Markets move like waves, and money is the current, says Lucas Downey of Mapsignals.com.

Follow that flow and you’ll have an edge. Stocks are rising as massive selling slows. Look, I get it. Investing has been a rough ride in 2022. Investors are dealing with an onslaught of non-stop macro headwinds. Inflation is running hot, interest rates keep rising, we have a war in Ukraine, and recession fears echo daily in the headlines.

It’s been choppy waters for months. The selloff has been epic. Recently though, that’s changing. Our data signals that market pain has died down considerably, sending equities higher. As de-risking grinds to a halt, the latest money current is a tailwind for stocks.

Today I’ll walk you through the Big Money landscape and zero in on why stocks keep bouncing. Odds are there’s still more near-term upside. Alright, let’s dive in!

Massive Selling Slows

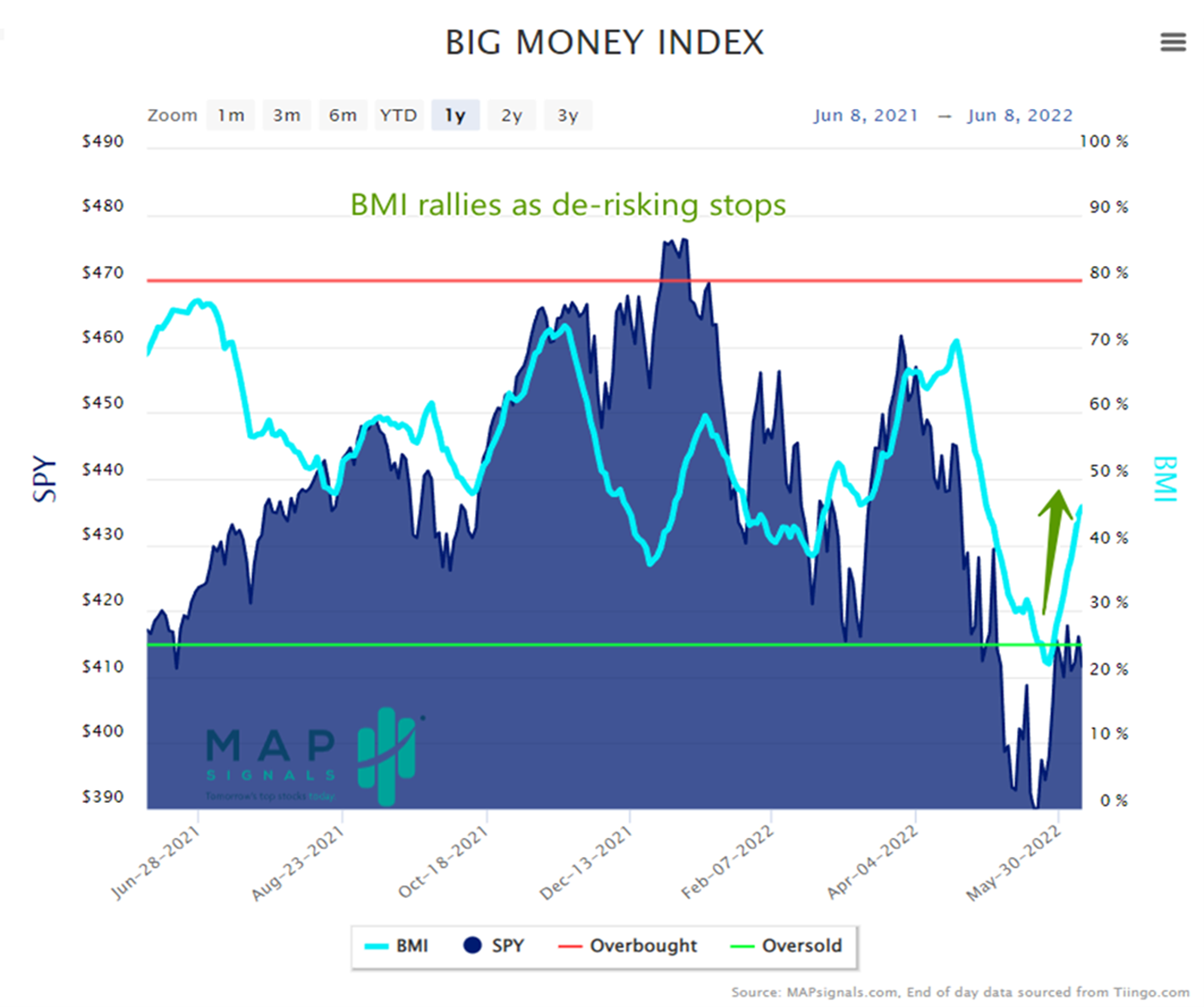

Just two weeks ago, stocks briefly reached oversold levels. Since then, markets have juiced higher. Since May 25, the S&P 500 (SPX) and the tech-heavy NASDAQ (NDX) gained 3.49% and 5.62%, respectively. As I’ve said repeatedly, oversold markets create attractive valuations and are epically bullish for stocks.

