Yesterday, a highly unusual meeting took place between Joe Biden and Jerome Powell, explains Ian Murphy of MurphyTrading.com.

Afterward, President Biden went to pains to stress his respect for the independence of the Federal Reserve.

The meeting struck me as odd, so I suspect Biden has been informed by his economic advisors about the pain coming down the line from interest rate hikes, and he wants to get ahead of the story. By emphasizing the independence of the bank in advance, maybe he is saying, "Don’t blame me when it happens!"

US equity markets ignored the meeting and were more likely focused on how firms are weathering the challenges of rising input costs. As it turns out, they’re doing fine. According to an analysis by Refinitiv released on May 27, 77% of firms in the S&P 500 (SPX) had earnings above expectations for Q1/2022.

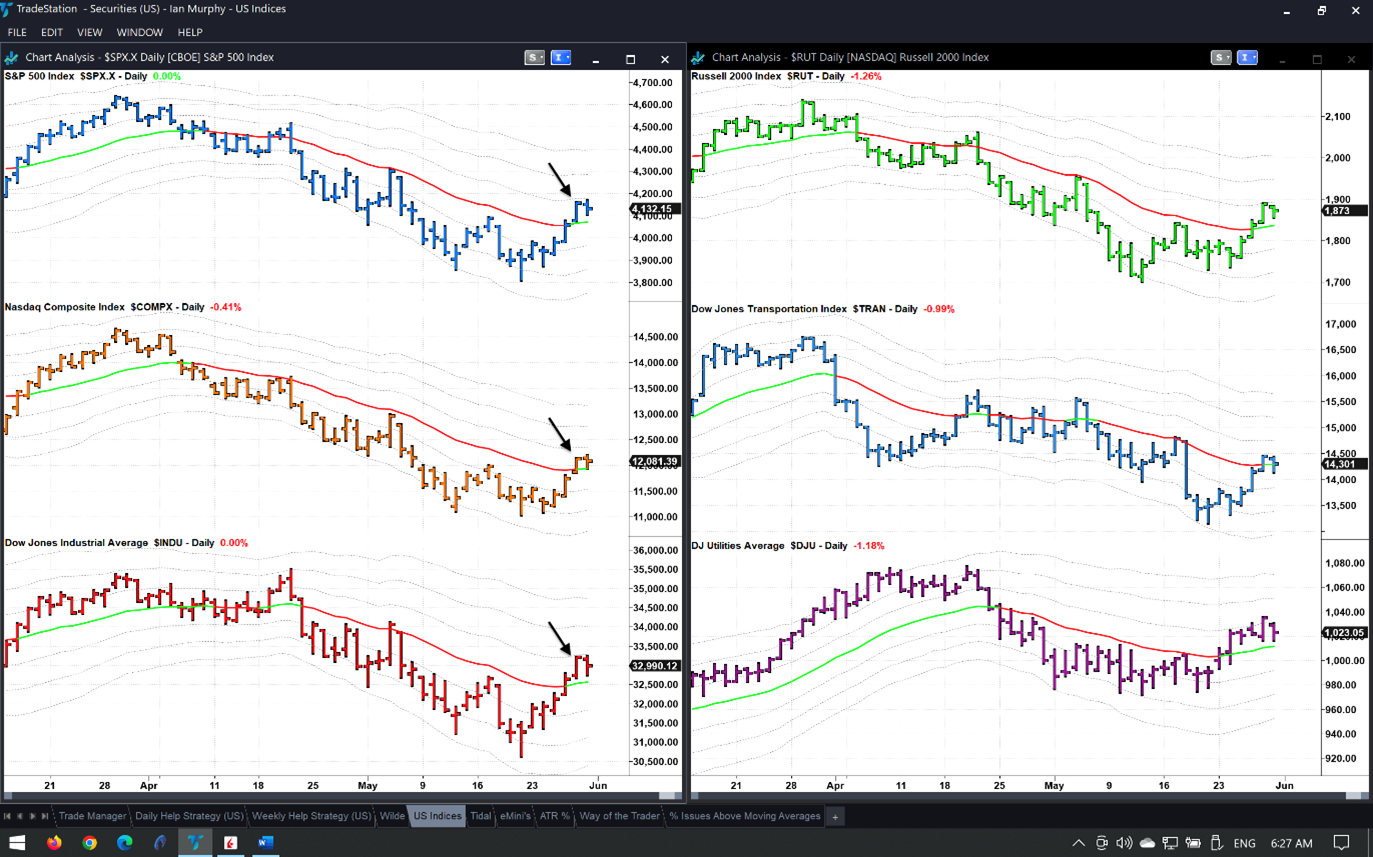

Click charts to enlarge

After Friday’s move to the upside, the three main US equity indices held firm yesterday and closed again above their respective 21EMACs.

