Across the globe firms are scrambling to quantify their exposure to Russian assets as sweeping sanctions start to bite, states Ian Murphy of MurphyTrading.com.

On the ground, the expected military conquest of Ukraine is not going to plan, and images of Russia’s president seated at the opposite end of a very long table from his advisors has some respected Kremlin watchers seriously questioning Mr. Putin’s mental health.

Apparently prolonged isolation during Covid lockdowns while interacting only with a handful of trusted yes-men may have changed his perspective on things. Admittedly, there may be an element of ‘Russia-phobia’ and propaganda in those opinions but if only some of the story is true, it’s a troubling thought.

Against this backdrop and the related activities in cyberspace, European investors faced ‘a technical issue on exchange side’ today which led Euronext to cancel all open equity orders on their exchanges. These orders need to be resubmitted, but all exchanges are operating and trading normally.

Not surprisingly, markets have endured a few volatile sessions, but price fluctuations are not as bad as might have been expected. Many participants are of the opinion that the sharp increase in oil prices and Russian sanctions will diminish the case for an interest rate increase at the Fed meeting later this month. The press conference is at 2:00 pm ET on March 16—one for the diary!

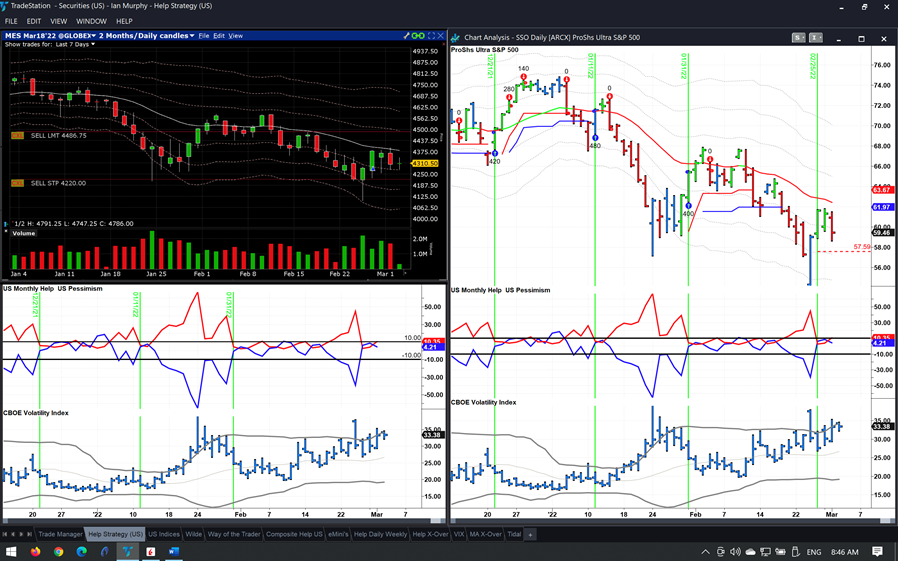

Click chart to enlarge

The Help strategy position in Micro E-Minis is still open and the number of stocks making new 20-day lows in yesterday’s negative reversal was surprisingly…well, low. Stops and targets for SSO and Micros are shown above.

Tonight is the first session of the new stock investing course which I’m presenting for the IIFT, an Irish based financial education firm. I plan to record the sessions and add them to the website.

Learn more about Ian Murphy at MurphyTrading.com.