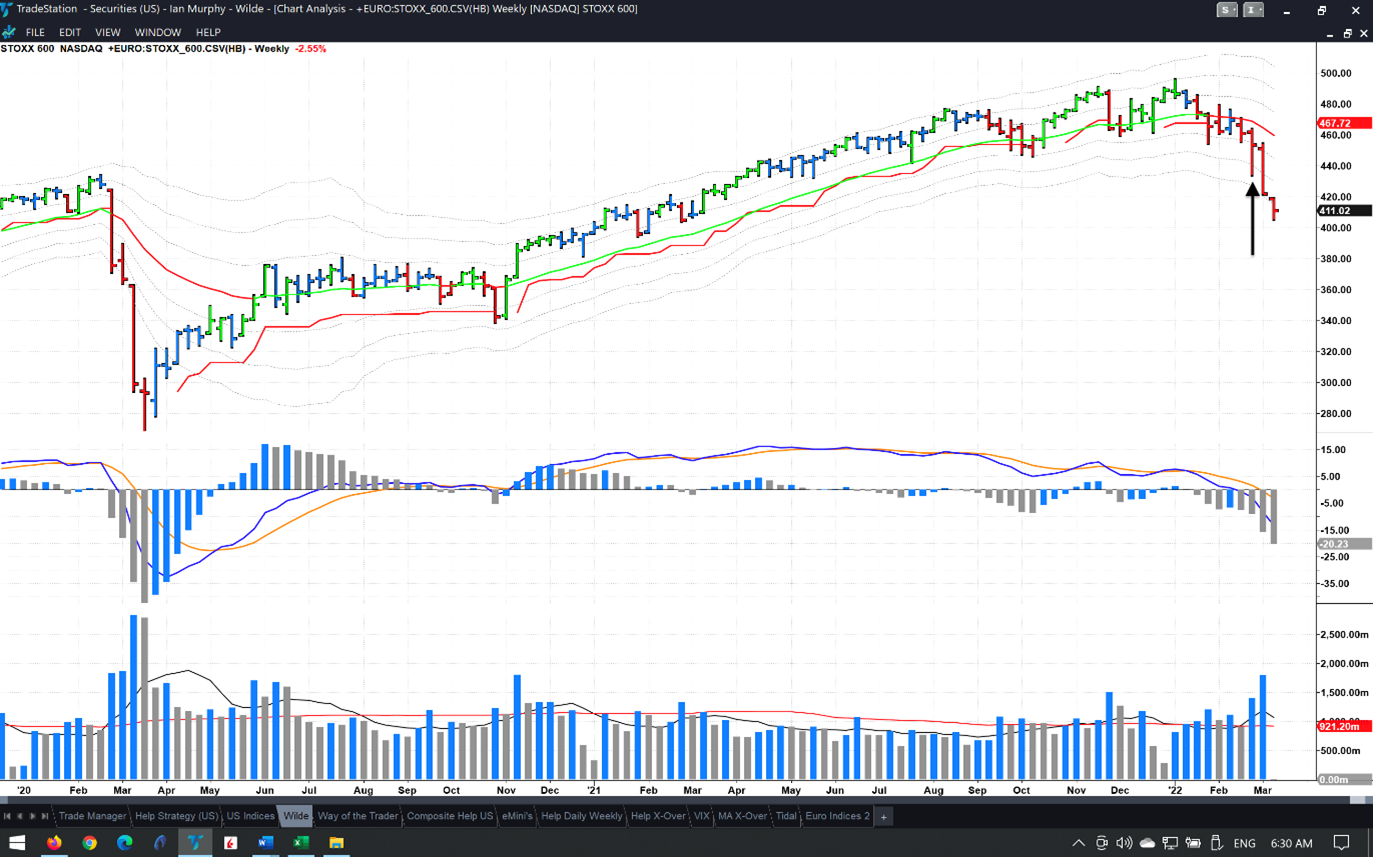

At midday Central European Time (CET) the STOXX 600 (STOXX) was down 2.5% from Friday’s close, states Ian Murphy of MurphyTrading.com.

Consisting of the largest 600 firms by market cap in western Europe and considered to be ‘Europe’s S&P500’, this equity index is now trading below the -3ATR channel on a weekly chart.

Click charts to enlarge

ETFs which track the index, such as the Lyxor Core STOXX Europe 600 (MEUD), are popular among European investors and those taking an active approach to managing positions will have (or should have) sold out when the index closed below the -1ATR line on the week ending February 25 (black arrow). Passive investors with a longer time horizon in mind and employing a buy-and-hold approach to the index need to sit tight and ride out the storm.

