We had a powerful bounce from the March lows and once again, as is always the case in the markets, we have reached a crossroads, exclaims Ian Murphy of MurphyTrading.com.

This may be a pause for breath before the market resumes its bullish climb, or this could be the last hurrah before the bear market resumes. We know it’s a possible turning point, we just don’t know which way the market will turn.

From a fundamental perspective, the headwinds are growing stronger by the day—global inflation is rampant, interest rate hikes are back in vogue, the war in Ukraine is settling in for a ghastly grind, while developing nations are facing unrest, impending food shortages, and currency crises.

None of which is conducive for gains in equity prices.

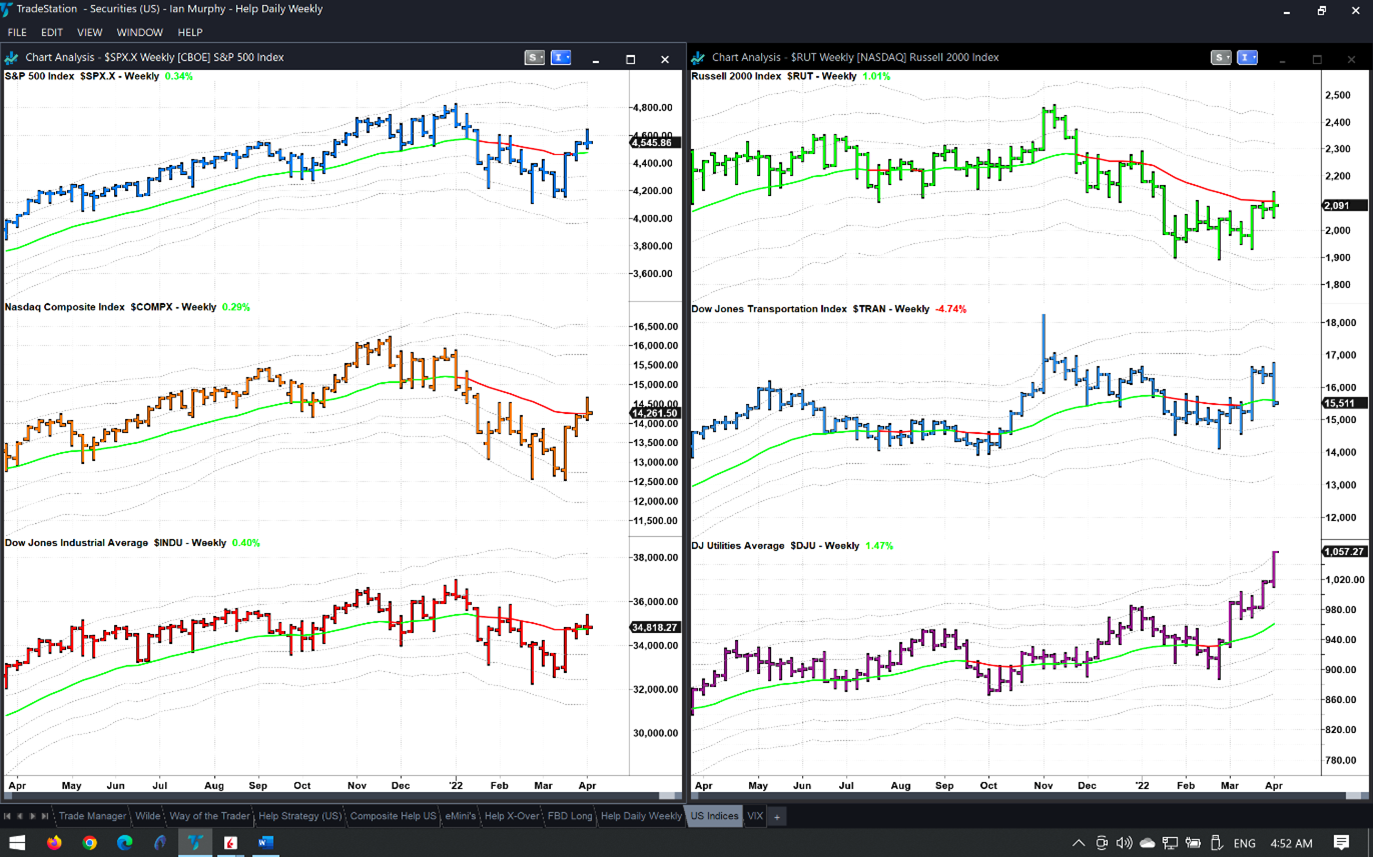

Click chart to enlarge

From a technical point of view, things are less pessimistic.

The S&P500 (SPX), Nasdaq (NDX), and Dow (DJI) are all sitting on or just above a 21-period exponential moving average on weekly charts (left), which means they are neutral—neither bullish nor bearish. Defensive utility stocks are powering ahead as demonstrated by the Dow Jones Utilities Average (bottom right). It has pierced the 3ATR line for the first time since February 2020.

This implies market participants continue to see value in the stock market with a bias towards dividend paying safe firms.

Learn more about Ian Murphy at MurphyTrading.com.