Stocks swirled on Friday as industrial and commodity sensitive issues found early and sustained bids while technology and consumer discretionary issues remained under pressure, suggests Jon Markman, editor of Strategic Advantage.

The S&P 500 (SPX) finished at 4,488, a decline of 0.3%.

The loss puts the benchmark slightly below its 200-day moving average at 4,490. For bulls, that is not great. Bull markets live above that key metric.

The weakness comes ahead of a barrage of first quarter earnings reports due this week from money center banks and semiconductor firms. Forecasts from JP Morgan (JPM) and Taiwan Semiconductor (TSM) in the middle of the week will set the tone for financial and technology stocks through the next several weeks.

Sentiment for these sectors is extremely bearish. Any positive news will lead to aggressive short covering.

I suspect the bias for the S&P 500 is higher going into the meat of the second quarter, yet bulls have to get going here.

A weaker tone in the early part of the week will lead to tests of support at 4,425, then 4,350. Key overhead resistance is still 4,715.

The Upshot

The S&P 500 fell 0.3% on Friday, while the Dow Jones Industrial Average (DJI) rose 0.4%, and the Nasdaq Composite fell 1.3%. For the week, the S&P 500 was down 1.3%, the Dow fell 0.3%, and the Nasdaq declined by 3.9%.

Technology and consumer discretionary were the biggest decliners, while energy and financials led gainers.

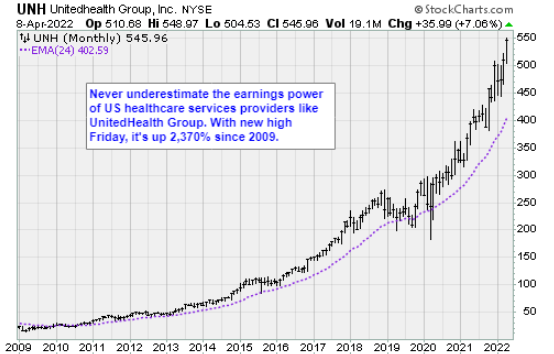

Decliners outpaced advancers by a four-three margin and there were 251 new one-year highs vs 520 new lows. Topping the new high list were UnitedHealth Group (UNH), Johnson & Johnson (JNJ), Walmart (WMT), AbbVie (ABBV), Coca-Cola (KO), Shell (SHEL), Sanofi (SNY), and Petrobras (PBR).

More of the same: health care, consumer staples, and energy are your leadership vanguard.

The US 10-Year Tresury Yield (TNX) rose by 5.2 basis points to 2.71%. It earlier touched 2.73%, a new three-year high. West Texas Intermediate crude futures advanced by $1.83 to $97.86 a barrel. Gold was up $10.80 to $1,948.60 per troy ounce.

The March meeting minutes of the Federal Open Market Committee, released earlier this week, signaled one or more half percentage point rate hikes in the months ahead and the shrinking of the Federal Reserve's portfolio of securities by $95 billion a month to tackle strong inflationary headwinds in the US.

BofA Securities is forecasting three 50 basis-point hikes in each of May, June, and July, which will strain borrowers.

In economic news, the FAO Food Price Index hit a new record high of 159.3 in March, up by almost 13% over February, as a war in Ukraine reduced supplies and soaring energy and fertilizer costs continued to weigh, Trading Economics reported.