Good European stocks are about to go on sale and profitable firms will be picked up at a steep discount, but we are not there yet.

Click charts to enlarge

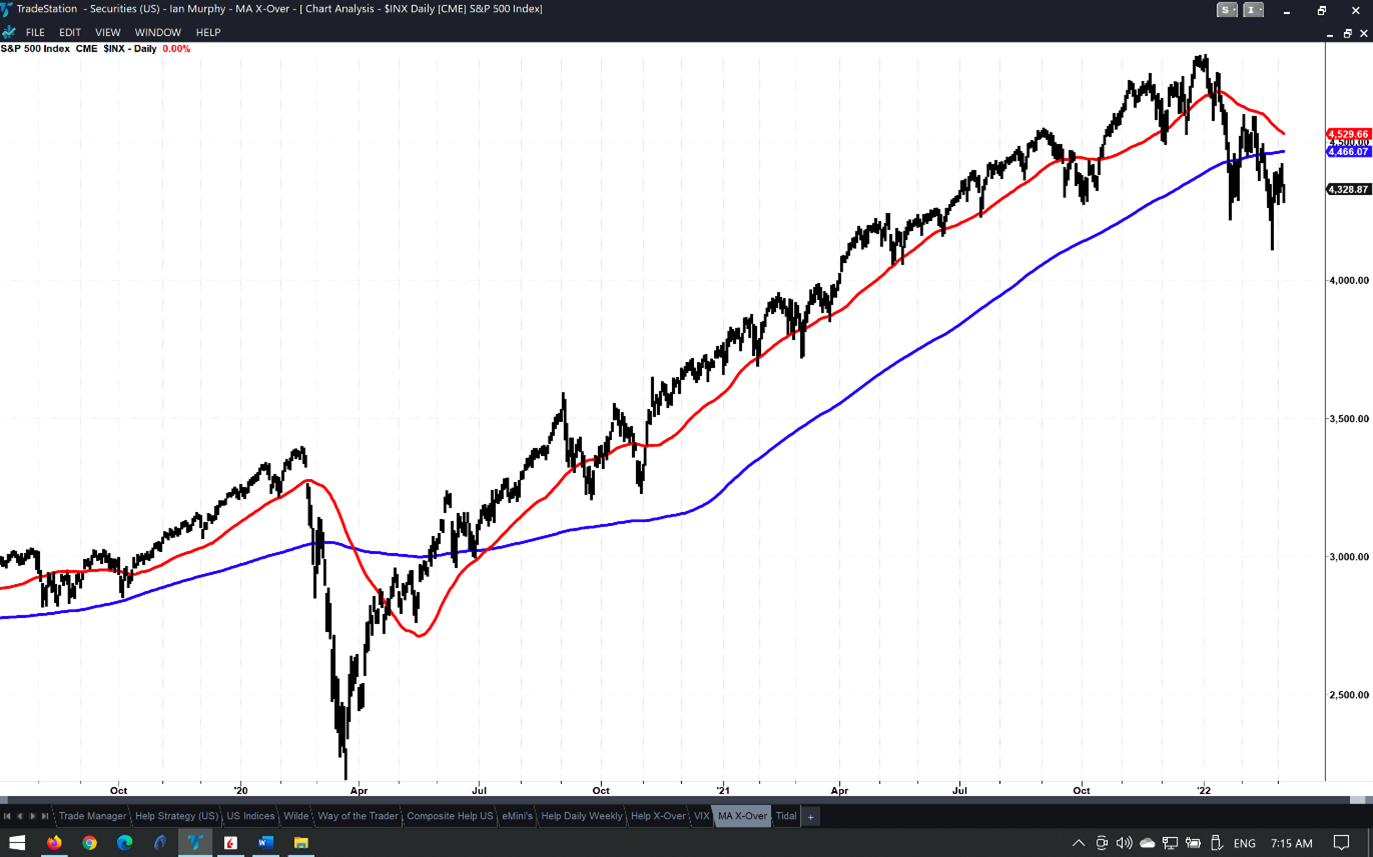

In the US the selloff has not been as steep but the direction of travel is the same. Among retail and passive investors, a crossover of the 50-day and 200-day moving average lines is a common reference point, which requires little knowledge of technical analysis. The S&P 500 (SPX) closed below the 200-day (blue line) on January 21 and after a brief rally is trading back below it. A so-called ‘Death Cross’, will occur when the 50-day (red line) crosses down over the slower moving 200-day, and this may be on the cards in the week ahead.

If a crossover does occur, we can expect the event to be diligently reported and a rush for the exit by retail investors could follow.

Learn more about Ian Murphy at MurphyTrading.com.