Stocks collapsed on Monday at the open, assesses Jon Markman, editor of Strategic Advantage.

Follow-through selling from Friday and a big decline in energy prices set the stage for the early weakness. The benchmark S&P 500 (SPX) traded all the way down to 4,200 before buyers emerged. The benchmark finished at 4,295, a gain of 0.6%.

The reversal means bears failed to make headway toward new lows. It also sets up another rally to 4,350, the middle of the current trading range. The most interesting development on Monday was a dichotomy between this year’s winners and losers. Chevron (CVX) and Exxon Mobil (XOM), among the best-performers in 2022, slumped badly. Both issues closed below their respective 50-day moving averages for the first time this year. On the other side of the ledger, Alphabet (GOOGL), Amazon (AMZN), and Apple (AAPL) found early bids and closed higher.

The combination of weaker leaders and stronger broken stocks underlines the frustration in both the bull and bear camps. There is no real, compelling follow-through. I do not expect this trend to change this week. The S&P 500 now has resistance at 4,350 and critical support at 4,157.

The Upshot

The Dow (DOW) was up 0.7% to 34,049.46 and the Nasdaq (NDX) was 1.3% higher at 13,004.85. Energy (XLE) led the decliners on Monday while Communication (XLP) services posted the biggest gains. Breadth favored advancers four-three, and there were 31 new highs vs 1,095 new highs.

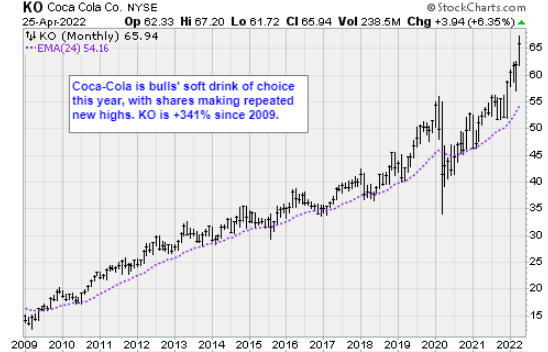

Big caps on the new high list included Johnsons & Johnson (JNJ), Coca-Cola (KO), Change Healthcare (CHNG), PS Business Parks (PSB), and H&R Block (HRB).

The US 10-Year yield sank 8.4 basis points to 2.82%. West Texas Intermediate crude oil futures declined $2.98 to $99.09 per barrel.

In US economic news, the Chicago Fed National Activity fell to 0.44 in March, a three-month low, from 0.54 in the previous month, in line with a drop to 0.45 in a survey compiled by Bloomberg. The Dallas Fed's manufacturing survey fell to 1.1 in April from 8.7 in March, with declines in the readings for production and employment offset by gains in new orders and prices.

Not good.

In company news, Twitter (TWTR) said Tesla (TSLA) Chief Executive Elon Musk will buy the social-media company for $54.20 per share in cash in a deal valued at about $44 billion. The price is a 38% premium to the closing stock price on April first, the last trading day before Musk unveiled his about 9% stake, Twitter said in a statement. After the deal closes, Twitter will become a privately held company. Shares of Twitter closed nearly 5.7% higher.

Scheduled to report earnings this week is Google-owner Alphabet, which rose 2.9% ahead of its financial results due to be released after market close on Tuesday. Other tech giants Apple, Inc. (AAPL), Amazon.com, Inc. (AMZN), and Meta Platforms, Inc. (FB), are also scheduled to report later this week.