Russia blinked in the Ukraine standoff and the market rallied, states Ian Murphy of MurphyTrading.com.

The required signals for a trigger on the help strategy were not present in yesterday’s session.

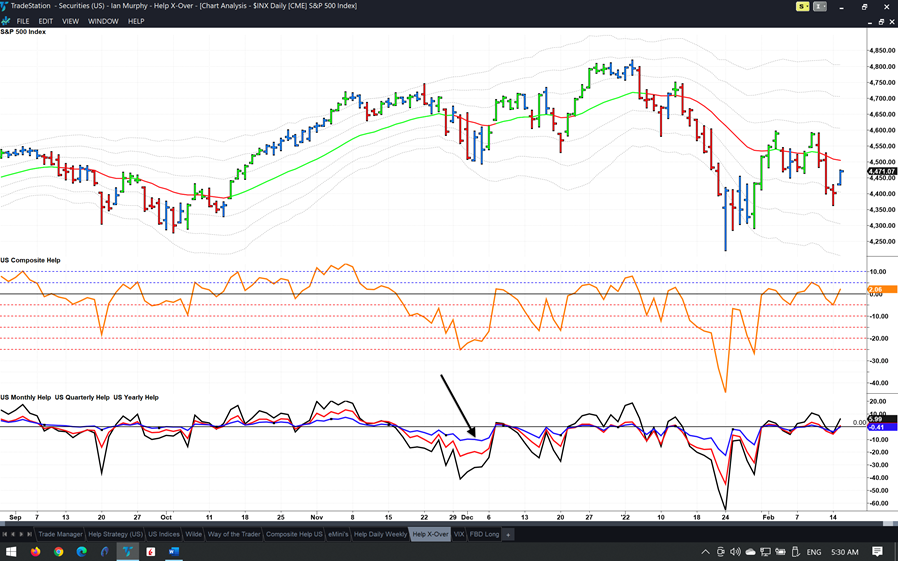

Price was fine, and so was the COBE SPX Volitility Index (VIX), but the help indicator did not climb out of the channel and return (circled). Pessimism (red line) briefly exceeded 10% but could only reach 10.2%, so the washout and reversal were very weak at best.

Minutes from the last meeting of the Federal Reserve’s monetary-policy committee will be out at 14:00 ET today. An interest rate increase next month is taken as given but traders will scan the text looking for an indication if the hike will be a standard 0.25% or a more aggressive 0.5%. This coupled with developments in eastern Europe will likely drive market sentiment today.

The blue line highlighted above is the number of US stocks making a new yearly high less the number making a new yearly low, with the result expressed as a percentage. Looking to the left of the chart we notice this ‘thin blue line’ must climb above zero and stay there for the market to remain bullish. Despite the recent rally, the line is stubbornly negative.

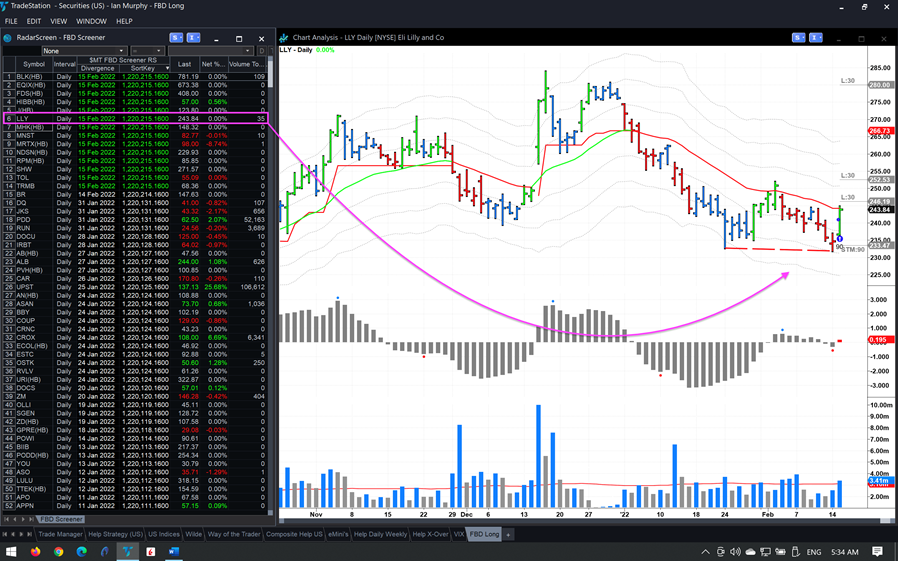

Apart from a few small daily swing trades, my personal account has been sitting in cash during the current selloff. For example, yesterday offered an entry on Eli Lilly (LLY) using the FBD strategy as price made a lower stab down and the corresponding MACD-H did not. 90 shares were purchased, and the initial stop and targets are shown above. Blackrock (BLK) and FactSet (FDS) also displayed the required signals but were not as attractive as LLY, I will watch those two in today’s session.

Learn More about Ian Murphy at MurphyTrading.com.