The rise in Treasury yields has accelerated, and the Fed is using essentially every opportunity to tell the public that interest rates are going to rise even more in the coming months, explains Jim Woods, editor of Bullseye Stock Trader.

So, as we all embark on this potentially steep rise in rates, I wanted to take a minute to see what effect rising rates have had on the “real economy,” because one of the biggest risks to the market right now is an economic slowdown—and understanding when rates reach a level where that might occur is very important.

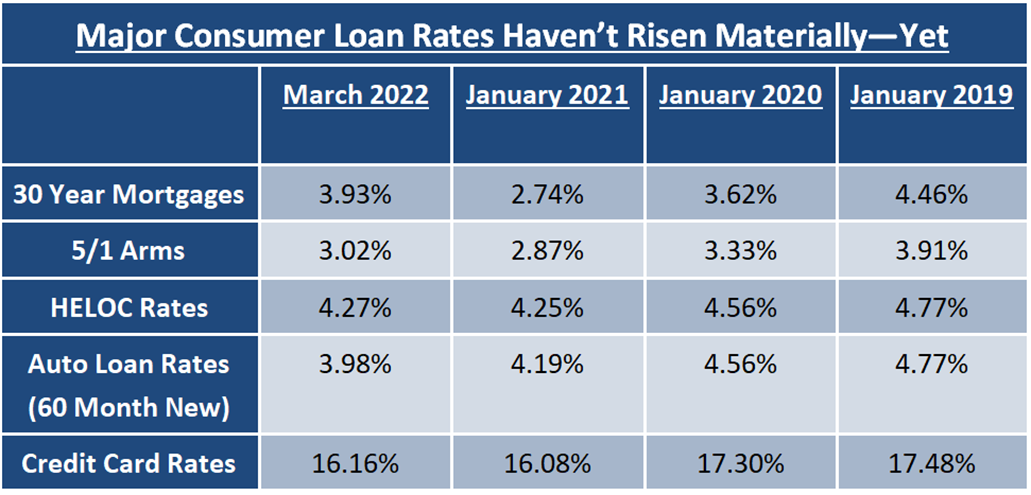

To see what effect rising interest rates have on the economy, we looked at rates of several important consumer loans: 30-year mortgages, 5/1 adjustable-rate mortgages (ARMs), 60-month auto loans, HELOCs (home equity lines of credit), and credit card debt.

And the conclusion for all these loans was clear: Rates aren’t yet at levels that we think will restrict growth (and in some cases they are still far from levels that would restrict growth).

With the exception of the 30-year mortgage (which arguably is the most important of these consumer loans), none of the other major consumer loans are meaningfully above levels seen in January 2021, when economic growth and inflation were both more subdued.

5/1 ARMs, HELOC rates, car loans, and credit card rates are all essentially at the same place they were in January 2021, and in all these cases they are below levels in January 2020 (pre-pandemic), a time when consumer balance sheets weren’t as strong as they are right now.

Now, mortgage rates have risen, and they are above pre-pandemic levels. But they are still well below the January 2019 levels, and that’s notable because early to mid-2019 was the last time we saw a meaningful loss of economic momentum, which prompted the Fed to halt balance sheet reduction and rate hikes in mid-2019.

The bottom line here is while Treasury yields have risen, causing mortgage rates to accelerate, the majority of other important consumer loan rates have not risen substantially.

So, what does this mean for financial markets?

We and others have said consistently that Fed rate hikes eventually choke off economic growth, but how many hikes and how long it takes is a function of (1) how low rates are at the start, and (2) how strong growth is when rates begin to rise.

Right now, rate “lift off” is starting very low and economic growth remains very strong, and this analysis of consumer loans reinforces this point: It’s going to take a while for the Fed to choke off the economic recovery, even if they raise rates 50 basis points at the next Federal Open Market Committee (FOMC) meeting in May.

Bottom line, interest rates are rising, and they will continue to become a stronger and stronger headwind on the economy and the markets. However, they aren’t near levels yet that would imply economic growth is stalling. That’s why, despite many risks facing markets, we’re sticking with equity allocations—because we could still have a year (or more) of economic expansion left (although that might be too optimistic, but we’ll be watching and, of course, let you know if something changes).

For now, the risk of stagflation (meaning high inflation and stagnant economic growth) remains a future problem, not an imminent one.