Data: Yahoo Finance (12:30 CEST, 01 Jun 2022)

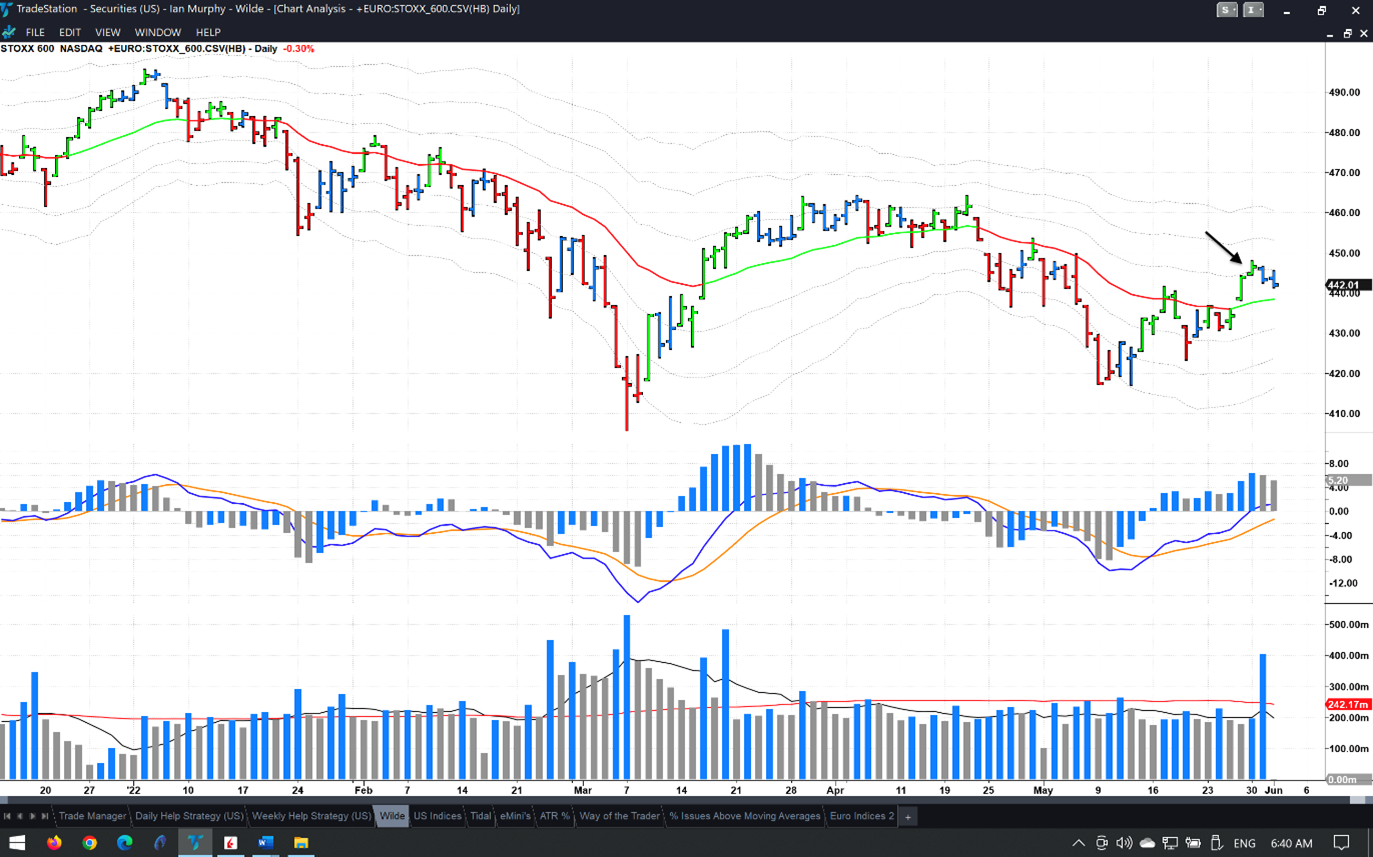

In Europe, the STOXX600 has started the month slightly down but remains above the 21EMAC in morning trade.

Now comes the moment of truth, can these international indices establish first higher low patterns which would be the first step for a new bullish trend in equities?

Learn more about Ian Murphy at MurphyTrading.com.