Stocks rallied briskly into the close Friday, a complete reversal from previous weeks when traders bailed out of equity positions ahead of the weekend, suggests Jon Markman, growth and technology stock expert and editor of Strategic Advantage.

The benchmark S&P 500 (SPX) finished at 4,543, a gain of 0.5%. For the week, the index added 1.8% and it is now within striking distance of the next overhead resistance level at 4,590, the February high.

Bears are in trouble. Stocks are climbing the wall of worry that includes the Ukraine war, inflation running at 40-year highs, soaring short-term interest rates and the stubborn pandemic. The strength is reminiscent of 2021 when shares ratcheted higher despite the blazing pandemic and all of the economic fallout that brought. In the short term, pullbacks are buying opportunities.

There is critical support for the S&P 500 at 4,410 and I would buy any decline to that level.

THE UPSHOT

The Nasdaq (IXIC) declined by 0.2% to 14,169.30 on Friday for the day but rose a big 2% for the week. The Dow (DIJ) rose by 0.4% to 34,861.24, translating into a weekly gain of 0.3%.

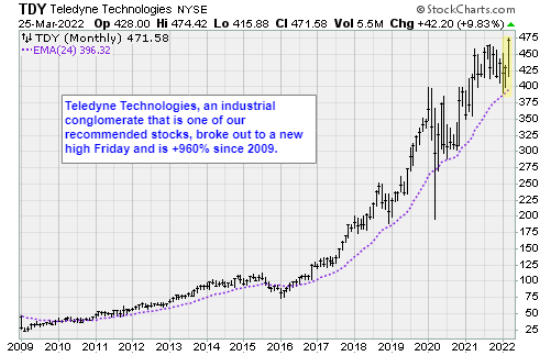

Breadth slightly favored decliners 4-3, and there were 413 new lows vs. 333 new highs. Big caps on the new high list included Berkshire Hathaway (BRK-B), UnitedHealth (UNH), AbbVie (ABBV), Union Pacific (UNP), Bristol-Myers Squibb (BMY), and our Teledyne Technologies (TDY).

Technology and consumer discretionary were the only decliners on Friday, while energy was the biggest gainer.

The US 10-year yield soared by 15.1 basis points to 2.49%. West Texas Intermediate crude futures advanced $0.44 to $112.78 a barrel, while gold fell by $7.30 to $1,960.40 per ounce.

Federal Reserve policymakers have recently doubled down on the message that policy tightening will be "front-loaded," according to a Morgan Stanley research note. Economists at the investment bank expect the Federal Reserve to lift the target rate by half a percentage point in both May and June, with quarter-point rate hikes penciled in at each meeting for the balance of the year.

Gasoline prices were among the main factors in the most recent surge in the monthly inflation print to a four-decade high. The average cost of gasoline has risen 48% from a year ago to $4.24 a gallon. In other economic news, pending US home sales unexpectedly fell in February, extending the losing streak to four months amid tight inventory and elevated borrowing costs. The pending home sales index fell 4.1%, the National Association of Realtors reported Friday. The Econoday consensus was for an increase of 0.9%.

The University of Michigan consumer sentiment index for March was revised lower to 59.4 from the preliminary estimate of 59.7 and was down from February's reading of 62.8. The current conditions index and expectations reading were revised lower, with inflation a key concern among consumers.

The US and the European Union will seek increased supplies of liquefied natural gas to Europe by the end of this year as part of efforts to replace some Russian gas, Bloomberg reported.