The market has turned away from technology and growth darlings, while value stocks have, on a relative basis, become more prized by investors, says Jim Woods, editor of The Deep Woods.

So-called “boring” companies often offer consistent, stable returns, and tend to hold their value more strongly in downturns. However, they are unlikely to offer massive returns over a short time the way some of the tech stocks do.

Still, there is something to be said for sound fundamentals. The consumer staples industry tends more towards “boring” stocks and business models. These stalwart companies, however, provide services that consumers need and will just about always demand, at least in the intermediate term. They are called “staples” for a reason. Represented industries include food and other staples such as retail, beverages, tobacco, and household products.

Perhaps the most “boring” way to invest in these stocks is through Consumer Staples Select Sector SPDR Fund (XLP). The Select Sector funds are well-known in the exchange-traded fund (ETF) space for providing exposure to some of the biggest companies in a sector, and this one is no different. As investing in equities goes, ETFs generally provide a measure of safety and reduce volatility compared to investing in single stocks.

In recent periods—one month, three months, six months, year to date, or one year—XLP has outperformed the S&P 500 (SPX) by two to seven percentage points, and that’s not including its 2.5% yield. This is representative of the investing trend in favor of this industry. Plus, a 0.10% expense ratio of this fund is quite low. The fund’s assets under management recently totaled $15.18 billion.

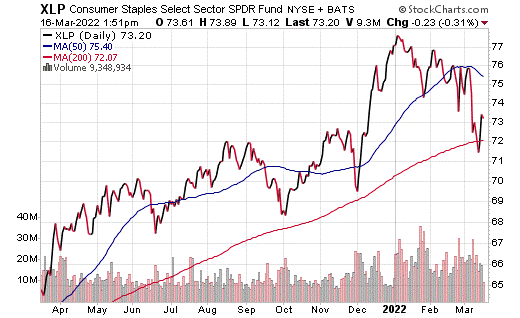

Chart courtesy of www.StockCharts.com

XLP’s holdings tend to be large-cap household names. Some of the most heavily weighted companies represented are Procter & Gamble Co. (PG), 15.8%; Costco Wholesale Corp. (COST), 10.6%; Coca-Cola Co. (KO), 10.14%; PepsiCo, Inc. (PEP), 9.62%; and Altria Group, Inc. (MO), 4.91%. There are 32 holdings in total.

For investors looking for a careful, more stable way to remain invested in equities during this turbulent time, Consumer Staples Select Sector SPDR Fund offers just such an ETF.

Learn more about Jim Woods here…