The S&P 500 (SPX) started Friday sharply lower after the April jobs report came in stronger than expected, observes Jon Markman, editor of Strategic Advantage.

The economy created 428,000 new jobs last month, stoking fears that the Federal Reserve has plenty of room to raise its short-term interest rate targets.

The benchmark S&P 500 briefly traded back to 4,067 before closing down 0.6% at 4,123. It was the sixth consecutive weekly loss for the benchmark. Bulls are in a tough spot: strong economic data provides cover for the Fed to fight inflation. Weak data negatively impacts stock valuations.

Bulls need a string of weaker than expected economic reports, and for bears to panic. It could happen. Short-covering rallies are common within the context of bear markets. They are also necessarily violent because bearish trends wipe out sellers, creating a vacuum of shares for sale.

That said, the path of least resistance is still lower. There is nominal support for the S&P at 4,000, then 3,950, the February 2020 highs. Resistance is 4,280.

The Upshot

The Dow Jones Industrials (DJI) fell 0.3% to 32,899 and the Nasdaq (NDX) was 1.4% lower at 12,144. For the week, the S&P 500 fell 0.2%, the Nasdaq slid 1.5% and the Dow was down 0.2%. Materials and Communication (XLC) services led the decliners, with energy and utilities the only two sectors in the green.

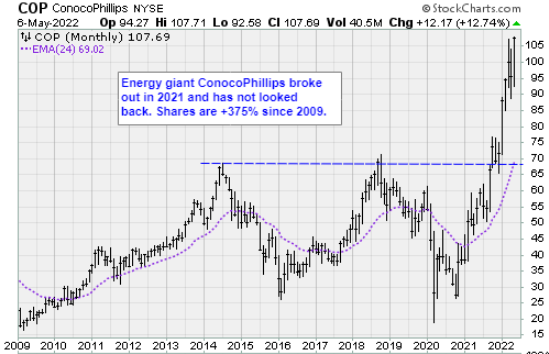

Breadth favored decliners three-one, and there were a stunning 2022 new lows vs 68 new highs. Big caps on the new high list included ConocoPhillips (COP), EOG Resources (EOG), Pioneer Natural Resources (PXD), Occidental Petroleum (OXY), and Valero (VLO). All energy, all the time.

The US 10-Year Yield (TNX) rose 6.1 basis points to nearly 3.13%, a day after it marked its highest intraday level since November 2018. Yields closed at around 2.92% Wednesday when Federal Reserve Chairman Jerome Powell said policymakers weren't "actively considering" increasing the Fed funds rate 75 basis points in one fell swoop of policy.

West Texas Intermediate crude oil futures added $2.26 to $110.52 a barrel. Gold rose $6.10 to $1,881.80 per troy ounce.

The April employment report showed nonfarm payrolls rose by 428,000, more than the 380,000 jobs increase expected in a survey compiled by Bloomberg. March payrolls were revised lower to a 428,000 increase. However, the labor force participation rate fell to 62.2% from 62.4% in the previous month. Further, hourly earnings rose by 0.3%, slower than the 0.4% gain expected and following a 0.5% increase in March.

"Chair Powell was very clear Wednesday that the Fed currently intends to hike by 50 basis points in both June and July, but if the wages numbers continue to signal a meaningful slowing we think the July 50 is not a done deal," said Pantheon Macroeconomics Chief Economist Ian Shepherdson in a research note Friday.

"Bear in mind that inflation will fall sharply over the next three months too, and we expect the housing market downturn to be undeniable in the data by then too."

In company news, Goodyear Tire (GT) declined 9.5% on Friday despite reporting better-than-expected Q1 results, including its best revenue in more than a decade despite supply chain issues, the Russia-Ukraine war, and growing Covid-19 restrictions in China. When a company reports great news and its shares skid out instead of peeling rubber, it’s a wake-up call.

Under Armour (UAA) sank 23.8% after the athletic wear company reported a surprise net loss of $0.13 per share for its quarter. These shares came completely undressed, sinking to 2012 levels.