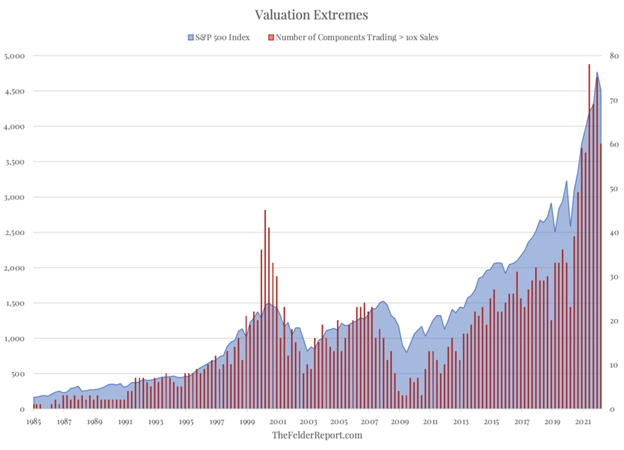

Moreover, there are still 60 stocks in the S&P 500 Index (SPX) that trade at more than 10-times sales. During the depths of the dotcom bust (almost exactly twenty years ago) after witnessing his own stock price plunge by more than 90%, Sun Microsystem’s Scott McNealy famously suggested this degree of overvaluation was “ridiculous.” By then, the number of stocks trading above this hurdle had fallen from a peak of almost 50 to about a dozen. So, if we are now seeing another bust in the most speculative segments of the stock market, it would appear it still has quite a ways to go.

Learn more about Jesse Felder at TheFelderReport.com.