I remain cautiously bullish on stocks at the moment, based on the fact that nothing has really changed in the last couple of weeks, especially when it comes to the technical aspects of the market, states Joe Duarte, editor of In the Money Options.

I am also well aware of the fact that I may be wrong with the most likely cause of the market souring being a liquidity crisis resulting from a major financial institution such as a hedge fund, a clearing house, a major commodities trader, or a government defaulting on a margin call or a debt payment.

Certainly, any of these things are plausible. And we’ve had some margin call reports, but nothing major has come of any of them.

So, since the usual stuff that crashes markets hasn’t happened, has not been reported, or hasn’t been big enough to crash the system, it seems logical to consider that we may be in transitional period in which the reality of the moment and the historical tendencies of the market are incongruent.

The Real World is Morphing

But here is where things get interesting. During similar periods in the past, the world was a different place.

For example, the combination of the pandemic and the war in Ukraine have some historical precedence, as wars often follow pandemics due to the economic disruptions which result from such cataclysms. The Black Death and the 100 Year War offer a historical parallel.

On the other hand, we’ve never had a pandemic where technology, communications, and financial conditions have been where they are now, simultaneously. Specifically, we’ve never had cryptocurrencies, social media, and algos before. We’ve also never had this many people who day trade, mine crypto, play video games, or who use credit to pay their bills.

So yeah. This is a different world and equally different financial landscape. As a result, expecting similar outcomes to past events is plausible, but not guaranteed.

What I’m saying is that the Fed’s tightening maneuvers may not have the expected effects because of the way money behaves in the present day. That doesn’t mean that they won’t have negative effects. And it does not exclude the fact that if the Fed pushes interest rates high enough, the system can’t and won’t crack.

It just means that at this point, we really don’t know what’s going to happen because the system has emerged to a new level and is now in a new phase of evolution. To what it’s evolving is up for discussion.

Nevertheless, this is a different world. So, until proven otherwise, neither the economy or the stock market may act in the same ways they have acted in the past in the wake of pandemics, inflation, wars, and the Fed raising rates.

Systems Emerge and Evolve

Here is the one thing that we do know for sure. When a complex system reaches the point at which it will move to a different level—the point of emergence—there is a mass effect that drives the entire system to that new level.

Simply stated, when the system emerges, the majority of agents in that system follow that path in order to reach the new level. And what many are still unaware of, but that is slowly emerging as the emergence catalyst, as well as the vehicle for emergence and evolution, is the stock market.

It seems as if the MELA system is replacing the old economic system, perhaps permanently. And what that means is that the stock market (M) is slowly becoming the engine that drives the economy (E) as it affects people’s life and financial decisions (L). Furthermore the process is accelerated because of the algorithms (A) in the communications systems—social media, the 24 hour news cycle—and the stock market.

So, while it remains plausible that the Fed raising rates can crash the markets as it has in the past, it is equally plausible that the MELA system is exerting its influence on the real world and that this time things may be—dare I say it—different.

The alternative, and equally plausible considerations, are that the Fed hasn’t tightened enough yet in order to cause a systemic crash or that the war in Ukraine will have unexpectedly extraordinary unintended consequences.

NYAD Retains Tight Trading Pattern. SPX Testing Key Support.

The New York Stock Exchange Advance Decline line (NYAD) remained in a tight trading pattern but rose above the former resistance of its 50-day moving average. If this remains in place, the odds favor a continuation of the rally.

