Covered call writing trades, when structured and managed properly, can result in impressive short-term and annualized returns, states Allan Ellman of The Blue Collar Investor.

Such was the case with Art, who shared with me a series of trades he executed with Revolve Grooup Inc. (RVLV) in August–September 2021. The returns were outstanding and enhanced via exit strategy execution. This article will analyze the final returns after closing both legs of the trade.

Art’s trades with RVLV

- 8/24/2021: Buy 500 x RVLV at $57.06

- 8/24/2021: STO 5 x 9/10/2021 $58.00 calls at 2.16

- 8/27/2021: Buy 200 x RVLV at $57.02

- 8/27/2021: STO 2 x 9/10/2021 $58.00 calls at $1.45

- Average cost/share = $57.05

- 9/10/2021: RVLV trading at $62.08

- 9/10/2021: BTC 7 x RVLV 9/10/2021 $58.00 calls at $4.20

- 9/10/2021: STO 7 $9/17/2021 $63.00 calls at $1.74

Art questioned what the final trade results would calculate to, should the seven contracts be exercised at the $63.00 strike.

What was the impact of rolling out-and-up to the 9/17/2021 strike?

RVLV: Rolling Out-And-Up Calculations

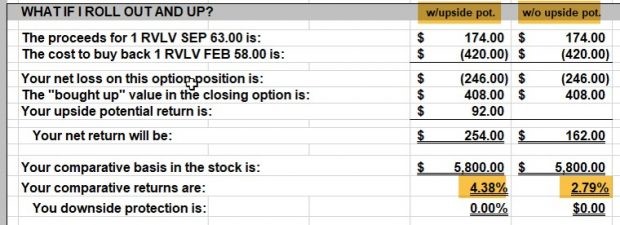

Using the “What Now” tab of the BCI Calculators, we see a positive initial return, when factoring in “bought-up” value of the shares, of 2.79% for the week and 4.38% if shares price moves up the new $63.00 strike, an assumption Art asked me to make.

Final trade calculations if RVLV is sold at the new $63.00 strike

- Stock side: [($63.00 – $57.05) x 700] = $4165.00

- Option side: [($1080.00) + ($290.00) – ($2940.00) + $1218.00)] = -$352.00

- Total net profit: [($4165.00) – ($352.00)] = $3813.00

- 24-day % return: $3813.00/$39,935.00 = 9.5%

- Annualized % return: [(9.5%/24) x 365] = 145%

Discussion:

Art hit a grand slam homerun with this one. An elite-performing security was selected and OTM (bullish) strikes were sold allowing for additional share appreciation income. Rolling-out-and-up resulted in a favorable (to say the least) profit enhancement trade execution. It looks like Art doesn’t need me anymore.

Learn more about Alan Ellman on the Blue Collar Investor Website.