You can see the Big Money Index has gone straight up since:

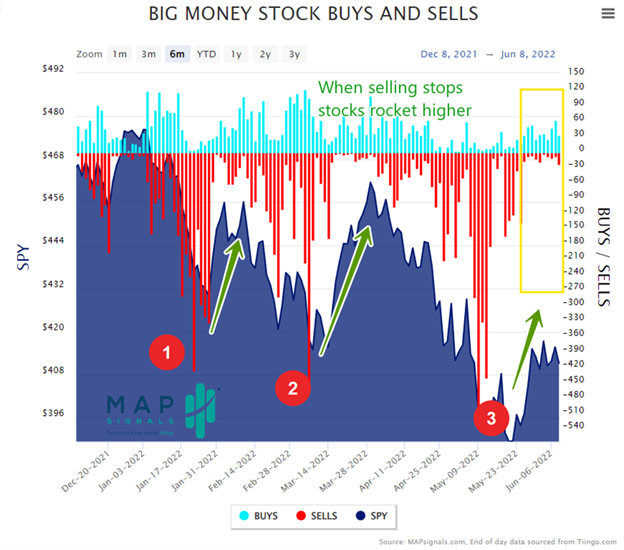

That’s a wicked move higher. The BMI’s latest reading is 46%. Clearly, something major is happening under the surface to launch the BMI 24 points higher in two weeks. Massive de-leveraging that sent stocks crashing has stopped. The wave of selling crested. Below you’ll see what I mean. Check out the Big Money Stock Buys and Sells chart. These are the daily buy and sell signals that make up the BMI. When stock selling evaporates, stocks rocket. I’ve outlined in yellow today’s data and marked prior times this similar pattern happened:

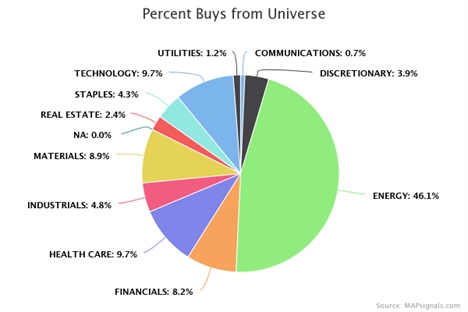

The lack of selling in equities is enough to buoy markets. And looking above, it’s a repeatable pattern, similar to waves in the ocean. As selling picks up, markets fall. When it peaks, they bounce. Using our data you can literally surf these market waves. But let’s keep going. The buying that we’re witnessing recently is very concentrated. Below is a pie chart breaking down all buy signals via sector since May 25. Amazingly, Energy makes up nearly half of all the buying:

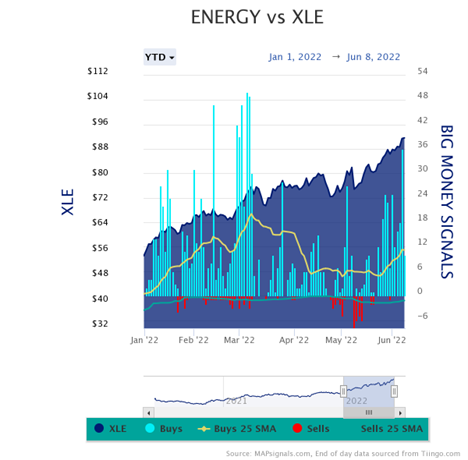

Normally when markets shoot out of oversold areas, I’d expect multiple sectors to participate in the rally. But, in 2022 Energy has been the top dog in terms of Big Money flows. Nearly 25% of all buy signals this year have been concentrated in the energy group. In the next chart, you’ll see the energy buys and sells this year. It’s been a massive non-stop wave of buying:

Our data has been all over that move. Now let’s talk about oversold stock opportunities:

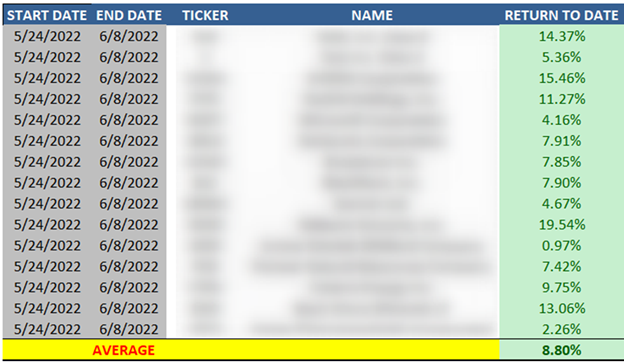

Each time the Big Money Index triggers oversold, it’s an opportunity to go shopping for great stocks on sale. History shows that those rare moments don’t last forever. And on May 23 we sent a list of 15 stocks to our members, primed for gains once the selling stopped. And boy did they. Below is a screenshot of their performance since. I’ve blurred out the names and returns since this list is for paying members.

Returns source: FactSet

Those 15 stocks doubled the market with an average gain of 8.8% vs the S&P 500 of 4.4%. In a sea of red, we’re proud of that! Let’s wrap up.

Here’s the bottom line: stocks move like waves in the ocean. Data allows you to follow trends…and ride them. It’s supply and demand 101. Our data has been signaling a change in trend for two weeks. As massive selling slows, stocks are rising. That’s near-term constructive.

We’re still not out of woods yet. For the bulls to take charge we’ll need evidence that buyers are stepping in across the board. I believe the Big Money Index will lead the way.

As Jon Kabat-Zinn said, “You can’t stop the waves, but you can learn to surf.”

To learn more about Lucas Downey, visit Mapsignals.com.