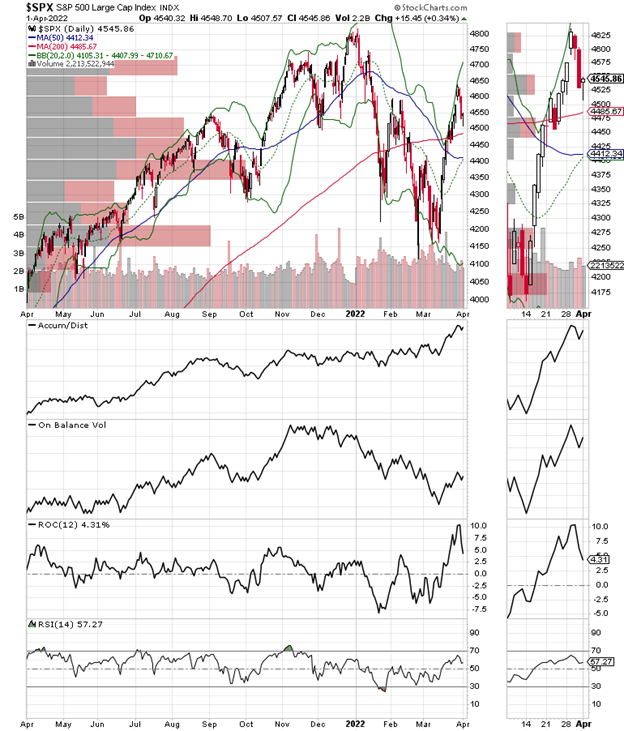

Meanwhile the S&P 500 (SPX) failed to hold above the key resistance area of 4600. On the other hand, it also remained above its 200-day moving average and the 4500 area. These are both positive developments for now.

Accumulation Distribution (ADI) and On Balance Volume (OBV) remain constructive suggesting that money is slowly moving back into the market.

Still, if the rally is to blossom, we need to see the following:

- The S & P 500 needs to hold above its 200-day moving average and rally from there

- Further improvement in OBV and

- A decisive move above 4600

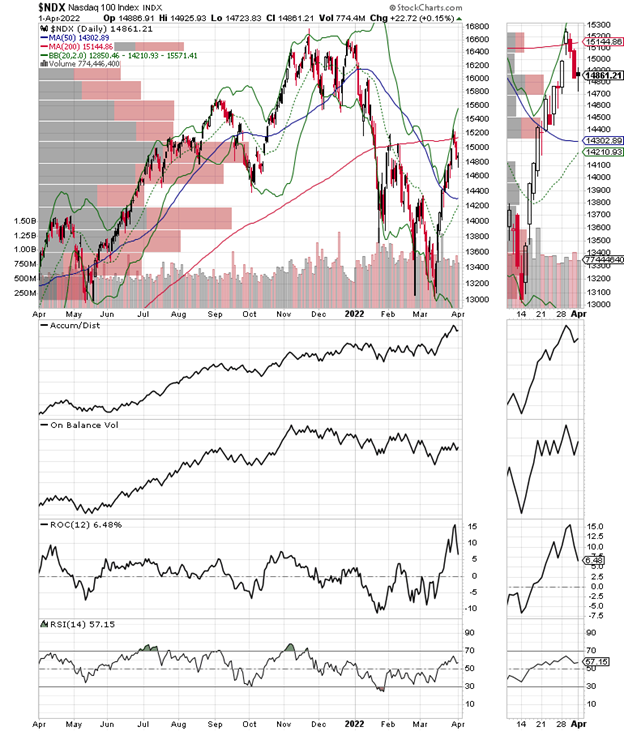

The Nasdaq 100 index (NDX) is still lagging the S & P 500 failing on its first attempt to regain a bullish long term trend. In order to have a bullish confirmation we need to see a move by NDX above its 200-day moving average.

- A continuation of the bullish action in ADI and OBV for NDX

- A decisive move above 15250

VIX Halts Decline as Bears Try to Regroup

As I noted last week, for the past few weeks we’ve seen the CBOE Volatility Index (VIX) fall significantly. It’s no accident that the stock market has recovered during that time.

That said, last week’s action suggested that the bears are trying to mount another attempt at moving stocks lower. This was evident in the failure of NDX to regain its 200-day moving average.

However with the VIX trading near its recent bottom below 20, the best the bulls can hope for here is a move sideways with the index remaining just above or just above 20. VIX has support around 15.

Remember that a rise in VIX signals that put option volume (bets that the market is going to fall) are on the rise. What follows when put volume rises is that market makers sell puts and simultaneously hedge their bets by selling stocks and stock index futures. This causes the market to fall.

So, if VIX continues to fall and NYAD continues to rise, we could see higher stock prices in the short term.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.